KARACHI: Recent measures taken by the State Bank of Pakistan (SBP) the financing for housing and construction sector increased significantly to Rs202 billion in March 2021.

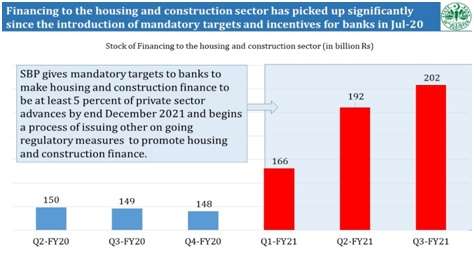

The SBP in a statement said that housing and construction finance has been progressing significantly and a momentum in housing and construction finance is building up. The banks’ housing and construction finance portfolio has increased from Rs148 billion by the end of June 2020 to Rs202 billion in March 2021 (chart).

This represents a growth of Rs54 billion or 36 percent in three quarters of FY21 compared to a stagnant position in earlier quarters. Such growth in housing and construction finance in such a period has never been witnessed in Pakistan’s history previously.

Overall financing to the housing and construction sector by banks is likely to increase further significantly as mortgage finance activity under Mera Pakistan Mera Ghar Scheme is picking up pace. As of April 20, 2021banks have received applications for financing of more than Rs52 billion from the general public under this scheme. Of these, the banks have approved financing of more than Rs15 billion to the applicants while the remaining applications are at different stages of the evaluation and approval process.

The SBP said that keeping in view the need to improve housing in the country and the important role of construction sector in boosting economic activities in the countries, the Government of Pakistan envisions to increase the number of housing units manifold in coming years and has taken several measures in this regard. A key element to ensure sustainable increase in the construction of building activities is the provision of financing both to the supply and demand side players of the housing and construction sector.

Financing to the housing and construction sector in Pakistan has almost always remained quite negligible in the credit portfolios of banks when compared with other developed and developing countries for various reasons. To support the vision of the Government of Pakistan, the State Bank of Pakistan has taken several measures since July 2020 to support the provision of financing for the housing and construction sector by way of giving incentives and targets to the banks. A key regulatory measure in this direction was assigning mandatory targets to banks to increase financing for mortgages to builders and developers. Banks are required to increase their housing and construction finance portfolios to at least 5 percent of their private sector advances by end December 2021.

In October 2020, the Government of Pakistan augmented these efforts by introducing the Government Markup Subsidy Scheme, now commonly known as Mera Pakistan Mera Ghar Housing Finance Scheme. This scheme enables banks to provide financing for the construction and purchase of houses at very low markup rates, targeting low to middle income segments of the population.

The State Bank of Pakistan has been actively engaged with banks to ensure that a vast majority of masses could benefit from the Mera Pakistan Mera Pakistan Housing Finance Scheme. For this purpose, SBP with the help of Pakistan Banks’ Association (PBA) and banks is ensuring that process of applying for housing finance is easy for the masses and in case they face any difficulty or have complaints, help is provided to them promptly and complaints are resolved in a timely manner.

To begin with, commercial Banks have designated 50% of their branches, around 7,700, across the country for accepting applications under Mera Pakistan Mera Ghar Housing Finance Scheme. In addition, all the remaining branches will also provide basic information about the scheme and refer applicants to the designated branches. Banks are regularly advertising the features of the scheme to attract and encourage potential customers.

In order to address complaints, the State Bank has established a comprehensive complaint resolution mechanism which comprises of an internet portal supported by a network of State Bank and commercial bank staff. The IT portal is live for registration of complaints by applicants who face any difficulty in obtaining loans. State Bank has also established help desks in its 16 offices across the country to facilitate applicants in registration of their complaints through the IT portal. These help desks address access challenges of applicants, especially from low-income strata, arising out of potential language and technology barriers.

The Pakistan Banks’ Association (PBA) has also been playing a very active role in the promotion of Mera Ghar Mera Pakistan Housing Finance Scheme. It is very close to establishing a single call center to address applicant’s questions and to guide them towards their nearest branches to submit application for home loans.

A significant number of Pakistanis who currently do not own a house and are eligible for financing under the Mera Pakistan Mera Ghar Scheme face difficulties in providing documentary evidence of regular sources of income to prove their ability to repay. To address this issue, the State Bank is coordinating with banks to develop a mechanism whereby income proxies, based on demonstrated expenses like rent payments or utility bills, could be used for credit evaluation and income assessment.

PBA is engaged with internationally renowned experts to develop scoring models in this regard in the coming months. The State Bank is facilitating banks to get data from mobile phone companies, utility providers and other government agencies to run these credit scoring models. Banks have already developed initial judgmental income proxy model to accommodate applicants with informal incomes till the time expert’s developed scoring models are implemented.