ISLAMABAD: Dr. Abdul Hafeez Shaikh, advisor to Prime Minister on Finance and Revenue, on Wednesday confirmed the agreement between the government and traders on various tax issues, including deferring the condition of Computerized National Identity Card (CNIC).

“An agreement has been reached between the government and the traders community to increase tax revenue for growth and public development and to provide support for the traders and generate economic activity,” Dr. Hafeez Shaikh said in a tweet message.

According to the agreement the government has relaxed the condition of CNIC on a single sale transaction above Rs50,000 for three months i.e. January 31, 2020.

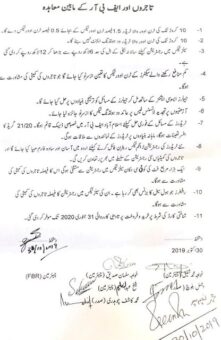

Following is the 11-point agreement that is shared by the advisor:

01. The tax rate shall be lowered to 0.5 percent from 1.5 percent for traders having turnover up to Rs100 million.

02. No liability on a trader having up to Rs100 million to collect / deposit withholding tax on transactions.

03. Threshold of annual electricity bill of Rs600,000 for mandatory sales tax registration has been increased to Rs1.2 million.

04. Turnover tax for sectors having lower returns will be revisted with consultation with traders associations.

05. Tax issues of jewelers will be resolved in consultation with jewelers associations.

06. The renewal license fees on middlemen will be revisited.

07. To resolve traders taxation issues a desk at FBR headquarters will be set up with immediate effect. A BS-20/21 officer will be designated to resolve the traders’ problems.

08. For new registration of traders a simple income tax return form in Urdu Language will be introduced. Trade associations will cooperation in FBR’s registration drive.

09. Which trader will be exempted from registration having 1000 square feet shop will be decided by traders committees.

10. The registration of those retailers engaged in wholesale business will be decided in consultation with traders community.

11. The FBR will take no action on sales transactions without CNIC information till January 31, 2020.