ISLAMABAD: The launch of electric vehicles in the country will help the country to save around $2 billion foreign exchange, which is spend on annually on oil import, Malik Amin Aslam, Prime Minister’s Adviser on Climate Change, said on Thursday.

Besides, adopting electric vehicle, the consumers could save over 30 percent cost of vehicle maintenance, because these do not require petrol or gas, no engine oil and driving them is highly comfortable, and affordable.

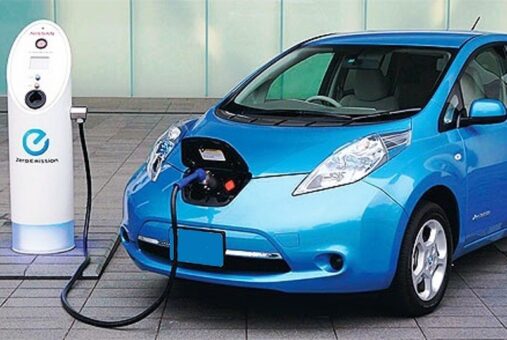

Addressing a press conference on Thursday along with private electric vehicle manufacturing stakeholders/investors, he told media that introduction of electric vehicles in Pakistan following the EV policy, which was framed after consultation with all relevant stakeholders from government and non-governmental sectors, are going to be a big change for the people to switch from fuelling at the pump to fuelling at an outlet.

He said that electric vehicle (EV) Policy would help revolutionize overall transport sector of the country in coming years and urban outlook with introduction of better, sustainable and environmental-friendly transport facility.

He also said that this policy, which has been approved by the Cabinet this year on November 5, would also significantly help boost pollution-free transport facilities in the country in a way that are not harmful to environment and do not emit any smoke and cause noise pollution.

From the running costs of electric cars to being very environmental-friendly, introduction of electric vehicles in the country will help cut country’s oil import bill, yield countless benefits for both environment and the people and their overall lifestyle and the way our cities look, the adviser said.

“Electric vehicles do not emit vehicle emissions and these are cleaner, do not cause noise pollution and eliminate your fuel costs. Besides, EVs are fun to drive and these have instant torque and offer a very smooth ride,” he explained while counting on the benefits of the electric vehicles.

The adviser Malik Amin Aslam noted that periodic trips to the gas station to fuel up your car are considerably expensive and time consuming for the people, particularly when the ever-fluctuating price of gasoline is high.

However, by choosing an electric vehicle, one can forget about paying for gasoline and being at the mercy of fuel prices.

“Not only is electricity less expensive than gasoline, it also has a much more stable price point, meaning that rapid price swings are all but eliminated by going electric,” he further explained.

Malik Amin Aslam stated that humans have historically had a very negative impact on our environment. “Carbon dioxide emissions from traditional vehicles contribute to greenhouse gases in the atmosphere and accelerate climate change and overall environmental degradation and hurt public health. Conversely, all-electric vehicles don’t produce climate change-causing carbon dioxide into the atmosphere, when any of us drives them.

Besides, hybrid electric vehicles use their battery to greatly improve the distance you can travel with a gasoline-powered engine,” he elaborated while highlighting environmental benefits of the electric vehicles.

Given the backdrop, switching to an electric vehicle is one way to reduce further damage to the earth, cut individual carbon and transport sector’s footprints, the prime minister’s adviser on climate change.

He said that with implementation of electric vehicle policy of Pakistan, a new economic sector will emerge, introducing a new electric vehicle producing industrial sector and thousands new jobs.

Talking about electric public transport system, he told media that as part of the policy goal, provincial governments are being approached to usher in launch mass transit system in urban areas, under which electric buses would be introduced to provide pollution, noise-free, comfortable and cheaper transport facilities to the masses, particularly women.

For this, federal government would provide every possible help to the provincial governments to introduce such mass transit system, Malik Amin Aslam added.