Islamabad, April 25, 2025 – In a continued effort to accommodate taxpayers facing procedural and technical hurdles, the Federal Board of Revenue (FBR) has announced a further extension for the filing of sales tax returns for the months of February and March 2025.

(more…)Author: Shahnawaz Akhter

-

PCDMA flags technical glitches in sales tax return filing

KARACHI, April 25, 2025 – The Pakistan Chemicals & Dyes Merchants Association (PCDMA) has raised serious alarms over the growing complications surrounding the filing of sales tax returns, citing newly introduced formats and technical glitches as major hurdles for taxpayers.

(more…) -

HBL posts strong 1Q CY2025 earnings, surpassing projections

Karachi, April 25, 2025 – Habib Bank Limited (HBL) has announced its financial results for the first quarter of calendar year 2025, reporting impressive earnings that surpassed market and industry expectations.

(more…) -

KCCI seeks tax credit revival to stimulate industrial investment

Karachi, April 25, 2025 – The Karachi Chamber of Commerce and Industry (KCCI) has strongly urged the Federal Board of Revenue (FBR) to reinstate the previously available tax credit under Section 65B of the Income Tax Ordinance, 2001, in a bid to encourage industrial investment and economic growth.

(more…) -

FBR sees 28% drop in tax revenue from cash withdrawals

Karachi, April 25, 2025 – The Federal Board of Revenue (FBR) has reported a notable 28% decrease in tax collection from cash withdrawals during the month of March 2025, highlighting a major shift in the behavior of banking customers.

(more…) -

PSX urges mandatory payment digitization to boost documentation

Karachi, April 25, 2025 – The Pakistan Stock Exchange (PSX) has strongly advocated for the digitization of all payment systems in its proposals for the upcoming federal budget 2025–26.

(more…) -

Bank allows fraudulent transfers via unverified mobile device

Karachi, April 25, 2025 – The Banking Mohtasib Pakistan has ordered a major commercial bank to refund Rs1,295,000 to a customer after it allowed fraudulent transfers from his account through a mobile device that was not verified using biometric authentication, violating key security protocols.

(more…) -

Pakistan’s bank deposits surge to historic Rs31.63 trillion

Karachi, April 25, 2025 – Pakistan’s banking sector has recorded a historic milestone as total bank deposits surged to an unprecedented Rs31.63 trillion by the end of March 2025, according to the latest data released by the State Bank of Pakistan (SBP) on Thursday.

(more…) -

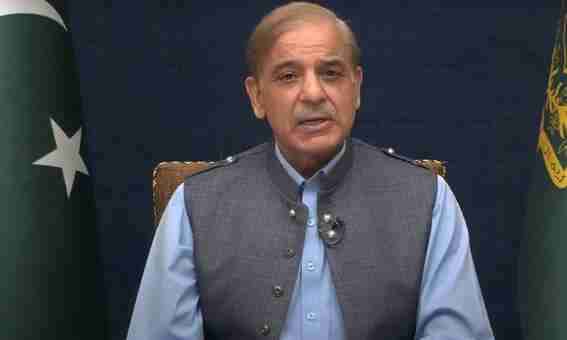

PM Shehbaz forms high-level committee for investment protection

Islamabad, April 24, 2025 — In a strategic step aimed at enhancing investor confidence and improving the business climate, Prime Minister Shehbaz Sharif has established a high-level committee to develop a comprehensive legal framework for the protection of investment in Pakistan.

(more…) -

SBP reports $367 million decline in official forex reserves

Karachi, April 24, 2025 – The State Bank of Pakistan (SBP) reported a significant drop in its official foreign exchange (forex) reserves, with a decline of $367 million during the week ending April 18, 2025.

(more…)