Karachi, April 15, 2025 – The Federal Board of Revenue (FBR) has reported that consumers in the tribal areas benefited from a significant tax relief of over Rs14 billion on the supply of electricity, granted through a sales tax exemption under the Sales Tax Act, 1990.

(more…)Author: Shahnawaz Akhter

-

KCCI Recommends Advance Tax Exemptions on FMCGs

Karachi, April 15, 2025 – The Karachi Chamber of Commerce and Industry (KCCI) has urged the government to exempt fast-moving consumer goods (FMCGs) from advance tax collection under Sections 236G and 236H of the Income Tax Ordinance, 2001.

(more…) -

FBR Urges Field Formations to Submit Vacancy Details by April 18

Islamabad, April 15, 2025 – The Federal Board of Revenue (FBR) has reiterated its directive to all concerned field formations to urgently submit details of vacant posts under their respective jurisdictions.

(more…) -

Ahsan Iqbal Urges Export-Led Growth, Calls for KCCI Partnership

KARACHI, April 14, 2025 – Federal Minister for Planning, Development & Special Initiatives Ahsan Iqbal has stressed the urgent need to transition Pakistan towards a sustainable, export-driven economy, cautioning that short-term growth reliant on consumption and imports leads to repeated cycles of instability.

(more…) -

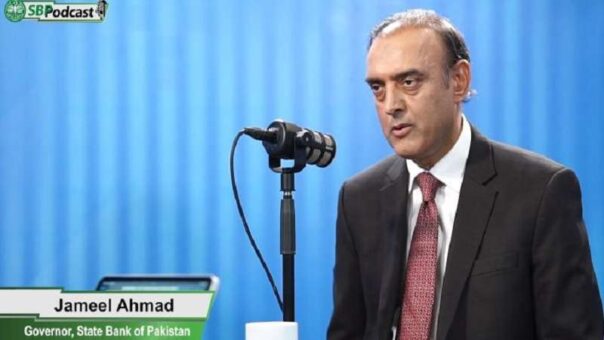

SBP Governor Showcases Pakistan’s Economic Recovery, Vision

Karachi, April 14, 2025 – Governor of the State Bank of Pakistan (SBP), Mr. Jameel Ahmad, addressed the audience at the gong ceremony held at the Pakistan Stock Exchange (PSX) on Monday, where he shed light on Pakistan’s macroeconomic progress and emphasized the nation’s shift toward stability and growth.

(more…) -

FBR Extends Rs 60 Billion Reduced Tax Relief on Imports

Karachi, April 14, 2025 – The Federal Board of Revenue (FBR) has revealed that it extended approximately Rs 60 billion in tax relief during the current fiscal year through reduced income tax rates applied to a wide range of imports. This relief was granted under Clause 56 of Part IV of the Second Schedule of the Income Tax Ordinance, 2001.

(more…) -

18% GST Pushing Businesses to Evade, Warns PBC

Karachi, April 14, 2025 – The Pakistan Business Council (PBC) has raised serious concerns over the impact of the current 18% General Sales Tax (GST), stating that such a high rate in a largely undocumented economy creates a powerful incentive for tax evasion.

(more…) -

Pakistan Receives Record $4.1 Billion Remittances in March 2025

Karachi, April 14, 2025 – Governor of the State Bank of Pakistan (SBP), Jameel Ahmad, announced on Monday that the country received a historic $4.1 billion in workers’ remittances during March 2025, the highest monthly inflow ever recorded.

(more…) -

FBR Grants Rs1.65 Billion Tax Relief on Gratuity Payments

Karachi, April 13, 2025 – In a significant move aimed at easing the financial burden on retiring employees, the Federal Board of Revenue (FBR) has extended income tax exemptions amounting to Rs1.65 billion on gratuity payments made to individuals during the tax year.

(more…) -

KCCI Seeks 0% VAT on Commercial Importers in Budget 2025-26

Karachi, April 13, 2025 – The Karachi Chamber of Commerce and Industry (KCCI) has strongly urged the federal government to eliminate the Value Added Tax (VAT) for commercial importers in the forthcoming federal budget for the fiscal year 2025-26.

(more…)