Karachi, March 7, 2025 – The Federal Board of Revenue (FBR) has successfully collected Rs 85 billion as advance income tax on electricity consumption during the first half (July – December) of the ongoing fiscal year 2024-25.

(more…)Author: Shahnawaz Akhter

-

FBR Reports 40% Growth in Tax Payments with Returns

Karachi, March 7, 2025 – The Federal Board of Revenue (FBR) has reported an impressive 40% surge in tax payments made alongside tax return filings for the tax year 2024. This significant increase highlights the effectiveness of the government’s recent tax enforcement measures and the growing compliance among taxpayers.

(more…) -

MPC Meets on March 10 to Decide Interest Rate: SBP

Karachi, March 6, 2025 – The State Bank of Pakistan (SBP) announced on Thursday that the Monetary Policy Committee (MPC) will convene on Monday, March 10, 2025, to deliberate on the policy interest rate.

(more…) -

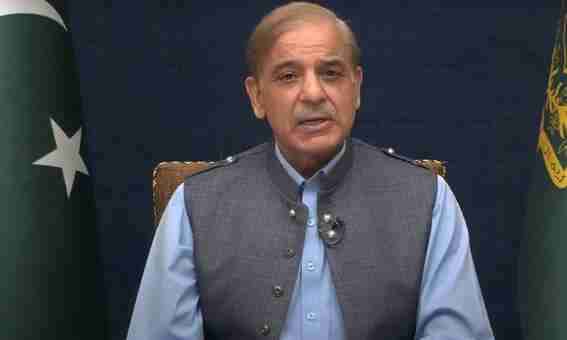

PM Shehbaz Directs Hiring Skilled Manpower for SMEDA

Islamabad, March 6, 2025 – Prime Minister Shehbaz Sharif has directed that skilled manpower should be hired from the market to strengthen the Small and Medium Enterprises Development Authority (SMEDA).

(more…) -

KCCI Highlights Tax Abuse at CTO Karachi

Karachi, March 6, 2025 – The Karachi Chamber of Commerce and Industry (KCCI) has voiced serious concerns regarding the fairness and legality of tax enforcement actions targeting the textile sector.

(more…) -

BankIslami to Challenge Windfall Tax in Supreme Court

Karachi, March 6, 2025 – BankIslami Pakistan Limited has decided to challenge the imposition of windfall tax in the Supreme Court of Pakistan after its petition was dismissed by the Sindh High Court.

(more…) -

KSE-100 Soars 1,459 Points as Global Oil Prices Plunge

Karachi, March 6, 2025 – The KSE-100 index of the Pakistan Stock Exchange (PSX) witnessed a significant surge on Thursday, gaining 1,459 points amid a sharp decline in international oil prices.

(more…) -

FBR Takes Major Action, Dismisses IR Inspector

Islamabad, March 6, 2025 – In a significant disciplinary action, the Federal Board of Revenue (FBR) has dismissed an Inland Revenue (IR) Inspector from service on charges of inefficiency and misconduct.

(more…) -

BMA Calls for Fresh KCCI Elections Within 60 Days

KARACHI: The Businessmen Alliance (BMA) has demanded fresh elections for the Karachi Chamber of Commerce & Industry (KCCI) within 60 days, following a decision by the Directorate General of Trade Organizations (DGTO) that nullified the incumbent body’s 2024-26 election results.

(more…) -

Banks Plan to Move Supreme Court on Windfall Tax

Karachi, March 6, 2025 – A group of banks in Pakistan is preparing to approach the Supreme Court to challenge the recent Sindh High Court decision regarding the windfall tax imposed on foreign exchange income.

(more…)