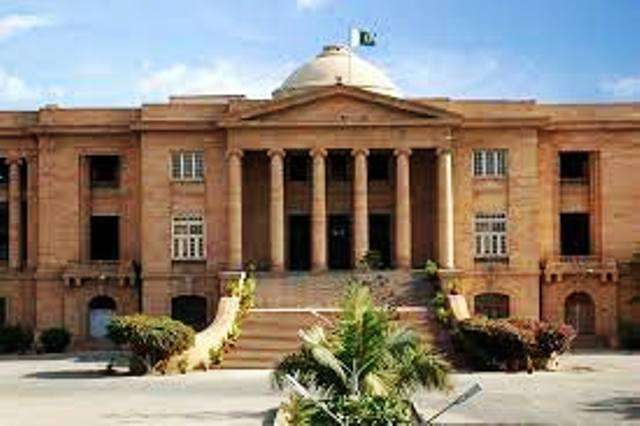

The Sindh High Court (SHC) has issued a pivotal directive to the Federal Board of Revenue (FBR), mandating that companies submit their sales tax returns for September 2024 without the requirement of affidavits from their chief financial officers. This order, articulated by the SHC on Friday, compels the FBR to facilitate the filing process of these returns devoid of the contested affidavits until the next scheduled hearing.

(more…)Author: Shahnawaz Akhter

-

FBR to Launch New Active Taxpayers List on November 1, 2024

Karachi, October 18, 2024 – The Federal Board of Revenue (FBR) is poised to unveil the new Active Taxpayers List (ATL) for the tax year 2024 on November 1, 2024, marking a pivotal moment in Pakistan’s tax management system.

(more…) -

KSE-100 Index Drops 335 Points As Profit Taking Continues

Karachi, October 18, 2024 – The Pakistan Stock Exchange (PSX) saw the KSE-100 index fall by 335 points on Friday, continuing its downward trend as investors engaged in profit-taking. The benchmark KSE-100 index closed at 85,250 points, down from the previous day’s close of 85,585 points.

(more…) -

FBR’s Sales Tax Crackdown Triggers Alarm Among Foreign Buyers

Karachi, October 18, 2024 – Major textile exporters have raised concerns about Pakistan’s international reputation following the Federal Board of Revenue’s (FBR’s) aggressive crackdown on sales tax fraud. The Pakistan Textile Council (PTC), representing leading textile and apparel exporters, has issued a stark warning that foreign buyers are losing confidence in the country’s credibility due to the FBR’s recent actions.

(more…) -

E-Intermediaries Face License Cancellation in Tax Fraud Cases

Karachi, October 18, 2024 – The Federal Board of Revenue (FBR) has initiated stringent legal action against e-intermediaries involved in widespread sales tax fraud. This decisive move follows the identification of numerous fraud cases linked to the manipulation of sales tax records, particularly through fake and flying invoices, as well as the suppression of sales.

(more…) -

SBP Unveils Alarming Insights on C-Efficiency Ratio and GST in Pakistan

Karachi, October 18, 2024 – In a striking revelation, the State Bank of Pakistan (SBP) has shed light on the alarming state of Pakistan’s C-Efficiency Ratio (CER) and the effective General Sales Tax (GST) rate during the fiscal year 2023-24. The SBP’s findings underscore critical challenges in the country’s tax enforcement and base expansion, painting a concerning picture for policymakers.

(more…) -

Pakistan’s Textile Exports Surge by 9.51% in First Quarter of FY25

Karachi, October 17, 2024 – Pakistan’s textile exports have experienced a robust surge, growing by 9.51% during the first quarter of the fiscal year 2024-25 (July to September) compared to the corresponding period of the previous fiscal year, according to figures released by the Pakistan Bureau of Statistics (PBS) on Thursday.

(more…) -

FPCCI Hails FBR’s Decision to Defer Affidavit Requirement

Karachi, October 17, 2024 – The Federation of Pakistan Chambers of Commerce and Industry (FPCCI) has lauded the Federal Board of Revenue’s (FBR) decision to temporarily defer the contentious requirement of an affidavit for sales tax returns. The FPCCI’s stance was clearly communicated by its president,

(more…) -

FBR Relaxes Affidavit Requirement for September Sales Tax Returns

Karachi, October 17, 2024 – The Federal Board of Revenue (FBR) has eased the requirement for submitting an affidavit alongside the sales tax return for September 2024, which is due to be filed in October. This relaxation follows appeals from trade bodies and aims to build trust among all stakeholders, the FBR announced on Thursday.

(more…) -

SBP Suggests Measures to Boost Pakistan’s Tax-to-GDP Ratio

Karachi, October 17, 2024 – The State Bank of Pakistan (SBP) on Thursday proposed a series of tax reforms aimed at significantly increasing the country’s tax-to-GDP ratio, which has stagnated at approximately 10% for the last two and a half decades.

(more…)