Karachi, August 11, 2024 – In a move that is likely to raise eyebrows, the Federal Board of Revenue (FBR) has extended tax concessions worth a staggering Rs 41 billion to the power sector for the tax year 2024.

(more…)Author: Shahnawaz Akhter

-

Unilever to Appeal Rs 60 Million Fine for Deceptive Advertising

Karachi, Pakistan – Unilever Pakistan has announced its decision to appeal a hefty Rs 60 million fine imposed by the Competition Commission of Pakistan (CCP). The fine, which stems from allegations of misleading advertising claims, specifically targets the marketing of Unilever’s Lifebuoy soap and hand wash products in Pakistan.

(more…) -

FBR Debunks Rumors of Taxing Arshad Nadeem’s Prize Money

Islamabad, August 11, 2024: The Federal Board of Revenue (FBR) has decisively quashed rumors swirling on social media about the alleged taxation of the prize money awarded to Arshad Nadeem, Pakistan’s golden athlete and the gold medalist at the Paris Olympics 2024.

(more…) -

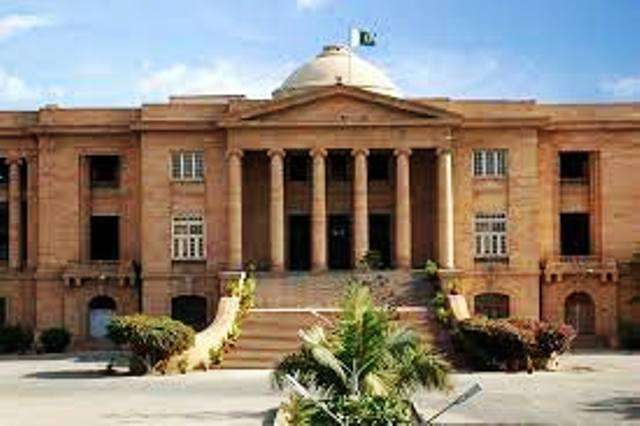

SHC Upholds FBR’s Transfer Orders: IRS Officers’ Plea Rejected

Karachi, August 10, 2024 – The Sindh High Court (SHC) has delivered a significant ruling by dismissing the petition of 12 senior officials from the Inland Revenue Service (IRS), who had challenged their recent transfers to the Federal Board of Revenue’s (FBR) administrative pool.

(more…) -

Pakistan Customs Tightens Green Channel Security

Karachi, August 10, 2024 – Pakistan Customs has announced a significant update regarding the Green Channel facility at airports across the country. Authorities now have the right to randomly select passengers using the Green Channel for additional checks, aiming to prevent the misuse of this facility.

(more…) -

Pakistan Stocks Set to Maintain Positive Trajectory Next Week

Karachi, August 10, 2024 – Pakistan stocks is expected to continue its upward momentum in the upcoming week starting August 12, 2024, as per analysts at Arif Habib Limited.

(more…) -

Entrustment Scheme: Pakistan Exempts Sales Tax on Gold Imports

Karachi, August 10, 2024 – Pakistan has granted a sales tax exemption on the import of gold under the entrustment scheme. The Federal Board of Revenue (FBR) announced the tax exemption, which has been introduced through the Finance Act, 2024. The exemption is part of broader changes made to the Sixth Schedule of the Sales Tax Act, 1990.

(more…) -

FBR Doubles Sales Tax on Imported Computers and Laptops

Karachi, August 10, 2024 – The Federal Board of Revenue (FBR) has announced a significant increase in the sales tax rate on imported computers and laptops for the tax year 2024-25.

(more…) -

CCP Slaps Rs60M Fine on Unilever Pakistan for Misleading Ads

KARACHI: August 10, 2024 — The Competition Commission of Pakistan (CCP) has imposed a substantial fine of PKR 60 million on Unilever Pakistan for broadcasting deceptive claims in television commercials for its hygiene and cleansing products, namely ‘Lifebuoy (Care and Protect) Soap’ and ‘Lifebuoy Hand Wash.’

(more…) -

FBR Mandates Sales Tax Registration for Key Business Sectors

Karachi, August 9, 2024 – In a move aimed at tightening tax compliance, the Federal Board of Revenue (FBR) has announced a mandate requiring several categories of individuals and businesses to obtain mandatory sales tax registration.

(more…)