Karachi, December 16, 2023 – The Federal Board of Revenue (FBR) in Pakistan has issued a significant directive, making it mandatory for businesses to display their National Tax Number (NTN) at their respective places of operation during the tax year 2024.

(more…)Author: Shahnawaz Akhter

-

Banks Witness All-Time High Deposits at Rs 26.80 Trillion

Karachi, December 15, 2023 – Banks in Pakistan have witnessed all-time high deposits of Rs 26.80 trillion by end of November 2023, according to official statistics.

(more…) -

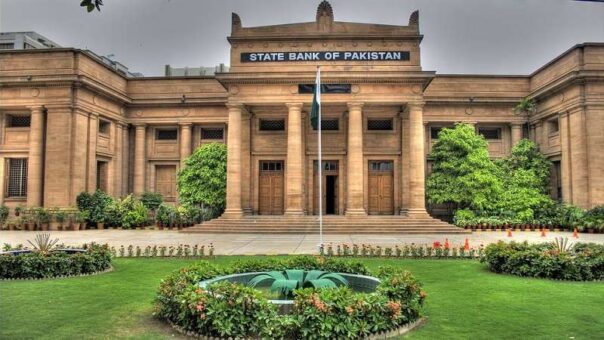

SBP Urges Banks to Boost Agricultural Outreach

Karachi, December 15, 2023 – The State Bank of Pakistan (SBP) has called on commercial banks to expand their reach and enhance their involvement in the agriculture sector, emphasizing the critical role this sector plays in the country’s socioeconomic development.

(more…) -

FBR Denies Goods Declaration Filing for Non-Active Taxpayers

Karachi, December 15, 2023 – The Federal Board of Revenue (FBR) has announced that non-active taxpayers will no longer be allowed to file goods declarations, as per the updated Sales Tax Rules, 2006 for the tax year 2024.

(more…) -

Persons Required to File Tax Return Deemed Registered

Karachi, December 15, 2023 – The Federal Board of Revenue (FBR) in Pakistan has announced significant updates to the Income Tax Rules, 2002, for the tax year 2024, emphasizing that individuals required to file income tax returns will now be considered as registered entities.

(more…) -

FBR Forms Committee to Evaluate Digital Invoicing Applications

Islamabad, December 14, 2023 – In a significant development to enhance digital integration within the tax system, the Federal Board of Revenue (FBR) has formed a specialized committee tasked with evaluating applications for the grant of licenses for the integration of registered persons.

(more…) -

FBR Releases HS Code List for Input Adjustment on Raw Materials

Islamabad, December 14, 2023 –The Federal Board of Revenue (FBR) issued a comprehensive list of Harmonized System (HS) Products eligible for tax input adjustment in a move aimed at facilitating manufacturers across various sectors.

(more…) -

Commissioner to Suspend Sales Tax Registration Without Notice

Karachi, December 14, 2023 – The Federal Board of Revenue (FBR) has updated the Income Tax Rules, 2002, for the tax year 2024, conferring enhanced powers upon the Commissioner Inland Revenue to suspend the sales tax registration of a taxpayer without issuing prior notice.

(more…) -

FBR Finds Solution to Confirm Electronic Service of Notices

Karachi, December 14, 2023 – The Federal Board of Revenue (FBR) in Pakistan has unveiled a groundbreaking solution to address concerns related to the electronic service of notices.

(more…) -

FBR Updates Procedure for Sales Tax De-registration

Karachi, December 13, 2023 – Federal Board of Revenue (FBR) has updated rules regarding procedure for sales tax de-registration.

(more…)