Islamabad, September 28, 2025 – The Pakistan Tax Advisors Association (PTAA) has formally appealed to the Federal Board of Revenue (FBR) to extend the last date for filing income tax returns for the tax year 2025. In its request, PTAA urged that the current deadline of September 30 should be moved to November 30, 2025, to provide relief to taxpayers and tax practitioners.

(more…)Author: Shahnawaz Akhter

-

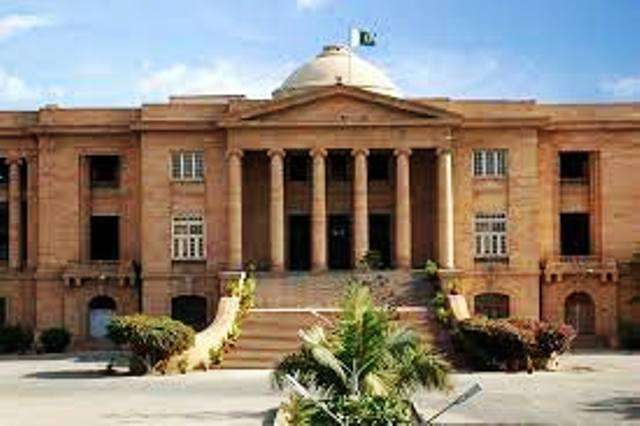

SHC rules in favor of FBR on e-invoicing dispute

Karachi, September 23, 2025 – The Sindh High Court has dismissed a constitutional petition filed by M/s. Gama Lux Oleochemicals Limited challenging the Federal Board of Revenue’s (FBR) move to make electronic invoicing mandatory for registered taxpayers.

(more…) -

Rates of Sales Tax Default Surcharge for 2025-26

Karachi, September 27, 2025 – The Federal Board of Revenue (FBR) has announced that the levy of default surcharge will continue during the tax year 2025-26 for all cases of non-compliance with the Sales Tax Act, 1990.

(more…) -

FBR makes online jurisdiction change mandatory

Islamabad, September 27, 2025 – The Federal Board of Revenue (FBR) has issued fresh instructions restricting all requests for jurisdiction changes to its online system.

(more…) -

FBR withdraws market value from 2025 tax filings

Islamabad, September 26, 2025 – The Federal Board of Revenue (FBR) has officially withdrawn the controversial column requiring taxpayers to declare the estimated market value of their assets in the annual income tax return for tax year 2025.

(more…) -

FBR keeps IR offices open ahead of return deadline

Islamabad, September 26, 2025 – The Federal Board of Revenue (FBR) has issued instructions to Inland Revenue (IR) offices to remain operational on Saturday, September 27, and Sunday, September 28, treating them as regular working days.

(more…) -

FTO probes controversial changes to wealth statement

Islamabad, September 26, 2025 – The Federal Tax Ombudsman (FTO) has initiated an investigation into recent changes made to the wealth statement, a crucial component of the annual income tax return.

(more…) -

FBR excludes key income tax exemptions from estimates

Islamabad, September 26, 2025 – The Federal Board of Revenue (FBR) has clarified that several income tax exemptions and concessions have been deliberately excluded from its official estimates in the newly issued Tax Expenditure Report 2025.

(more…) -

FBR’s Magical Return Form: Changed Without Change!

In yet another episode of “Taxpayers vs. Logic,” the Federal Board of Revenue (FBR) has officially declared that the 2025 income tax return form has not changed at all—except that it now magically requires new restrictions.

(more…) -

Tax experts reject market value rule in 2025 returns

KARACHI – Leading tax practitioners have urged the Federal Board of Revenue (FBR) to withdraw the recently added requirement of declaring the estimated market value of assets in income tax returns for the year 2025.

(more…)