Islamabad, August 30, 2025 – The Federal Board of Revenue (FBR) has issued the updated withholding tax card for Tax Year 2025-26, covering the period from July 1, 2025, to June 30, 2026.

(more…)Author: Shahnawaz Akhter

-

Customs clearing agents welcome faceless system implementation

Karachi – August 29, 2025 – The All Pakistan Customs Agents Association (APCAA) and Karachi Customs Agents Association (KCAA) have expressed strong satisfaction with the introduction of the Faceless Customs Clearance system, calling it a milestone in modernizing trade procedures.

(more…) -

SBP orders banks to track billions in outward remittances

KARACHI, August 29, 2025 – The State Bank of Pakistan (SBP) has instructed all banks to provide detailed data on outward remittances and foreign exchange transactions sent abroad by corporate entities and individual investors.

(more…) -

FBR collects taxes on holidays ahead of IMF review visit

ISLAMABAD – August 29, 2025 – The Federal Board of Revenue (FBR) has announced that its tax collection offices will remain open on the last two weekly holidays of August 2025, in a move aimed at meeting revenue targets ahead of an upcoming International Monetary Fund (IMF) review mission.

(more…) -

SBP announces 27% drop in after-tax profit for FY25

Karachi, August 28, 2025 – The State Bank of Pakistan (SBP) has reported a sharp 27% decline in its after-tax profit for the fiscal year 2024-25, reflecting a challenging financial environment.

(more…) -

Pakistan’s forex reserves inch up to $19.62 billion

Karachi, August 28, 2025 – Pakistan’s foreign exchange (forex) reserves saw a marginal improvement, rising by $47 million to reach $19.618 billion for the week ending August 22, 2025, according to the State Bank of Pakistan (SBP).

(more…) -

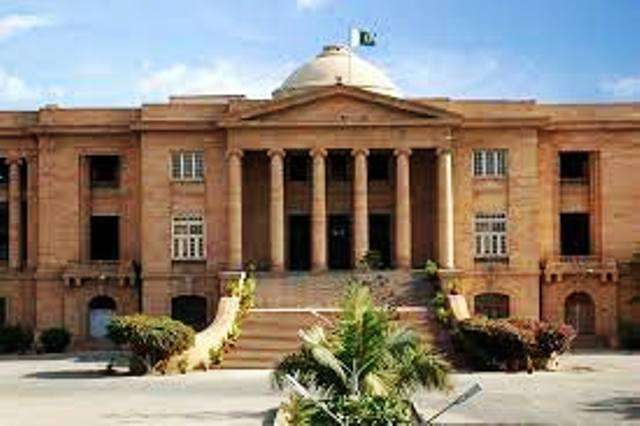

FBR, SRB reach accord; SHC closes toll tax case

Karachi, August 28, 2025 – The Sindh High Court (SHC) has finally resolved the long-standing dispute over the levy of sales tax on toll manufacturing through a consensus agreement submitted jointly by the Federal Board of Revenue (FBR) and Sindh Revenue Board (SRB).

(more…) -

KTBA exposes FBR’s digital disaster – national comedy of errors

Karachi, August 28, 2025 – In a blistering takedown, the Karachi Tax Bar Association (KTBA) has unleashed a scathing critique of the Federal Board of Revenue (FBR), branding the tax authority’s handling of annual return forms and its glitch-ridden IRIS portal as a “catastrophic failure” that is sabotaging taxpayers across Pakistan.

(more…) -

Sindh launches online portal for agricultural income tax

Karachi, August 28, 2025 – The Sindh Revenue Board (SRB) has officially launched a dedicated online portal for the registration and payment of agricultural income tax, aiming to simplify tax compliance for farmers and landowners across Sindh.

(more…) -

TPL Trakker secures first-ever project in African region

Karachi, August 28, 2025 – TPL Trakker announced on Thursday that it has successfully secured its first-ever project in the African region, marking a major milestone in the company’s international expansion strategy.

(more…)