Karachi, August 15, 2025 – If you’re part of Pakistan’s textile industry, it’s time to pay close attention. The Federal Board of Revenue (FBR) is preparing to roll out a massive audit exercise targeting the textile sector and its various sub-sectors nationwide.

(more…)Author: Shahnawaz Akhter

-

FBR issues comprehensive super tax guidelines for FY 2025–26

Karachi, August 14, 2025 – The Federal Board of Revenue (FBR) has released an updated set of guidelines outlining the scope, calculation method, and applicable rates of the super tax for the fiscal year 2025–26, aiming to bring clarity to a measure that has remained under debate since its inception.

(more…) -

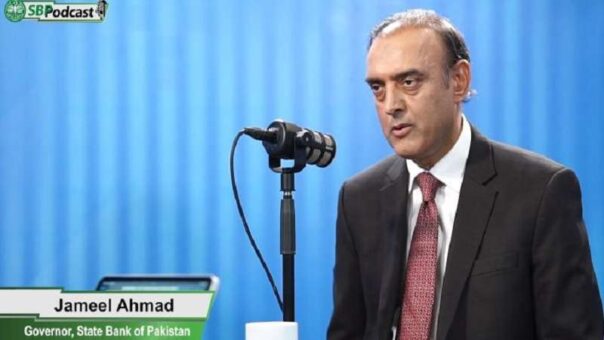

Pakistan advancing on path of economic stability: SBP governor

Karachi, August 14, 2025 – Governor of the State Bank of Pakistan (SBP), Jameel Ahmad, has expressed confidence that Pakistan is firmly advancing on the path of economic stability, supported by sustained reforms and prudent monetary policies.

(more…) -

SBP targets overpriced trade transactions in major move

Karachi, August 14, 2025 – The State Bank of Pakistan (SBP) has instructed all commercial banks to strengthen oversight on prices declared in trade transactions, introducing detailed due diligence measures aimed at combating Trade-Based Money Laundering (TBML) and Terrorist Financing.

(more…) -

SBP orders banks to implement stricter CDD for traders

KARACHI, August 14, 2025 – The State Bank of Pakistan (SBP) has issued a detailed directive requiring banks to enhance their customer due diligence (CDD) processes for all clients engaged in trade-related activities.

(more…) -

FBR caps cash payments at Rs200,000 for retail, e-commerce

Islamabad, August 13, 2025 – The Federal Board of Revenue (FBR) has formally set limit for cash payments of Rs200,000 for both retail outlets and cash-on-delivery (COD) orders in the e-commerce sector.

(more…) -

MPR forecasts FY26 GDP growth between 3.25% and 4.25%

Karachi, August 13, 2025 – The State Bank of Pakistan (SBP), in its flagship Monetary Policy Report (MPR), has projected Pakistan’s real GDP growth to range between 3.25% and 4.25% in the fiscal year 2025-26.

(more…) -

SRB announces 75 prizes in second POS invoices draw

Karachi, August 13, 2025 – The Sindh Revenue Board (SRB) has announced a total of 75 prizes in its second prize ballot draw for Point of Sale (POS) invoices.

(more…) -

Meezan Bank reports 10% profit decline in 1HCY25

Karachi, August 13, 2025 – Meezan Bank Limited, the country’s largest Islamic bank, announced on Wednesday that its net profit for the first half of the calendar year 2025 (January–June) fell by 10%.

(more…) -

Jilani raises rice exporters concerns with SBP

KARACHI – A high-level delegation of the Rice Exporters Association of Pakistan (REAP), led by Senior Vice Chairman Javed Jilani, met with State Bank of Pakistan (SBP) Governor Jameel Ahmad to discuss pressing issues confronting rice exporters.

(more…)