PESHAWAR: Khyber Pakthunkhwa government on Monday presented Rs1.332 trillion budget for fiscal year 2022-2023.

The budget included an allocation of Rs1.11 trillion for settled districts and Rs223.1 billion for merged tribal districts.

Presenting its fourth budget at Khyber Pakthunkhwa Assembly floor, Finance Minister Taimur Salim Jhagra said that the volume of the current budget is Rs913.8 billion including Rs789.8 billion for settled districts and Rs124 billion for merged tribal districts.

READ MORE: Advance tax on immovable property purchase enhanced to 250% for non-filers

He said total development budget of Khyber Pakthunkhwa was Rs418.2 billion including Rs319.2 billion for settled districts and Rs99 billion for merged tribal districts.

Regarding revenue and receipts collection, the minister said that total receipts was estimated at Rs1,332 billion including Rs750.9 billion to be collected from federal taxes receipts and Rs68.6percent as one percent share of divisible pool on war on terror.

He said Rs31 billion would be collected through oil and gas royalty and surcharge and Rs61.9 billion through net hydel power in accordance of MoU 2015-16 and arrears.

READ MORE: Pakistan massively increases taxation on motor vehicles

The minister said Rs85 billion would be collected through provincial tax and non-tax revenue, Rs4.3 billion under the head of foreign program assistance (FPA) for settled districts and Rs208.7 billion grant for merged tribal districts besides Rs212.7 billion receipts through other resources.

The Finance Minister Taimur Salim Jhagra said that Rs447.9 billion would be spent on salaries including Rs372.1 billion in settled districts and Rs75.8 billion through merged tribal districts while Rs107 billion on pension including Rs106 billion in settled districts and Rs one billion in merged tribal districts.

Besides salaries, he said Rs247.4billion would be spent on O&M, emergency and district expenditures, Rs111.4 billion on others current expenditures while volume of provincial development program including accelerated development program budget was Rs241 billion including Rs185 billion for settled districts and Rs56 billion for merged tribal districts while volume of total development budget was Rs383.5 billion including 319.2 billion for settled districts and Rs64.3billion for merged tribal districts.

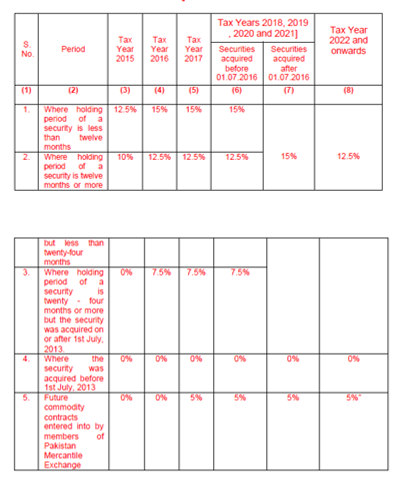

READ MORE: New rates of capital gain tax on disposal of securities

Under foreign program assistance, Rs93.2 billion would be spent including Rs88.9 billion for settled districts and Rs4.3 billion for merged tribal districts while 8.3 billion would be received through Public Sector Development Program for settled districts of Khyber Pakthunkhwa.

The Minister said that Rs26,458 million would be spent on agriculture, Rs4191 on Aukaf, Religious Affairs, Rs73 million on Bureau of Statistics, Rs71653 million on communication and works, Rs227,087 million for elementary and secondary education, Rs29203 million on energy and power,

Rs4191 million for environment, Rs1607 million for excise and taxation, Rs32,446 million through finance, Rs6433 million through forestry, Rs6655 million through general administration, Rs205,725 million for health, Rs34,191 million through higher education, Rs101,572 million for home and Rs823 million for housing sectors.

READ MORE: Pakistan slaps 45% corporate tax on banks

Likewise, Rs4926 million were allocated for industries, Rs1808 million for information and public relations, Rs2990 million for information technology, Rs25725 million for irrigation, Rs1033 million for labour, Rs14377 million for law and justice, Rs22337 million for local government, Rs1426 million for mines and mineral, Rs64372 million for planning and development,

Rs3616 million for population welfare, Rs23071 million for public health engineering, Rs30003 million for relief, rehabilitation and settlement, Rs3045 million revenue and estate, Rs6068 million for social welfare, Rs22017 million sports, culture and tourism, Rs2849 million through technical education, Rs12151 million for transport and Rs392 million for Zakat and Usher.

Finance Minister Taimur Salim Jhagra said health department budget has been increased by Rs55 billion, elementary and secondary education by Rs47 billion, police by Rs14 billion and energy and power by Rs11 billion.

The Minister announced Rs15percent increase in salaries and pension of all the government employees, Rs15 percent ad-hoc relief allowance, adding the increase for grade1-19 employees besides DRA allowance. He said risk allowance of police officials from grade 7-16 have been increased and was brought at par of DRA in line with the police martyrs package.

Transport monetization and vehicle leasing policy, change of executive allowance to performance allowance, work from home on Fridays and introduction of fleet cards to save fuel and reduce risk of pilferage across all departments announced.

Taimur Salim Jhagra said 100 percent increase in pension expenditure have been witnessed in last couple of years, adding expenditure of pensions, which was only one percent of total KP budget expenditure in 2003-04 ie Rs0.87 billion has jumped to 14.7percent ie Rs90 billion in 2021-22.

He said amendment in KP Civil Servant Act 1973 has been made under which contributory and provident fund were increased for newly recruited employees under contributory pension scheme under which either lumsum amount one time or long terms investment offer would be given to retired employees.

As many as services of 63,0000 employees would be regularized including 675 adhoc doctors from July 1, 2002, regularization of 58,0000 teachers and 4079 employees of 128 projects of erstwhile Fata during 2022-23.

OPD services under Sehat Card Plus program would soon be launched in all Govt hospitals and patient can available free treatment up to Rs10 million, he said adding Rs25 billion were allocated for Sehat Plus Card through eight lakh patients were benefited during 2021-22.

Following inclusion of liver transplant, he said five more chronic diseases including bone marrow transplant, sclerosis, cochlear implants, thalassemia and advance cancer coverage would be included in Sehat Card for which Rs2.5billion were allocated. He said that Rs53.6 billion earmarked for MTIs, allied and medical hospitals in Khyber Pakthunkhwa.

Four new medical colleges at Dir, Buner, Charsadda and Haripur would be established besides setting up of four new MTIs at Fountains House Peshawar, Kohat Institute of Medical and Dental Sciences, DHQ Charassadda and Women Children Hospital and DHQ Haripur.

As many as Rs3 billion were set aside for revamping of secondary care and service delivery while renovation of rehabilitation of 32 hospitals were completed.

Besides allocation of Rs2.7 billion for 58 hospitals in 24 districts for secondary care hospital under Public Private Partnership, he said that 3000 more beds would be established while primary care revamping program carrying allocation Rs2125 million was producing excellent results.

He said renovation of 700BHUs and RHCs costing Rs82.4 billion have been started while renovation of 500 facilities completed. He said Rs2 billion allocated for strengthening of 15 BHUs and RHCs in 15 districts provision of better services to people.

He said Rs10 billion would be spent on provision of free medicines to people besides allocation of Rs500 million for LHS and LHWs in addition to 3500 additional LHWs recruitment and additional funds of Rs one billion funds for arrangements regarding eradication of polio in Bannu and Dera Ismail and Rs1.3 billion for launching of maternal ambulance service.

Taimur Jhagra said KP Govt has decided to maintain tax rates of fiscal year 2021-22, adding 20pc relaxation would be provided for re-registration of motor vehicles or first registration and there would be not tax on land with full exemption from capital value tax (CVT) and registration fee.

He announced students of elementary and secondary education are exempted from fee and exempted library, archives and hostels fees. The Minister claimed that tax rates of Khyber Pakthunkhwa Revenue Authority was minimum than other provinces of Pakistan.

He said PFM (Public Financial Management) law was being introduced under Article 119 of the Constitution for bringing more transparency in the financial system. Insaf Food Cards program has been introduced under which Rs26 billion targeted subsidy would be provided to one million families of KP.