The upcoming federal budget for 2025-26 is expected to include significant relief measures for salaried individuals, with a key focus on easing the tax burden.

(more…)Category: Budget

This is parent category of budgets presented by Pakistan government. Here you will find year-wise federal and provincial budgets.

-

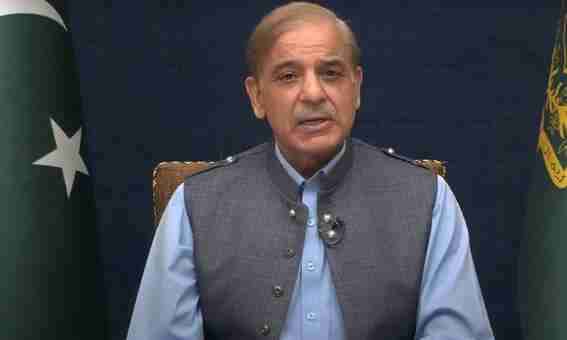

PM Shehbaz vows major relief for citizens in budget 2025-26

Islamabad, May 9, 2025 — Prime Minister Shehbaz Sharif reaffirmed the government’s commitment to providing meaningful relief to the masses in the upcoming budget for fiscal year 2025-26.

(more…) -

OICCI advocates broadening tax base to achieve 15% tax-to-GDP

ISLAMABAD, May 9, 2025 — The Overseas Investors Chamber of Commerce and Industry (OICCI) has urged the government to prioritize broadening the tax base in the upcoming budget for FY2025-26, stating that this is essential to achieving a sustainable tax-to-GDP ratio of 15%.

(more…) -

FY26 Budget: telecom sector seeks 15% withholding tax removal

ISLAMABAD, May 9, 2025 – As Pakistan prepares its federal budget for fiscal year 2025–26, the telecom industry has put forward a comprehensive set of proposals, calling for the abolition and rationalization of various tax measures that, it says, are stifling growth, innovation, and affordability in the sector.

(more…) -

OICCI recommends gradual phasing out of minimum turnover tax

Karachi, May 9, 2025 – The Overseas Investors Chamber of Commerce and Industry (OICCI) has proposed a structured, three-year phase-out of the minimum turnover tax, citing its detrimental impact on businesses operating on slim profit margins.

(more…) -

Foreign investors demand abolition of super tax in FY26 budget

Karachi, May 9, 2025 – A strong call has emerged from the foreign business community in Pakistan, urging the government to abolish the super tax in the upcoming federal budget for 2025–26.

(more…) -

KTBA urges FBR to prioritize return enforcement over high tax rates

Karachi, May 6, 2025 – The Karachi Tax Bar Association (KTBA) has formally recommended that the Federal Board of Revenue (FBR) reorient its tax policy strategy by prioritizing the enforcement of tax return filing rather than relying heavily on collecting higher taxes from non-filers.

(more…) -

FBR mulls tax on high pensions, income tax relief in FY26 budget

As Pakistan gears up for Budget 2025-26, the Federal Board of Revenue (FBR) is actively working on two major fiscal proposals — imposing a tax on high-value pensions and increasing the income tax exemption threshold for salaried individuals.

(more…) -

PSX urges elimination of minimum tax on listed companies

Karachi, May 5, 2025 – The Pakistan Stock Exchange (PSX) has submitted a formal recommendation to the government for the upcoming federal budget 2025-26, calling for the removal of the minimum tax regime for listed companies.

(more…) -

KTBA proposes overhaul of tax audit framework for FBR

Karachi, May 4, 2025 – The Karachi Tax Bar Association (KTBA) has put forward a detailed proposal for the Federal Board of Revenue (FBR) to adopt a comprehensive and transparent audit plan aimed at improving tax compliance and restoring taxpayer confidence.

(more…)