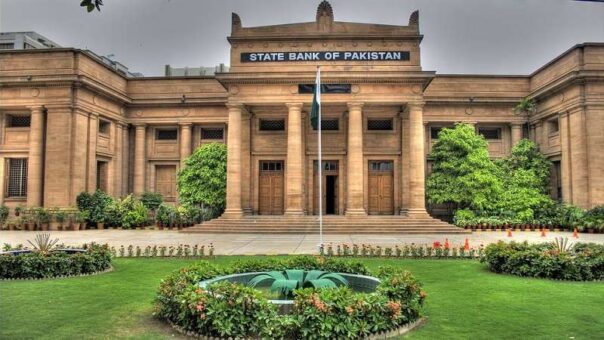

Karachi, March 28, 2024 – Pakistan has experienced a notable increase of $37 million in its foreign exchange reserves for the week ending March 22, 2024, according to official data released on Thursday.

(more…)Explore finance-related stories with Pakistan Revenue, your source for the latest updates on Pakistan’s economy, financial trends, and market insights. Stay informed with real-time economic developments.