OPPO ColorOSHack 2023, with the theme “Pantanal Service, Empowering Lives with Intelligence,” commences on July 11th, focusing on creating intelligent living experiences for over 500 million ColorOS users worldwide.

(more…)Category: IT & Telecom

Explore IT and Telecom stories with Pakistan Revenue, your go-to source for the latest updates on Pakistan’s technology and telecom sector. Stay ahead with real-time industry insights and economic developments.

-

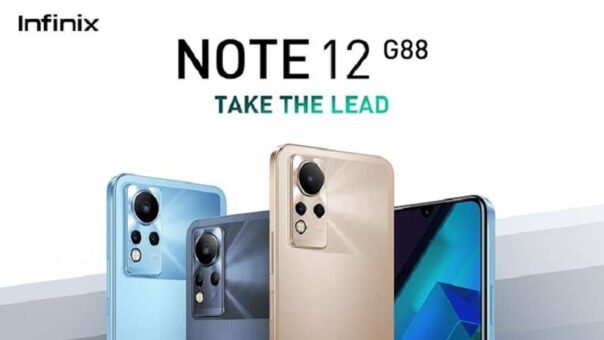

Price of Infinix Note 12 G88 from July 15

The Infinix Note 12 G88 was launched in Pakistan on May 26, 2022, offering impressive features and specifications. With a generous internal memory of 128GB and 6GB of RAM, this phone comes at a price of Rs50,999.

(more…) -

Vivo Y36: New Smartphone Release with Impressive Features

Vivo has unveiled its latest smartphone, the Vivo Y36, which comes packed with impressive features and an appealing design. The device is priced at Rs.89,999, making it an attractive option for users seeking a high-quality smartphone experience.

(more…) -

After the Whistle Podcast Returns, Covering Women’s World Cup

Apple News has exciting news for sports enthusiasts! The highly popular podcast “After the Whistle,” hosted by Brendan Hunt and Rebecca Lowe, is set to make a comeback with its second season.

(more…) -

Zong 4G and Sehat Kahani Partner to Expand Telemedicine Services in Pakistan

Karachi, July 10, 2023 – Zong 4G, Pakistan’s leading telecommunications operator, has partnered with Sehat Kahani, a pioneering telemedicine platform, to expand telemedicine services across the country.

(more…) -

Updated price of Apple iPhone 13 from July 17

Introducing the Apple iPhone 13, unveiled on September 24, 2021. The price of this exceptional phone varies based on its storage capacity.

(more…) -

New prices of Apple iPhone 14 from July 15

On September 7th, 2022, the highly anticipated Apple iPhone 14 made its debut in the Pakistani market, offering a variety of storage and RAM options to cater to every user’s requirements. Here are the key details:

(more…) -

New price of Samsung Galaxy S22 Ultra from July 15

The Samsung Galaxy S22 Ultra was introduced in Pakistan on February 09, 2022, boasting remarkable features and performance.

(more…) -

Price of Apple iPhone 13 Pro Max from July 10

The iPhone 13 Pro Max made its debut in Pakistan on March 24, 2021. The phone’s price varies depending on the storage capacity it offers.

(more…) -

Updated price of Realme GT Master Edition

Introducing the Realme GT Master Edition, now available in Pakistan since October 11, 2021. This incredible smartphone offers various storage capacities at different prices.

(more…)