KARACHI: A delegation from the Japanese Consulate in Karachi visited Central Depositor Company of Pakistan Limited (CDC) on Wednesday.

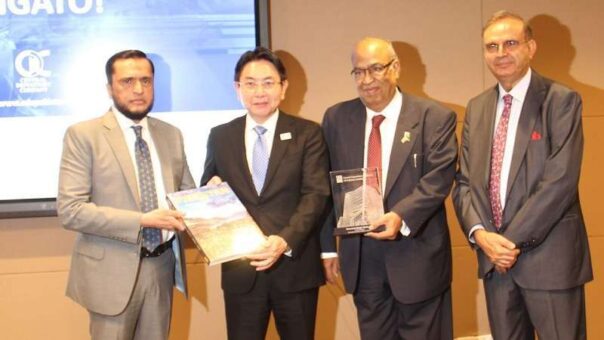

Odagiri Toshio San, Consul General of Japan in Karachi headed the delegation. Representatives from Pakistan Japan Business Forum and leading Pakistani corporates also attended this event.

Moin M. Fudda – Chairman CDC welcomed the delegation and spoke about the long term bilateral relations between Japan and Pakistan while stressing on the need to foster greater ties on business and trade initiatives.

Badiuddin Akber – CEO-CDC presented an overview of the Pakistan Capital Market landscape and CDC’s key role in its development as an integral infrastructure institution that handles the settlement and custody of securities, while highlighting the association between CDC and Japan Securities Depositories Center, Inc. (JASDEC), which is CDC’s counterpart from the Japanese Capital Market.

Japanese Consul General Odagiri Toshio San lauded CDC on its achievements in transforming the Pakistani Capital Market.

He said that “It is important to work further on bringing the two sides closer together for the benefit of both countries. Japan and Pakistan should bring together expertise and technology, particularly for bigger future projects through more effective Public Private Partnerships.”

Kalim Farooqui – Chairman Pakistan Japan Business Forum (PBJF) – also applauded the efforts of CDC in the development of Pakistan’s Capital Market and highlighted that CDC has been a success story for Pakistan’s business landscape.

He stressed on the need to scale up the efforts to strengthen the business ties between Pakistan and Japan for mutual benefit and progress.

The event was attended by prominent Industry leaders, including Dr. Shamshad Akhtar – Chairperson Pakistan Stock Exchange and Irfan Siddiqui – President Meezan Bank Limited.