ISLAMABAD: The government has proposed new rates of capital gain tax on disposal of securities traded at Pakistan Stock Exchange (PSX).

Pakistan presented its federal budget on June 10, 2022 and introduced various taxation measures to boost revenue collection.

READ MORE: Pakistan slaps 45% corporate tax on banks

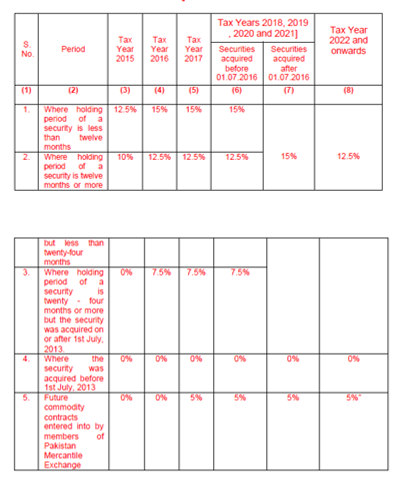

Through Finance Bill, 2022 proposed to revise the rates of capital gain tax for tax year 2023 and onwards.

Following is the proposed rates of capital gain tax:

| S.No | Holding Period | Rate of Tax for Tax year 2023 and onwards |

| (1) | (2) | (3) |

| 1. | Where the holding period does not exceed one year | 15% |

| 2. | Where the holding period exceeds one year but does not exceed two years | 12.5% |

| 3. | Where the holding period exceeds two years but does not exceed three years | 10% |

| 4. | Where the holding period exceeds three years but does not exceed four years | 7.5% |

| 5. | Where the holding period exceeds four years but does not exceed five years | 5% |

| 6. | Where the holding period exceeds five years but does not exceed six years | 2.5% |

| 7. | Where the holding period exceeds six years | 0% |

| 8. | Future commodity contracts entered into by members of Pakistan Mercantile Exchange | 5%”; |

The Federal Board of Revenue (FBR) collects capital gain tax on disposal of securities under Section 37A of the Income Tax Ordinance, 2001.

Following is the text of Section 37A of Income Tax Ordinance, 2001:

READ MORE: Tax rates for business individuals, AOPs during TY2023

37A. Capital gain on disposal of securities.—(1) The capital gain arising on or after the first day of July 2010, from disposal of securities, other than a gain that is exempt from tax under this Ordinance, shall be chargeable to tax at the rates specified in Division VII of Part I of the First Schedule:

Provided that this section shall not apply to a banking company and an insurance company.

(1A) The gain arising on the disposal of a security by a person shall be computed in accordance with the following formula, namely: —

A – B

Where —

(i) ‘A’ is the consideration received by the person on disposal of the security; and

READ MORE: Pakistan reintroduces advance tax on foreign payments

(ii) ‘B’ is the cost of acquisition of the security.

(2) The holding period of a security, for the purposes of this section, shall be reckoned from the date of acquisition (whether before, on or after the thirtieth day of June, 2010) to the date of disposal of such security falling after the thirtieth day of June, 2010.

(3) For the purposes of this section “security” means share of a public company, voucher of Pakistan Telecommunication Corporation, Modaraba Certificate, an instrument of redeemable capital,debt Securities, unit of exchange traded fund and derivative products.

(3A) For the purpose of this section, “debt securities” means –

READ MORE: Exchange companies to withhold tax on payment to MTOs

(a) Corporate Debt Securities such as Term Finance Certificates (TFCs), Sukuk Certificates (Sharia Compliant Bonds), Registered Bonds, Commercial Papers, Participation Term Certificates (PTCs) and all kinds of debt instruments issued by any Pakistani or foreign company or corporation registered in Pakistan; and

(b) Government Debt Securities such as Treasury Bills (T-bills), Federal Investment Bonds (FIBs), Pakistan Investment Bonds (PIBs), Foreign Currency Bonds, Government Papers, Municipal Bonds, Infrastructure Bonds and all kinds of debt instruments issued by Federal Government, Provincial Governments, Local Authorities and other statutory bodies.

“Explanation: For removal of doubt it is clarified that derivative products include future commodity contracts entered into by the members of Pakistan Mercantile Exchange whether or not settled by physical delivery.”

(3B) For the purpose of this section, “shares of a public company” shall be considered as security if such company is a public company at the time of disposal of such shares.

(4) Gain under this section shall be treated as a separate block of income.

(5) Notwithstanding anything contained in this Ordinance, where a person sustains a loss on disposal of securities in a tax year, the loss shall be set off only against the gain of the person from any other securities chargeable to tax under this section and no loss shall be carried forward to the subsequent tax year:

Provided that so much of the loss sustained on disposal of securities in tax year 20l9 and onwards that has not been set off against the gain of the person from disposal of securities chargeable to tax under this section shall be carried forward to the following tax year and set off only against the gain of the person from disposal of securities chargeable to tax under this section, but no such loss shall be carried forward to more than three tax years immediately succeeding the tax year for which the loss was first computed.

(6) To carry out purpose of this section, the Board may prescribe rules.

The rate of tax to be paid under section 37A shall be as follows:—