Karachi, June 30, 2024 – The Federal Board of Revenue (FBR) has issued a new list imposing regulatory duties on 657 imported items, effective from July 1, 2024. This action, detailed in SRO 928(I)/2024, supersedes the previous SRO 966(I)/2022 issued on June 30, 2022.

(more…)Category: Taxation

Pakistan Revenue delivers the latest taxation news, covering income tax, sales tax, and customs duty. Stay updated with insights on tax policies, regulations, and financial developments in Pakistan.

-

Check Tax Burden on Your Salary Income from July 1

Salary persons should calculate their income for the purpose of tax chargeability under changes made through Finance Act, 2024 and effective from July 1, 2024.

(more…) -

FBR to Permit Non-Filers for Hajj and Umrah

Karachi, June 30, 2024 – In a significant policy shift, the Federal Board of Revenue (FBR) will now permit non-filers of income tax returns to travel abroad for performing Hajj and Umrah.

(more…) -

FED Rates on Property Transfer Applicable from July 1, 2024

Karachi, June 29, 2024 – The Finance Act, 2024 has set new rates for Federal Excise Duty (FED) on property transfers, effective from July 1, 2024. The Federal Board of Revenue (FBR) has detailed the application of these rates, which vary based on the taxpayer status of the buyer.

(more…) -

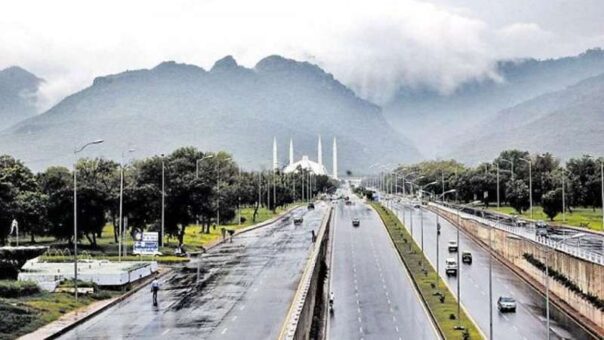

CVT Imposed on Farmhouses, Residential Houses in Islamabad

Islamabad, June 29, 2024 – The government has imposed a capital value tax (CVT) on farmhouses and residential houses within the territorial limits of Islamabad Capital Territory, as outlined in the Finance Act, 2024.

(more…) -

Government Introduces Separate Tax Regime for Property Sale

Karachi, June 29, 2024 – The government of Pakistan has introduced a separate tax regime for income tax on property sales through the amended Finance Bill, 2024.

(more…) -

Income Tax Surcharge at 10% Levied on Salaried Persons

Karachi, June 29, 2024 – In a surprising move aimed at generating more tax revenue, the government has imposed a 10 percent surcharge on income tax for individuals earning over Rs 10 million.

(more…) -

Pakistan Puts More Tax Burden on 2024-25 Budget Approval

Pakistan has intensified its fiscal measures by increasing the tax burden on the nation as it seeks approval for the 2024-25 budget. The government has added further amendments to the earlier proposed Finance Bill 2024, imposing additional taxes to meet revenue targets.

(more…) -

Aurangzeb Urges Inclusion of Retailers and Real Estate in Tax Net

Islamabad, June 28, 2024 – Finance Minister Mohammad Aurangzeb emphasized the necessity of broadening Pakistan’s tax base by incorporating retailers and the real estate sector into the tax net.

(more…) -

SBP Issues Bank Timings for Tax Collection in FY24 Closing

Karachi, June 28, 2024 – The State Bank of Pakistan (SBP) announced on Friday the bank timings for the collection of duty and tax during the last three days of the fiscal year 2024-25.

(more…)