Lahore, January 29, 2026 — Pakistan Customs has announced that importers submitting correct and complete declarations will be given priority for placement in the Green Channel, enabling faster clearance without physical examination.

(more…)Category: Taxation

Pakistan Revenue delivers the latest taxation news, covering income tax, sales tax, and customs duty. Stay updated with insights on tax policies, regulations, and financial developments in Pakistan.

-

KCCI calls on FBR to allow super tax adjustment against refunds

Karachi, January 28, 2026 – The Karachi Chamber of Commerce and Industry (KCCI) has urged the Federal Board of Revenue (FBR) to allow the adjustment of super tax liabilities against pending income tax and sales tax refunds to ease pressure on the business community.

(more…) -

FBR instructs Inland Revenue offices to open collection counters on January 31

Islamabad, January 28, 2026 — The Federal Board of Revenue (FBR) on Wednesday directed all Inland Revenue (IR) field formations to keep their collection counters open on Saturday, January 31, 2026, in a move aimed at strengthening revenue collection towards the end of the month.

(more…) -

FBR withholding tax collection surges past Rs3 trillion in first half of FY26

Islamabad, January 28, 2026 – The Federal Board of Revenue (FBR) has collected withholding tax over Rs3 trillion during the first half (July–December) of fiscal year 2025-26 (1HFY26), reflecting a notable improvement in revenue mobilization despite mixed performance across various withholding tax heads.

(more…) -

Banks to pay super tax from tax year 2023 onwards, court rules

Islamabad, January 28, 2026 — Banks will be required to pay super tax from tax year 2023 onwards after the Federal Constitutional Court upheld the applicability of super tax under Section 4C of the Income Tax Ordinance, 2001, according to a press release issued by the Federal Board of Revenue (FBR).

(more…) -

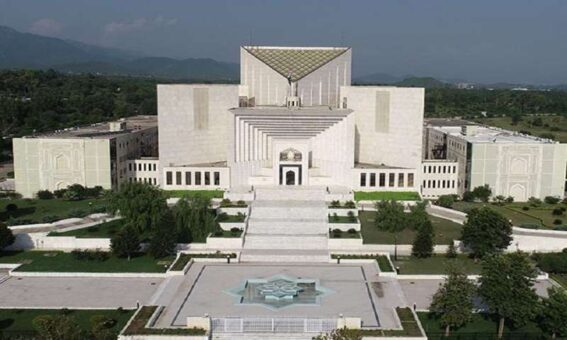

Supreme Court declares FBR notices issued after expiry unlawful

Islamabad, January 28, 2026 — The Supreme Court of Pakistan has ruled that tax orders issued by the Federal Board of Revenue (FBR) after the expiry of the legally prescribed time limit are unlawful, reaffirming that such actions cannot be sustained under the Sales Tax Act, 1990.

(more…) -

Taxpayers lose super tax legal battle as FBR eyes Rs300 billion recovery

Islamabad, January 27, 2026 — In a major setback for taxpayers and corporate entities, the Federal Constitutional Court (FCC) on Tuesday upheld the legality of the super tax, paving the way for the Federal Board of Revenue (FBR) to recover nearly Rs300 billion in outstanding dues.

(more…) -

Islamabad Customs to Auction Luxury Vehicles on January 28

Islamabad, January 27, 2026 – The Collectorate of Customs Enforcement, Islamabad, has announced a public auction of luxury and high-end vehicles seized by customs authorities. The auction is scheduled for January 28, 2026, and will be held at the State Warehouse of the Collectorate of Customs Enforcement, Islamabad.

(more…) -

FBR introduces AI-based chick counting system to monitor poultry sector

Islamabad, January 27, 2026 – In a move to tighten oversight of the poultry industry, the Federal Board of Revenue (FBR) has announced plans to implement an advanced Artificial Intelligence (AI) system to monitor every chick produced across Pakistan’s hatcheries.

(more…) -

Unlocking Customs Secrets: How Pakistan Examines Your Imports in 2026

The examination of goods declarations is a critical pillar of customs control, revenue protection, and trade facilitation in Pakistan. Under Section 80 of the Customs Act, 1969, as updated for tax year 2026, Pakistan Customs has been empowered to verify, examine, reassess, and digitally analyze import declarations to ensure accuracy and compliance.

(more…)