Karachi, July 5, 2024 – The Finance Act, 2024, has empowered the officers of Pakistan Customs to seek assistance from the Intelligence Bureau (IB) for resolving particular cases.

(more…)Category: Top stories

Find top stories in this section. Pakistan Revenue brings you the latest and most important news from Pakistan and around the world, keeping you informed with key updates and insights.

-

Petrol Pumps to Remain Open Despite Strike Call: Authorities

Islamabad, July 5, 2024: In a move to mitigate disruptions caused by a planned strike by the Pakistan Petroleum Dealer’s Association (PPDA), the Petroleum Division has taken steps to ensure an uninterrupted fuel supply across the country.

(more…) -

FBR Announces Major Reshuffle of 51 Senior Customs Officers

Karachi, July 4, 2024 – In a significant administrative move, the Federal Board of Revenue (FBR) of Pakistan has announced a comprehensive reshuffle affecting 51 senior officers within the Pakistan Customs Service (PCS).

(more…) -

SBP Reports $494 Million Increase in Weekly Forex Reserves

Karachi, July 4, 2024 – The State Bank of Pakistan (SBP) has announced a notable increase of $494 million in its official foreign exchange reserves for the week ending June 28, 2024, reflecting positive inflows from multilateral agencies.

(more…) -

FBR Makes Batch of 27 BS-20 Officers as OSD

Karachi, July 4, 2024 – In a sweeping move aimed at cleansing its ranks of alleged incompetence and corruption, the Federal Board of Revenue (FBR) has relegated a cohort of 27 officers to Officer on Special Duty (OSD) status.

(more…) -

SBP Tightens Oversight on Foreign Currency Accounts

Karachi, July 3, 2024 – The State Bank of Pakistan (SBP) on Wednesday issued a directive to all banks, requiring detailed submissions of transactions conducted through foreign currency accounts (FCA).

(more…) -

Pakistan Stocks Reach Record High at 80,234 Points

Karachi, July 3, 2024 – Pakistan stocks achieved a historic milestone on Wednesday as the benchmark KSE-100 index of the Pakistan Stock Exchange (PSX) surged to a record high of 80,234 points, driven by positive market sentiment and increased investor participation.

(more…) -

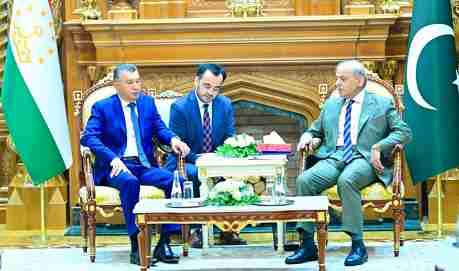

Pakistan Offers Tajikistan Use of Karachi Port for Transit Trade

Karachi, July 3, 2024 – In a significant move to boost regional trade and connectivity, Prime Minister Muhammad Shehbaz Sharif extended an invitation to Tajikistan to utilize Karachi Port for transit trade.

(more…) -

Pakistan Seeks Bigger Bite of IMF Apple: Requests $10 Billion

Islamabad, July 2, 2024 – Pakistan has requested the International Monetary Fund (IMF) to expand its proposed bailout package to $10 billion, citing the country’s deteriorating economic conditions.

(more…) -

Pakistan Registers 10.54% Jump in Exports for FY24

Islamabad, July 2, 2024 (PkRevenue.com) – Pakistan has recorded a remarkable growth of 10.54 percent in exports during the fiscal year 2023-24, according to data released by the Pakistan Bureau of Statistics (PBS) on Tuesday. The country’s exports surged to $30.65 billion during FY24, up from $27.72 billion in the previous fiscal year.

(more…)