Islamabad, September 16, 2025 – The government of Pakistan has announced a fresh adjustment in fuel prices, increasing the rate of high-speed diesel (HSD) while keeping the price of petrol unchanged for the next fortnight.

(more…)Category: Top stories

Find top stories in this section. Pakistan Revenue brings you the latest and most important news from Pakistan and around the world, keeping you informed with key updates and insights.

-

Iran and Pakistan agree to finalize FTA, activate border markets

Tehran/Islamabad, September 15, 2025 – Pakistan and Iran have moved a step closer toward strengthening bilateral trade ties, as both countries agreed to finalize a Free Trade Agreement (FTA) and operationalize border markets aimed at boosting commerce and improving connectivity.

(more…) -

SBP maintains policy rate at 11% amid floods shock

Karachi, September 15, 2025 – The State Bank of Pakistan (SBP) on Monday kept its policy rate unchanged at 11 percent, citing ongoing economic challenges and heightened uncertainty following the devastating floods that have disrupted the country’s agriculture and supply chains.

(more…) -

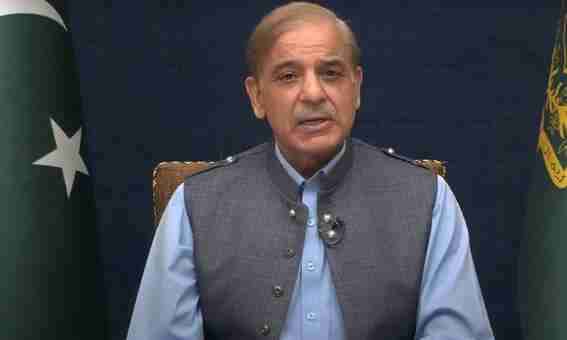

PM Shehbaz announces relief package for flood victims

Islamabad, September 14, 2025 – Prime Minister Shehbaz Sharif on Sunday unveiled a wide-ranging relief package to support communities devastated by torrential rains and flash floods across the country.

(more…) -

Tax exemption to electricity companies surge 173%: FBR

Karachi, September 14, 2025 – The Federal Board of Revenue (FBR) has reported a massive surge in tax benefits provided to the electricity generation sector.

(more…) -

PM Shehbaz suspends electricity bill collection in flood-hit areas

Islamabad, September 13, 2025 – Prime Minister Shehbaz Sharif on Saturday announced a significant relief step for citizens living in flood-affected regions of Pakistan.

(more…) -

Pakistan grants tax exemption to judiciary of superior courts

Karachi, September 13, 2025 – Pakistan’s apex tax agency, the Federal Board of Revenue (FBR) has formally granted income tax exemption to judges of the superior judiciary for the tax year 2025–26.

(more…) -

SBP sets timelines for export payment realization

Karachi, September 12, 2025 – The State Bank of Pakistan (SBP) has introduced detailed timelines for the realization of export proceeds, aiming to bring clarity and discipline to foreign trade transactions.

(more…) -

Weekly SPI inflation eases marginally: PBS report

Islamabad, September 12, 2025 – The Pakistan Bureau of Statistics (PBS) on Friday announced that weekly inflation, measured through the Sensitive Price Indicator (SPI), eased slightly by 2 basis points. For the week ending September 11, 2025, the SPI recorded a minor decline of 0.02%.

(more…) -

Govt collects sales tax as PDL on petroleum products: FBR

Islamabad, September 11, 2025 – The Federal Board of Revenue (FBR) has clarified reports suggesting that the government had granted a blanket sales tax exemption on petroleum products.

(more…)