Islamabad, February 13, 2026 – Pakistan’s State-Owned Enterprises (SOEs) recorded a staggering net loss of Rs122 billion in the fiscal year 2025, marking a 300% increase compared to the previous year, according to the latest annual report released by the Finance Ministry.

(more…)Category: Top stories

Find top stories in this section. Pakistan Revenue brings you the latest and most important news from Pakistan and around the world, keeping you informed with key updates and insights.

-

Finance Minister Aurangzeb reaffirms support for PM’s fan replacement program

Islamabad, February 12, 2026 — Federal Minister for Finance and Revenue Senator Muhammad Aurangzeb has reaffirmed the Ministry of Finance’s full commitment to supporting the Prime Minister’s Fan Replacement Program, terming it a key initiative for energy conservation, fiscal responsibility, and climate action.

(more…) -

NEPRA tweaks power tariffs: Low-use consumers pay fixed charges, high-use save

Islamabad, February 11, 2026 – The National Electric Power Regulatory Authority (NEPRA) has announced a new electricity tariff structure, introducing fixed monthly charges for domestic consumers using up to 300 units of electricity, while reducing per-unit rates for higher usage.

(more…) -

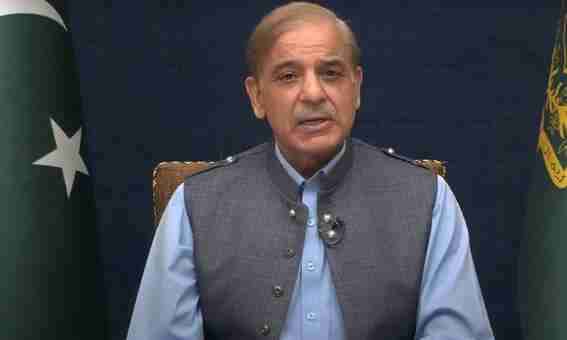

PM Shehbaz orders NEPRA review to protect existing solar consumers

Islamabad, February 11, 2026 – Prime Minister Muhammad Shehbaz Sharif on Wednesday directed a review of the new Prosumer Regulations 2026 issued by the National Electric Power Regulatory Authority (NEPRA) to safeguard the contracts of existing solar energy consumers.

(more…) -

Sindh revenue explodes as ports and telecom deliver record collections: SRB FY25 report

Karachi, February 11, 2026 – Port and terminal operators emerged as the largest contributors to sales tax on services in Sindh during fiscal year 2024-25, according to the annual performance report released by the Sindh Revenue Board (SRB).

(more…) -

Sindh leads Pakistan in sales tax collection as provinces report strong growth in 1HFY26

Islamabad, February 10, 2026 – Sindh province maintained its position as the largest collector of Sales Tax on Services among Pakistan’s provinces during the first half (July to December) of fiscal year 2025-26, according to data released by the Federal Finance Ministry.

(more…) -

Pakistan drops boycott, sets sights on India clash in T20 World Cup 2026

Islamabad, February 9, 2026 – The federal government of Pakistan on Monday directed the Pakistan national cricket team to play its scheduled ICC Men’s T20 World Cup 2026 match against India on February 15 in Colombo.

(more…) -

Pakistan-Saudi Arabia ties remain strong despite global tensions: Aurangzeb

Islamabad, February 9, 2026 – Pakistan’s relationship with Saudi Arabia continues to remain resilient despite global geopolitical tensions, said Federal Minister for Finance and Revenue Senator Muhammad Aurangzeb on Monday.

(more…) -

SBP sees stronger growth ahead as FY26 GDP outlook improves

Karachi, February 9, 2026 — The State Bank of Pakistan (SBP) on Monday projected the country’s real gross domestic product (GDP) growth in the range of 3.4 to 4.75 percent for fiscal year 2025-26 (FY26), while estimating further improvement in FY27, supported by macroeconomic stabilization, easing financial conditions, and continued fiscal consolidation.

(more…) -

Pakistan to invest $1 billion in AI by 2030, empowering youth nationwide

ISLAMABAD, February 9, 2026 — Prime Minister Shehbaz Sharif announced on Monday that the government will invest $1 billion in Pakistan’s Artificial Intelligence (AI) sector by 2030, aiming to build a future-ready digital economy and empower the country’s youth.

(more…)