Karachi, March 9, 2025 – The State Bank of Pakistan (SBP) is set to unveil its latest monetary policy statement on Monday, March 10, 2025. The central bank’s Monetary Policy Committee (MPC) will deliberate on potential adjustments to the benchmark policy rate amid an economic landscape marked by decade-low inflation.

(more…)Category: Top stories

Find top stories in this section. Pakistan Revenue brings you the latest and most important news from Pakistan and around the world, keeping you informed with key updates and insights.

-

Pakistan to Launch Paperless Prize Bonds to Curb Black Money

Islamabad, March 9, 2025 – Pakistan is gearing up to introduce paperless prize bonds as part of a comprehensive strategy to curb black money circulation and strengthen the documentation of the economy.

(more…) -

CDNS Announces Draw Schedule 2025 for Premium Prize Bonds

Islamabad: The Central Directorate of National Savings (CDNS) has officially announced the draw schedule for premium prize bonds for the year 2025. This announcement brings anticipation for investors who have placed their savings in premium prize bonds, offering lucrative prizes and periodic profit payments.

(more…) -

FBR Issues SRO 301 to Implement Key Changes in EFS

Islamabad – The Federal Board of Revenue (FBR) has issued SRO 301(I)/2025, introducing significant amendments to the Export Facilitation Scheme (EFS) and modifying key aspects of the Customs Rules, 2001.

(more…) -

Pakistan’s Weekly Inflation Turns Negative for First Time in 7 Years

Karachi, March 7, 2025 – In a significant economic development, Pakistan’s weekly inflation, as measured by the Sensitive Price Indicator (SPI), has turned negative for the first time in nearly seven years.

(more…) -

FBR Reports 40% Growth in Tax Payments with Returns

Karachi, March 7, 2025 – The Federal Board of Revenue (FBR) has reported an impressive 40% surge in tax payments made alongside tax return filings for the tax year 2024. This significant increase highlights the effectiveness of the government’s recent tax enforcement measures and the growing compliance among taxpayers.

(more…) -

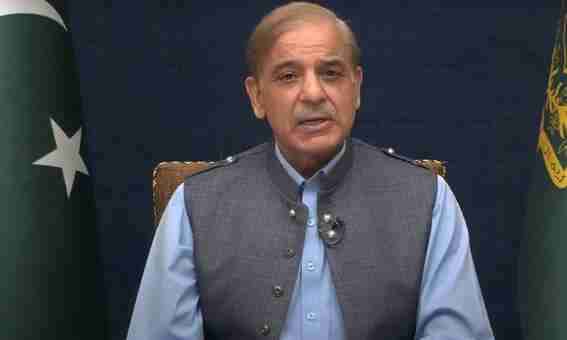

PM Shehbaz Directs Hiring Skilled Manpower for SMEDA

Islamabad, March 6, 2025 – Prime Minister Shehbaz Sharif has directed that skilled manpower should be hired from the market to strengthen the Small and Medium Enterprises Development Authority (SMEDA).

(more…) -

KSE-100 Soars 1,459 Points as Global Oil Prices Plunge

Karachi, March 6, 2025 – The KSE-100 index of the Pakistan Stock Exchange (PSX) witnessed a significant surge on Thursday, gaining 1,459 points amid a sharp decline in international oil prices.

(more…) -

Banks Plan to Move Supreme Court on Windfall Tax

Karachi, March 6, 2025 – A group of banks in Pakistan is preparing to approach the Supreme Court to challenge the recent Sindh High Court decision regarding the windfall tax imposed on foreign exchange income.

(more…) -

Silkbank Faces Uncertainty as Auditors Raise Red Flags

Grant Thornton Anjum Rahman, a reputable firm of Chartered Accountants, has raised significant concerns regarding the financial viability of Silkbank Limited.

(more…)