KARACHI: SITE Association of Industry has demanded the government to ensure dollar availability for import of raw material and avert industrial shutdown.

(more…)Category: Trade & Industry

This section covers news on trade and industry. Pakistan Revenue is committed to providing the latest updates on business trends.

-

Kohinoor Spinning Mills stops production due to high cost

KARACHI: A spinning mill has stopped production due to high cost of production and economic downturn.

Kohinoor Spinning Mills Limited in a communication sent to Pakistan Stock Exchange on Wednesday said that due to prevailing global and economic downturn, overdue plant maintenance, high cost of production and low price and demand, it is not feasible to operation the production facility.

“Therefore, the management of the company has decided to temporary close/stop the production activities of the company with immediate effect,” the company said.

The management is hopeful that the current situation will improve in the first quarter of 2023 enabling the company to restart its operations.

-

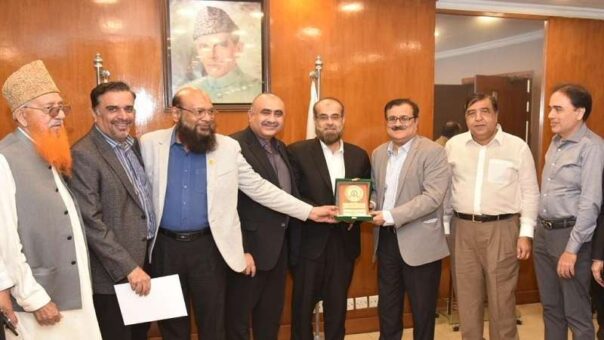

FPCCI, BoI to launch Invest Pakistan initiative

KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) and Board of Investment (BoI) have agreed to form a Joint Consultative Working Group to help constitute and effectively operationalize an independent body called Invest Pakistan under the leadership of Prime Minister through Prime Minister’s Office (PMO).

READ MORE: Over 400 vegetable containers stuck up at ports due to dollar shortage

According to a statement issued on Monday, FPCCI President Irfan Iqbal Sheikh apprised that Invest Pakistan will ensure the policy advocacy initiatives with the support and full-backing of private-sector to promote and facilitate FDI in Pakistan. We have decided to lend a helping hand to make this initiative a success story in the broader national interest, he added.

READ MORE: FPCCI demands release of soybean, canola cargoes

FPCCI Chief added that he has liked the initiative as its concept note entails giving up to 80 percent representation to private-sector on Invest Pakistan board and 51 percent equity or shareholding to private-sector. However, the exact modalities and ToRs will be worked out when the meetings of the working group take place, he added.

Suleman Chawla, SVP FPCCI, who co-chaired the meeting with Ms. Ambreen Iftikhar, Additional Secretary BoI, at the FPCCI Head Office, explained the Public-Private Partnership (PPP) frameworks have proven to be most successful the world over – be it promoting FDI or enticing private-sector investments. He added that PPP mechanism ensures first-hand knowledge and expertise on a sectorial-level from the business, industry and trade community.

READ MORE: KATI urges removal of regulatory duty on yarn

Ms. Ambreen Iftikhar outlined the objectives of Invest Pakistan intuitive as: (i) develop a new and innovative private partnership to facilitate, promote and convert FDI (ii) possibility of joint equity of Invest Pakistan between public and private sectors (iii) seat on the policy negotiation and decision-making forums to avoid disconnect between government institutions and the business community (iv) joint targeting of investment and customized resolution of binding constraints (v) Brand Pakistan through actual investment successes rather through verbose material.

READ MORE: Pakistan slaps 5pc regulatory duty on yarn import

It is pertinent to note that apart from its President and SVP, FPCCI has nominated three other of its prominent members to Joint Consultative Working Group; namely, Mian Nasser Hyatt Maggo, immediate past President FPCCI; Mr. Amjad Rafi, Chairman of Pakistan-Turkiye Joint Business Council of FPCCI and Mr. Jawaid Ilyas, Chairman of Pakistan-China Business Council of FPCCI.

-

Floor tile production halts on LC restrictions, gas shortage

KARACHI: A ceramic company has decided to shut down its floor tile production due to restrictions of Letter of Credit (LC) opening and prevailing gas shortage.

In a communication received by Pakistan Stock Exchange (PSX), Frontier Ceramics Limited announced the shut down its floor tile production plant for an uncertain period due to gas supply shortage.

The company further stated that the unforeseen devaluation of Pakistani Rupee (PKR) coupled with government’s restriction, including LC approval constraints and general economic instability were also the reason behind the decision.

“The resumption of operation (as the case may be) will be communicated accordingly,” the company stated in the communication.

It said the information is being conveyed in accordance with the requirements of Regulation of Pakistan Stock Exchange Limited (PSX) and the applicable provisions of the Securities Act, 2015.

The company also requested the stock exchange that the information may be disseminated amongst the TRE Certificate Holders of the stock exchange as well.

-

SRB says cases worth Rs 80 billion stuck in litigation

KARACHI: Sindh Revenue Board (SRB) Friday said that cases worth Rs80 billion were stuck in litigation and it is willing to resolve amicably.

SRB chairman Dr. Wasif Ali Memon highlighted that Rs80 billion worth of cases are stuck in litigation and the provincial revenue board is all-willing to resolve as many cases amicably as possible.

READ MORE: Customs appraising officer awarded major penalty for inefficiency

“We want to be the facilitators and partners to the business community and no highhandedness is ever desired by SRB,” he added during his visit to Federation of Pakistan Chambers of Commerce and Industry (FPCCI).

On the demand of FPCCI, Dr. Wasif Ali Memon announced that an effective and inclusive Alternative Dispute Resolution Committee (ADRC) would be formulated by SRB in few weeks and we will include 5 – 6 nominees of FPCCI into the committee.

READ MORE: Further tax collection on pharmaceutical products unlawful: KTBA

Chairman SRB also proposed that FPCCI nominees should come from varied sectors to address issues of all the sectors. Additionally, he requested the business community to exhaust the ADRC and other SRB procedures before going into litigation as it only delays the dispute resolution.

On the occasion, Irfan Iqbal Sheikh, President FPCCI, has stressed upon the need to strengthen and broaden the scope of ADRC to save the precious time, resources and hassle of both the sides, i.e. business community and the SRB.

Co-chairing the high-profile meeting with SRB Chairman, Suleman Chawla, SVP FPCCI, offered to nominate technical and expert members of the business, industry and trade community from the platform of FPCCI to facilitate SRB’s efforts to strengthen ADRC.

READ MORE: Non-filers will not be included in ATL 2022

FPCCI nominees will come with the first-hand knowledge of real issues and with deep understanding of the taxation matters, he added.

Shabbir Mansha, VP FPCCI, demanded that as Karachi contributes the lion’s share of taxes in federal & provincial authorities, there should be an enhanced focus on the infrastructural development of Karachi – specifically in industrial& commercial areas and port infrastructure. This will only increase the revenue generation from Karachi, he added.

READ MORE: FBR directs BS-21 officers to submit declaration of assets

Shuakat Omerson, VP FPCCI, apprised the top management of SRB that many members of FPCCI are qualified in alternative dispute resolution mechanism; including the incumbent and former office bearers of FPCCI; and, they can offer great support to SRB’s ADRC initiatives.

Khurram Ejaz, Advisor to the President of FPCCI on FBR & revenue matters, said that FPCCI considers SRB as their partners and not as adversaries; because objectives of both the institutions are same – economic development of the province and resolution of all disputes & anomalies pertaining to provincial tax collection.

-

Pakistan’s business confidence turns negative: survey

KARACHI: Pakistan’s business confidence turned negative owing to highly challenging political and economic situation, according to a survey conducted by Overseas Investors Chamber of Commerce and Industry (OICCI).

OICCI, is representative of foreign and multinational companies in Pakistan, announced the results of its comprehensive Business Confidence Index (BCI) Survey – Wave 22, conducted throughout the country during September to October 2022, which revealed that the overall Business Confidence Score (BCS) in Pakistan now stands at negative 4 percent showing a decrease by 21 percent from the previous positive 17 percent in Wave 21 Survey conducted in March to April 2022.

READ MORE: Over 400 vegetable containers stuck up at ports due to dollar shortage

The highest drop in confidence was recorded in the “services sector” (24 percent), followed by “Retail & Wholesale trade” (22 percent), and Manufacturing sector (20 percent). The survey sample consisted of 42 percent respondents from Manufacturing sector, 33 percent from the Services sector and 25 percent from the retail/ wholesale trade.

Despite recording a significant drop in confidence of 20 percent, the Manufacturing sector recorded a net confidence level of positive 3 percent, whereas services and retail sector stood at negative of 8 percent and 14 percent respectively.

Commenting on the BCS, Ghias Khan, President OICCI, observed: “The substantial decline in the overall Business Confidence to negative 4 percent is regrettable but not surprising considering the highly challenging political and economic situation during the past six months. Besides very high inflation and increased fuel prices, the significant currency devaluation also dampened the economic activity. The record level of rains during August leading to severe flooding in Sindh and other parts of the country further restricted the business activities”.

READ MORE: FPCCI demands release of soybean, canola cargoes

OICCI BCI Survey, conducted periodically face to face, across the country in nine cities, covering 80 percent of the GDP, with higher weightage given to key business centres of Karachi, Lahore, Rawalpindi-Islamabad, and Faisalabad.

The OICCI Survey feedback covers business environment at regional, national, sectorial, and own business entity levels in the past six months, as well as the anticipated business and investment environment in the next six months.

Overall, more than half (56 percent vs 19 percent in previous wave) survey respondents were negative on the business environment in the past six months and going forward only net 2 percent (vs 18 percent in the previous survey) were positive for the next six months.

Commenting on the business situation for the next six months, the OICCI Vice President Amir Paracha observed, “these are challenging times, and the authorities are doing all they can to navigate the enormous challenges in front including managing inflation, restricted availability of foreign exchange and resource constraints.”

READ MORE: KATI urges removal of regulatory duty on yarn

Amir added: “Key stakeholders especially foreign investors will continue to support the authorities in taking long term policy measures to streamline the economic fundamentals including fair taxation for all and facilitate business and investment in the country.”

The sentiments of the OICCI members, the leading foreign investors, who were randomly included in the survey, stands at positive 6 percent, substantially lower to positive 33 percent in the previous wave.

Foreign investors have in the past also shown higher confidence than non-members. Commenting on OICCI members survey feedback, Ghias Khan, observed that “foreign investors feedback could have been more positive but for serious concerns on few critical issues like the undue delay in revising the pharma pricing and the extreme delays in overseas remittances for goods, services and dividends. Such actions are seriously counter productive for attracting FDI in the country.”

The three major threats to business growth identified in the survey are Inflation (78 percent), High Taxation (71 percent), and currency devaluation (70 percent) which could potentially slow down business growth in Pakistan.

READ MORE: Pakistan slaps 5pc regulatory duty on yarn import

Looking ahead, only 18 percent (34 percent in Wave 21) expect expansion in business operations, 2 percent (21 percent in Wave 21) planning new capital investment and 7 percent respondents (positive 16 percent in Wave 21) expect increased employment in their respective businesses.

The OICCI is the collective voice of major foreign investors in Pakistan. The over 200 OICCI members, from 31 different countries, have a presence in 14 sectors of the economy and contribute around one-third of Pakistan’s total tax revenue, besides facilitating transfer of technology and skills and providing employment to a sizeable number of people.

About a third of OICCI member companies are listed on the Pakistan Stock Exchange and 40 members are associates of the Global Fortune 500 companies. Besides their business operations the OICCI members realize their corporate social responsibilities and are major contributors to various CSR activities benefitting 34 million persons from underprivileged communities.

-

Over 400 vegetable containers stuck up at ports due to dollar shortage

KARACHI: Over 400 containers of vegetables have been stuck up at ports as commercial banks are not issuing documents due to shortage of dollars.

All Pakistan Fruit and Vegetable Exporters, Importers and Merchants Association in a letter to the commerce ministry sent on Tuesday, stated that the containers of Onion are still held up at the various terminals of Karachi sea port since the commercial banks are not releasing the documents due to non-availability of foreign exchange as per statement of the banks.

READ MORE: FPCCI demands release of soybean, canola cargoes

The in-ordinance delay in timely clearance would lead to multiplication of cost of the containers (e.g. terminal charges and shipping charges) with each passing day. The high cost of onion containers would have a serious negative impact on common men making onion out of their reach due to high price and hence the government sincere initiative to provide relief to the common men would be jeopardized.

READ MORE: KATI urges removal of regulatory duty on yarn

The association said that as of today the wholesale rate of onion is Rs175 per kilogram and retail price is Rs250-270 per kg and with further delay in clearance, these rates are anticipated to further shoot up depriving the common men to buy the daily used vegetable onion.

READ MORE: Pakistan slaps 5pc regulatory duty on yarn import

The status of containers of various vegetables held up the various terminals of Karachi sea ports as of today is as follow:

Onion: 250 containers approximately worth $2.1 million

Ginger: 63 containers approximately worth $0.82 million

Garlic: 104 containers approximately worth $2.53 million

The association demanded the government to take prompt action in the best interest of the common people to provide relief to them and make sincere efforts of the government successful.

READ MORE: Industries threaten mass protest against gas supply shutdown

-

FPCCI demands release of soybean, canola cargoes

KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) on Monday demanded the government to release the consignments of soybean and canola cargoes at the earliest.

In different communications sent to the Prime Minister, the finance minister and the commerce minister, the apex trade body informed that soybean seed was a major raw material for the different industries in Pakistan.

READ MORE: KATI urges removal of regulatory duty on yarn

Initially it has been used for oil extracting industry for the production of oil purpose then its residual is used in the feed of animals because it is protein rich substance. In poultry industry it has been used as feed.

If the supply of this raw material is stopped or delayed then the industries which are directly attached with the poultry industry like hatching industry and feed mills may also suffer and as a result of this millions of people will lose their jobs.

READ MORE: Pakistan slaps 5pc regulatory duty on yarn import

“It is also used in the feed of cows, goats and buffalos in this connection the Halal industry of Pakistan will also be hurt by this decision,” the FPCCI added.

The soybean and canola cargoes are stuck up at port area Karachi due to restriction of PPRO organization which comes under the ministry of food security. The ministry has stopped the consignments on the arguments that the goods are GMO Seeds with the apprehension which may cause cancer to humans.

“Whereas the industry has a point of view that it only happens when it is used in sowing purpose and in Pakistan it is only used in oil extracting and feed industry,” the FPCCI informed.

READ MORE: Industries threaten mass protest against gas supply shutdown

The cargoes are under heavy demurrage and detention since their arrival and adding cost to the miseries of stakeholders. It is pointed out that soybean meal is an ingredient which contributes 15-20 per cent of used in the industry.

Soybean is termed as to contain the highest crude protein content to the extent of 44 per cent which contributes to reasonable yield in milk production.

It is to record that soybean is being imported in the country since last many years and widely traded commodity. However, its clearance is at halt for the reasons best known to the hierarchy. “The situation is causing cancellation of market commitment and contracts escalating the cost of doing business,” it added.

READ MORE: Member Customs assures swift clearance of export consignments

On the other hand its substitute i.e. canola meal is also being treated on the same line and consignments are pending clearance at the port.

The FPCCI of the view that if such practices are carried on and the consignments are stuck up at the port, the situation will result in shortage of poultry, meat and dairy items are the basic commodities which has a routine use in daily life,

FPCCI is analyzing the situation seriously, and strongly recommended that immediate relief to the stakeholders may be granted before the situation gets out of control.

-

KATI urges removal of regulatory duty on yarn

KARACHI: Korangi Association of Trade and Industry (KATI) has urged the government to withdraw the regulatory duty on yarn import because the levy would increase cost of product for textile industry.

The Economic Coordination Committee (ECC) of the Cabinet on November 30, 2022 imposed five per cent regulatory duty on filament yarn.

READ MORE: Merchants protest imposition of 5pc regulatory duty on polyester yarn

In a statement on Monday KATI President Faraz-Ur-Rehman rejected the government’s imposition of regulatory duty on yarn and thread.

Rehman said that yarn and thread are the raw material of the textile sector, and duty on it is not acceptable in any case. He said that KATI fully supports the stance of yarn traders as the imposition of duty will adversely affect textile exports.

READ MORE: Pakistan slaps 5pc regulatory duty on yarn import

President KATI said that due to the ongoing economic crisis in the country, shortage of gas and expensive electricity, the cost of production is already at the highest level and due to the financial crisis, most of the textile mills have closed down and are on the verge of closing down more.

Faraz-Ur-Rehman said that the government should reconsider this decision, otherwise millions of people who are involved in the textile sector will become unemployed.

READ MORE: PYMA urges government not to impose regulatory duty on yarn

President KATI said that the textile sector is the backbone of the country’s exports, and most of the export earnings come from this sector. He said that the imposition of duty on this sector will cause the sector to suffer from a severe financial crisis which will directly harm the economy.

Faraz-Ur-Rehman further said that the government and the concerned authorities are implementing duties to avoid their responsibilities without consulting the stakeholders, which is causing serious damage to the industry.

READ MORE: Industries threaten mass protest against gas supply shutdown

He said that the government should withdraw the regulatory duty immediately otherwise the employment of millions of people will be at risk.

President KATI said that the survival of the export industry is not possible without ending the implementation of a 17 per cent general sales tax on textile exports.

Therefore, to improve the liquidity position of exporters and competitiveness in the global market and to prevent fraud and smuggling, the restoration of ‘zero rating’ has become indispensable.

-

Merchants protest imposition of 5pc regulatory duty on polyester yarn

KARACHI: Yarn merchants have protested the levy of regulatory duty at 5 per cent on import of polyester filament yarn.

Economic Coordination Committee (ECC) of the cabinet this week approved the imposition of regulatory duty at five per cent on import of polyester filament yarn.

Pakistan Yarn Merchants Association (PYMA), while rejecting ECC decision to impose 5 per cent regulatory duty (RD) on polyester filament yarn, stated that it was primary raw material of textile industry. The association also termed that move as the cause of destruction of 800,000 power looms which were the lifeline of textile industry.

READ MORE: Pakistan slaps 5pc regulatory duty on yarn import

PYMA Senior Vice Chairman Sohail Nisar, Vice Chairman Javed Khanani, Former President FPCCI Nasir Hayat Magoon, Mohammad Usman, Saqib Goodluck, Khurshid Sheikh, Aslam Moten, Hanif Lakhany, Farhan Ashrafi, Danish Hanif, Saqib Naseem, Adnan Riaz, Khurram Bharara, Junaid Teli, Managing Committee and members strongly protested against ECC’s decision to impose RD on Yarn at Karachi Press Club, where they appealed to Prime Minister Shahbaz Sharif and Finance Minister Senator Ishaq Dar to suspend the ECC decision to save the SMEs sector of Pakistan from destruction.

“The government to issue directives not to impose RD on Yarn in the best economic interests of the country. Otherwise, SMEs will be shut down and millions of workers will be unemployed,” they requested.

READ MORE: PYMA urges government not to impose regulatory duty on yarn

PYMA leaders pointed out that there is already 11 per cent custom duty on polyester filament yarn, so with 5 per cent RD, the duty will be 16 per cent while fabric is also subject to 16 per cent duty. As a result of the imposition of RD, power looms will be locked and millions of workers will be unemployed while the 2 million households will be in poverty.

PYMA leaders questioned the government to benefit only two producers as to the wisdom of the decision to destroy Small & Medium Enterprises (SMEs), especially power looms which are associated with the textile industry. Although these two producers meet barely 25 per cent of the industry’s demand, they are not manufacturing other items.

Yarn merchants warned that they will continue their protest against the ECC’s imposition of 5 per cent RD on yarn until the decision is withdrawn. PYMA along with power looms owners of Karachi, Hyderabad, Tando Adam, Lahore, Multan, Faisalabad and Pakistan Art Silk Factories of Gujranwala were also protesting.

READ MORE: Industries threaten mass protest against gas supply shutdown

“National Tariff Commission (NTC), saying that the NTC sent its recommendations without any consultation with the stakeholders which was unfair. NTC must listen to us and any decision must be taken in consultation with stakeholders”, they criticized.

They mentioned to media persons that 11 per cent customs duty was imposed on the import of Polyester Filament Yarn, which will increase to 16 per cent after 5 per cent RD.

Yarn was subject to income tax, sales tax, additional sales tax and even anti-dumping. If all taxes were combined, 50 to 55 per cent taxes were paid on import stage of Yarn, yet the imported raw material was cheaper than both local two producers. From which the monopolies and extreme profiteering of the two producers can be estimated.

PYMA leaders pointed out, “Although local producers make only 25 per cent of the total demand of Polyester Filament Yarn, the textile industry has to depend on 75 per cent of imported Yarn. They further said that in the presence of ongoing inflation, high electricity and gas tariffs, labor issues, if more tax burden was imposed on industries, unemployment will increase and the government will have to pay many times more for 5 per cent RD.”

READ MORE: Pakistan organizes first international housing expo next month

PYMA leaders appealed to Prime Minister Shahbaz Sharif and Finance Minister Senator Ishaq Dar to maintain the current duty structure on Yarn and requested them to ask the ECC to avoid imposing regulatory duty on Yarn.

“Instead of measures to destroy economic activities, such policies should be formulated which will promote business and industrial activities and create ample employment opportunities.”