KARACHI: Despite elimination of exemption and strengthening enforcement the duty free import surged by 17.1 percent during 2018/2019, according to official documents.

The FBR in its report released this month said that the duty free imports increased by 17.1 percent to Rs2,445 billion during fiscal year 2018/2019 as compared with Rs2,087 billion in the preceding fiscal year.

The documents revealed that goods under Chapter 27 of Customs Tariff were imported duty free worth Rs600 billion during fiscal year 2018/2019 as compared with Rs491 billion in the corresponding period of the preceding fiscal year.

The import of products including Mineral fuels, mineral oils and products under this chapter has increased by 22.3 percent during the period under review.

An amount of Rs317 billion has been allowed duty free for the import of boilers, machinery and mechanical during fiscal year 2018/2019, which is 12.5 percent higher than Rs282 billion in the same period of the preceding fiscal year.

The customs authorities granted duty free import of around Rs189 billion for the clearance of organic chemical during fiscal year 2018/2019 as compared with Rs144.85 billion in the preceding fiscal year, showing growth of 30.5 percent.

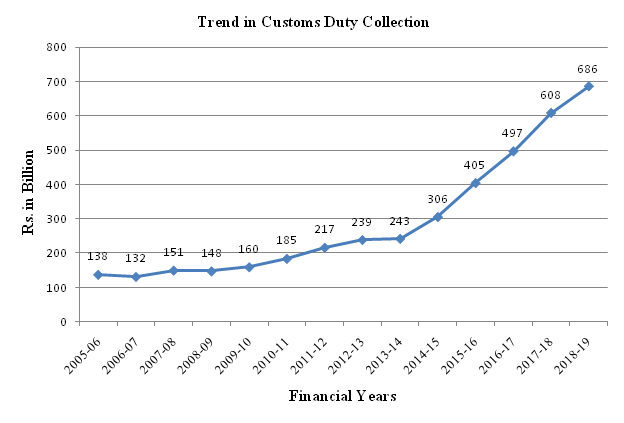

Despite lowering of tariff over the years, the customs duty is still one of the important sources of Federal Tax collection. The Dutiable Imports are the tax base for Customs Duty.

The collection of customs duty stood at around Rs686 billion and has contributed around 28.8 percent in the Indirect Taxes and 17.9 percent in total taxes during the F.Y.: 2018-2019.

It has increased by around 13 percent as compared to previous year.

The target of customs duty was Rs. 735 billion during FY: 2018-2019 which was missed by 6.7 percent.

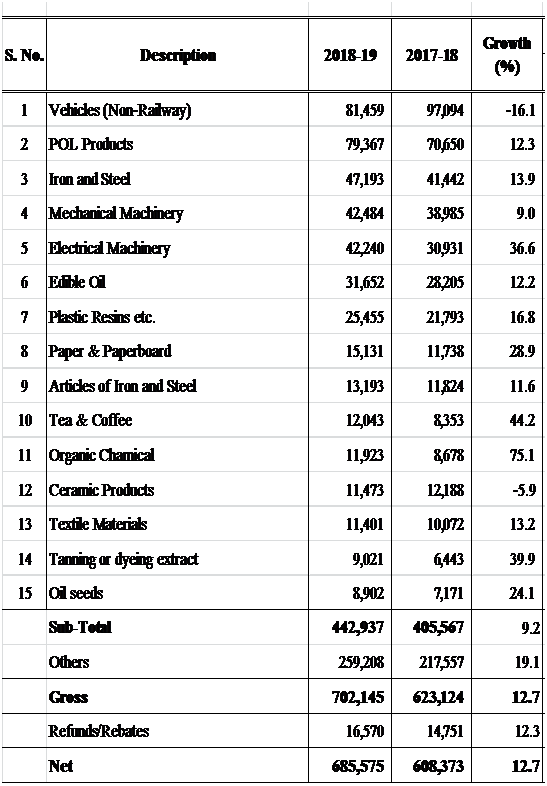

Out of 15 major revenue spinners, 13 items of imports recorded positive growth during FY: 2018-19 mainly due to increased Imports. On the other hand, only automobile (Ch:87) and ceramic products recorded negative growths.

The details of Customs Duty collection from major commodity groups (chapters) are presented in table below.