KARACHI: Federal Board of Revenue (FBR) has issued fresh customs values of mobile phone devices for the determination of duty and tax, sources said on Tuesday.

The Directorate General of Customs Valuation has issued valuation advice dated February 18, 2021, in respect of mobile phone devices to determine assessable customs values of mobile phone devices.

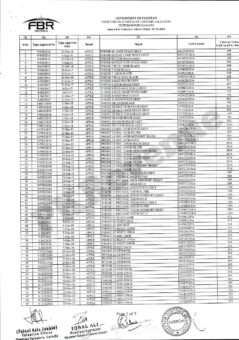

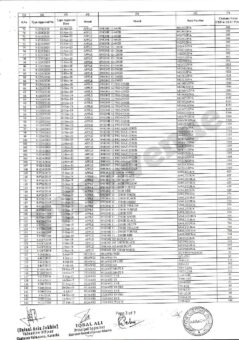

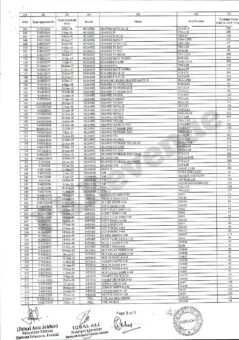

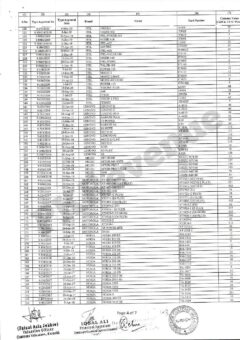

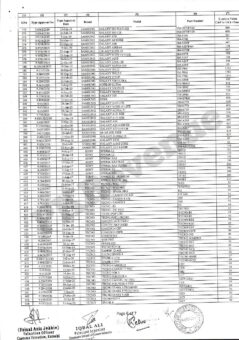

The directorate said that customs values as given in column 7 of the attached images may be considered for the purpose of assessment of duty and taxes.

These values will also be relevant for assessment and proceedings under SRO 1455(I)/2018 and SRO 1456(I)/2018 both dated November 29, 2018 read with Customs General Order No. 06/2018 dated November 29, 2018.

The directorate further said that the enclosed list is not exhaustive; however, mostly traded brands and models as provided by Mobile Phone Importers and Manufacturers Association (MPIMA).

For assessment of brands and models which are imported in commercial quantity but are not included in the enclosed annexure, the clearance collectorate have been advised to assess those under Section 81 of the Customs Act, 1969 and then forward a reference to the directorate for final determination of values thereof.

It further said that where in the enclosed annexure, type approval is not given or is under process, clearance collectorate shall fulfill the regulatory requirements pertaining for type approval/certificate of compliance from PTA first as envisaged under the law.

It is pertinent to mention that the valuation advice will be regularly updated and issued accordingly.

Following is the fresh customs valuation for mobile phone devices:

To watch the news in Urdu please visit and subscribe our YouTube Channel at