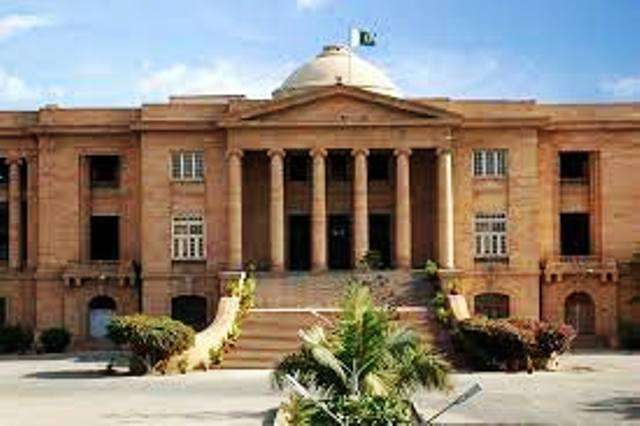

Karachi, August 28, 2025 – The Sindh High Court (SHC) has finally resolved the long-standing dispute over the levy of sales tax on toll manufacturing through a consensus agreement submitted jointly by the Federal Board of Revenue (FBR) and Sindh Revenue Board (SRB).

The resolution marks a significant development in Pakistan’s tax jurisprudence, bringing clarity to a matter that has caused uncertainty for manufacturers and service providers for several years.

The SHC took up the matter after prolonged litigation where multiple petitioners challenged the imposition of sales tax on services relating to manufacturing and processing of goods for third parties, commonly known as toll manufacturing. The dispute primarily revolved around overlapping jurisdiction between federal and provincial tax laws, resulting in the potential for double taxation.

During the hearing, Commissioner Inland Revenue of the Large Taxpayers Office (LTO), on behalf of FBR, and Commissioner-V of SRB jointly filed a statement outlining the terms of settlement. The SHC observed that the “grievance of the petitioners/applicants now stands satisfied” and ordered that all petitions and reference applications be disposed of in line with the mutually agreed terms. Furthermore, the SHC directed both tax authorities to act strictly in accordance with the agreement to prevent future disputes over toll manufacturing.

Abid H. Shaban, a prominent tax lawyer known for his expertise in complex tax litigation, represented the petitioners. His negotiation skills played a crucial role in bringing the matter to a satisfactory conclusion.

The joint statement, filed before the SHC, laid down several key points. First, toll manufacturing services became liable to Sindh Sales Tax with effect from July 1, 2013, when these services were added to the Second Schedule of the Sindh Sales Tax on Services Act, 2011 through the Sindh Finance Act, 2013. Second, a corresponding amendment was made to the federal Sales Tax Act, 1990 via the Finance Act, 2015, effective from July 1, 2015, extending tax liability to cases where goods are manufactured for another person and subsequently delivered to the owner.

Crucially, for the period between July 2015 and June 2022, where both federal and provincial tax laws applied, the agreement provides that there will be no double taxation. Payments made to either authority will be treated as final, subject to verification. Moreover, with the SRB’s notification dated June 28, 2022, toll manufacturing services were exempted from Sindh Sales Tax effective July 1, 2022, thereby eliminating further disputes.

Lastly, the SHC-approved agreement ensures that no coercive recovery action will be taken by either authority until December 12, 2025. Taxpayers have been given time to submit proof of payments already made, ensuring fairness and compliance without unnecessary litigation.