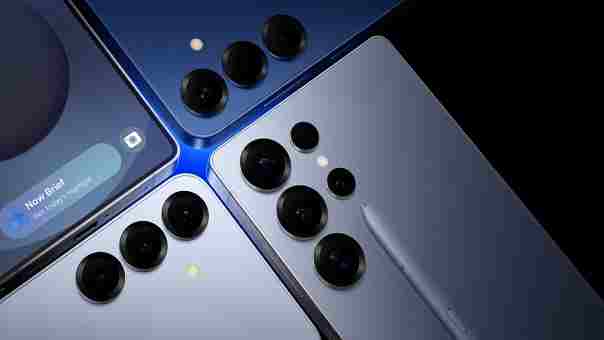

Samsung’s upcoming flagship strategy is becoming clearer as fresh leaks shed light on the Galaxy S27 series, expected to launch next year.

(more…)Blog

-

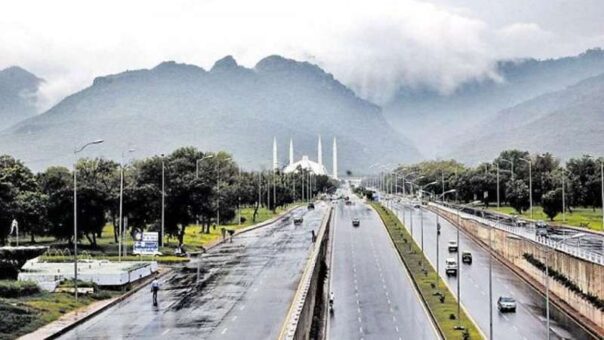

PTA Confirms March 10, 2026 Date for Pakistan 5G Auction

The Pakistan Telecommunication Authority (PTA) has officially announced that the long-awaited Spectrum Auction for Next Generation Mobile Services (NGMS), including 5G, will take place on March 10, 2026.

(more…) -

Clearance for Exportation Under Customs Act, 1969 (Updated 2026)

Export clearance is a critical compliance step in Pakistan’s international trade regime. Section 131 of the Customs Act, 1969, as applicable for tax year 2026, lays down the mandatory legal requirements that must be fulfilled before any goods are allowed to be loaded for exportation.

(more…) -

Transit of Goods Under Pakistan Customs Act, 1969 (Updated 2026)

Pakistan’s strategic location makes it a vital transit corridor for regional and international trade. The Customs Act, 1969, through Sections 127 to 129A, provides a comprehensive legal framework governing the transit of goods within Pakistan and across Pakistan to foreign destinations, while ensuring revenue protection and regulatory control.

(more…) -

What Is Transshipment of Goods Under the Customs Act, 1969? (Updated 2026)

Transshipment plays a critical role in Pakistan’s import–export and transit trade framework. Under Section 121 of the Customs Act, 1969, transshipment allows goods to move from one customs station to another—or onward to a foreign destination—without immediate payment of customs duty, subject to specific legal conditions.

(more…) -

Today’s Bitcoin Rates in Pakistan and US Dollar – January 30, 2026

Karachi, January 30, 2026: Bitcoin (BTC), the world’s leading cryptocurrency, continues to show volatility in both the United States Dollar (USD) and Pakistani Rupee (PKR) markets.

(more…) -

Today’s Currency Exchange Rates in Pakistan – January 30, 2026

Karachi, January 30, 2026: Exchange companies across Pakistan have released the updated currency exchange rates for Friday, January 30, 2026. These rates, updated at 8:00 AM Pakistan Standard Time (PST), are provided to assist businesses, travelers, and the general public in making informed financial decisions.

(more…) -

FBR launches super tax recovery after apex court ruling, targets Rs200 billion

Islamabad, January 30, 2026: The Federal Board of Revenue (FBR) has initiated recovery of Super Tax from taxpayers following the landmark judgment of the Federal Constitutional Court. Field formations of the FBR began issuing notices on Thursday for outstanding Super Tax payments exceeding Rs200 billion.

(more…) -

FBR’s limiting refund adjustment amount declared unlawful by FTO

Islamabad, January 30, 2026 — The Federal Tax Ombudsman (FTO) has ruled that the Federal Board of Revenue’s (FBR) practice of limiting the adjustment of income tax refunds against a taxpayer’s liability is unlawful and amounts to maladministration

(more…) -

Pakistan clerics and religious authorities agree on unified Azan, prayer timings

Islamabad, January 30, 2026 – In a significant move to promote religious unity, Pakistan’s Ministry of Religious Affairs, alongside prominent clerics, scholars from all schools of thought, and representatives from the business community, agreed on issuing a unified calendar for Azan and prayer timings.

(more…)