Karachi, June 26, 2025 — Pakistan’s foreign exchange (forex) reserves have witnessed a dramatic plunge of $2.61 billion in just one week, raising fresh concerns over the country’s external financial stability ahead of the fiscal year-end.

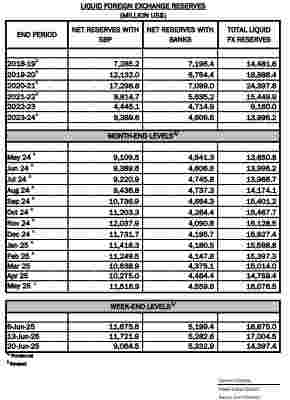

According to the latest data released by the State Bank of Pakistan (SBP) on Thursday, total national forex reserves dropped to $14.397 billion by the week ending June 20, 2025, down from $17 billion recorded on June 13.

This alarming fall in forex reserves is largely attributed to substantial debt repayments made by the government during the period. The SBP’s official reserves alone saw a staggering decline of $2.658 billion, reducing the central bank’s holdings to $9.064 billion from the previous level of $11.722 billion. This steep drop signals a challenging period for economic managers, especially as the country attempts to close its books for the fiscal year by June 30.

Economists warn that this sharp depletion in forex reserves could put additional pressure on the rupee and hamper the country’s ability to stabilize its external account. With mounting debt obligations and increasing import needs, maintaining an adequate buffer of forex reserves is crucial for shielding the economy from external shocks and ensuring timely payments to international creditors.

The government had been striving to build up its reserves through multilateral inflows and foreign investment commitments. However, the recent outflow suggests that debt servicing remains a formidable challenge despite various fiscal reforms and revenue enhancement measures taken in Budget 2025-26.

In contrast, forex reserves held by commercial banks showed a modest improvement. These rose by $50 million to reach $5.333 billion during the week under review, up from $5.283 billion the previous week. While this uptick offers some reassurance about private sector stability, it is insufficient to offset the broader downward trend in national forex holdings.

As the fiscal year draws to a close, policymakers are under pressure to stabilize reserves and secure fresh external support to avert a balance of payments crisis in the coming months.