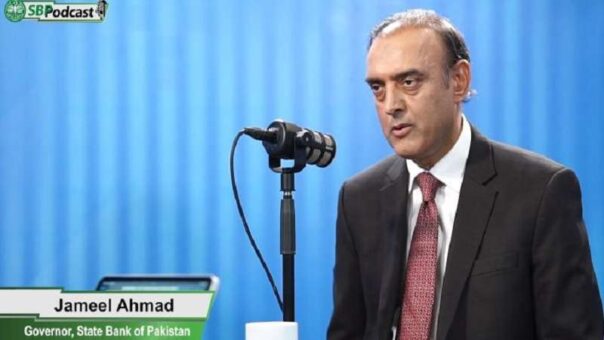

Karachi, October 25, 2024 – Jameel Ahmad, Governor of the State Bank of Pakistan (SBP), met with international rating agencies and global investors during events hosted by prominent financial institutions, including Standard Chartered, JP Morgan, Bank of America, and Jefferies. These meetings took place on the sidelines of the 2024 IMF-World Bank annual gatherings in Washington, DC.

During his address, Ahmad provided an optimistic overview of Pakistan’s economic resurgence over the past year, attributing the positive shift to a prudent monetary policy and the government’s fiscal consolidation efforts. He highlighted that the SBP and the government had tackled macroeconomic instability through necessary, and sometimes challenging, policy adjustments. Ahmad’s message was clear: Pakistan is on a path of economic recovery.

In his briefing, Ahmad noted significant progress in Pakistan’s inflation and foreign reserves. Inflation, which spiked at 38% in May 2023, has since dropped to 6.9% year-on-year by September 2024. This disinflation, he emphasized, reflects broad-based improvements across core inflation indicators. Despite facing global economic uncertainties, Pakistan’s external account has strengthened, due largely to enhanced foreign exchange reserves, an uptick in exports, and steady inflows of workers’ remittances. Foreign exchange reserves have grown from a low of $3.1 billion in January 2023 to $11 billion by October 11, 2024, and the SBP aims to increase this to $13 billion by the end of June 2025.

Ahmad also noted a narrowing current account deficit, highlighting that while imports, especially non-oil goods, have risen, the current account remains within manageable limits. This narrowing is primarily attributed to export growth and a recovery in remittances, key drivers supporting Pakistan’s external finances. He emphasized that these factors have allowed Pakistan’s economic stability to improve, with an anticipated increase in GDP growth for the fiscal year.

Looking forward, Ahmad outlined the SBP’s strategic plan for 2024-2028, emphasizing structural reforms aligned with Pakistan’s recent IMF program. This reform agenda aims to foster sustainable growth, build up foreign reserves, and ensure price stability. Key elements of the strategy include developing an inclusive and innovative digital financial services ecosystem and strengthening the fairness, efficiency, and stability of Pakistan’s financial sector.

The SBP governor concluded by expressing optimism that Pakistan’s policy measures and ongoing reform efforts, combined with multilateral and bilateral partnerships, will continue to drive economic stability. With inflation stabilizing, foreign reserves on the rise, and GDP growth on track, Pakistan’s economy appears poised for sustained recovery, signaling a positive outlook for potential investors.