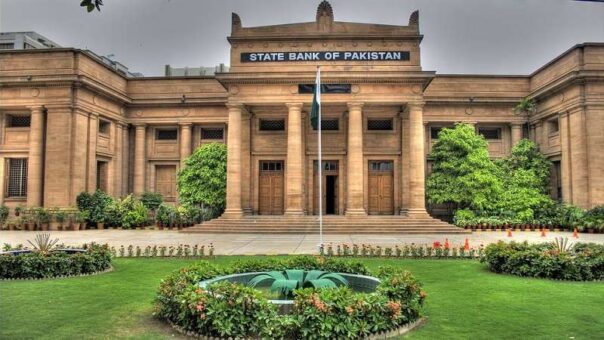

Karachi, June 26, 2023 – In an unexpected move on Monday, the State Bank of Pakistan (SBP) raised the benchmark key policy rate by 100 basis points to 22 percent.

This decision, made in an unscheduled policy announcement, brings the policy rate to one of the highest levels seen in recent years.

READ MORE: PM Sharif Reaffirms Commitment to IMF Program for Pakistan’s Economic Stability

Experts suggest that the central bank’s decision reflects the government’s willingness to accept stringent conditions in order to regain the loan program of the International Monetary Fund (IMF).

According to the statement issued by the SBP, the Monetary Policy Committee (MPC) considered the previous monetary policy stance appropriate to achieve the objective of price stability, assuming no unexpected domestic or external shocks. However, the MPC acknowledged two important domestic developments since its last meeting that have slightly worsened the inflation outlook and increased pressure on the already strained external account.

READ MORE: Pakistan’s Foreign Exchange Reserves Plunge by $514 Million, Raising Concerns

Firstly, there have been revisions in taxes, duties, and the Pakistan Development Levy (PDL) rate in the FY24 budget approved by the National Assembly on June 25. Secondly, on June 23, the SBP withdrew its general guidance for commercial banks regarding import prioritization. While these measures are deemed necessary in the context of completing the ongoing IMF program, they have raised upside risks to the inflation outlook.

The MPC believes that the additional tax measures are likely to contribute to inflation directly and indirectly, while the relaxation in imports may exert pressure on the foreign exchange market, potentially leading to a higher-than-anticipated exchange rate pass-through to domestic prices.

READ MORE: Up to 10% Advance Tax Imposed on Value of New Motor Vehicles

In response to these developments, the MPC held an emergency meeting and decided to raise the policy rate by 100 basis points to 22 percent, effective from June 27, 2023. The MPC considers this action necessary to maintain a positive real interest rate on a forward-looking basis. This move aims to anchor inflation expectations, which have already shown signs of moderation in recent months, and support the objective of reducing inflation to the medium-term target of 5-7 percent by the end of FY25, barring any unforeseen circumstances.

READ MORE: New Tax Rates for Business Individuals and AOPs Effective From July 01, 2023

The MPC believes that today’s decision, in conjunction with the expected completion of the ongoing IMF program and the government’s commitment to generating a primary surplus in FY24, will help address external sector vulnerabilities and reduce economic uncertainty. The Committee reiterates its commitment to closely monitor evolving economic developments and stands ready to take appropriate action, if necessary, to achieve the objective of price stability over the medium term.