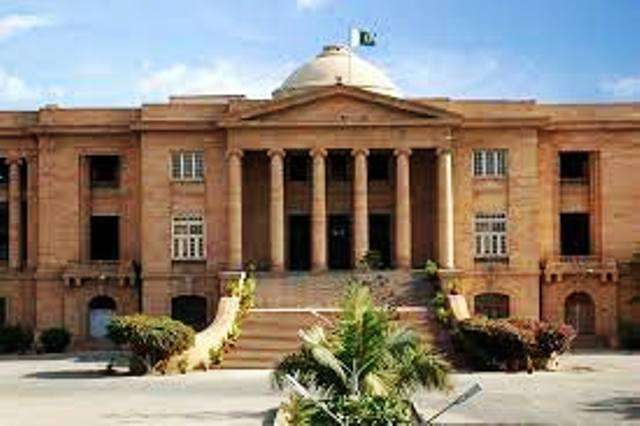

The Sindh High Court (SHC) has issued a pivotal directive to the Federal Board of Revenue (FBR), mandating that companies submit their sales tax returns for September 2024 without the requirement of affidavits from their chief financial officers. This order, articulated by the SHC on Friday, compels the FBR to facilitate the filing process of these returns devoid of the contested affidavits until the next scheduled hearing.

The court’s ruling underscores a widespread grievance among the petitioners—various corporate entities—who have been obligated to swear and sign affidavits in conjunction with their sales tax returns. Legal representatives for the petitioners argued that such a requirement contravenes the stipulations established under the Sales Tax Act of 1990. They contended that the demand for affirmation regarding the actions of their suppliers is impracticable at the juncture of filing returns, as it places undue responsibility upon the companies.

During the proceedings, the petitioners’ counsel presented a press release from the FBR, dated October 17, 2024, which revealed a significant shift in policy. The FBR confirmed that, for the present tax cycle, it has dispensed with the necessity for affidavits concerning sales tax returns for September 2024.

The SHC has scheduled a notice for the FBR and the Deputy Attorney General for November 1, 2024, to address these developments further. In its recent press release, the FBR articulated that, in response to requests from trade organizations and with the aim of maintaining transparency with all stakeholders, it has resolved the following:

a) The submission of affidavits will not be mandated for sales tax returns pertaining to the tax period of September 2024, which are due for filing in October 2024.

b) The FBR is open to receiving alternative proposals from stakeholders until October 31, 2024, aimed at combating the pervasive issue of falsified sales tax returns.

c) The Board may amend the particulars of the affidavit should legitimate concerns from stakeholders arise.

Nevertheless, the FBR reiterated that the “affidavit” does not engender any new legal obligations. Registered taxpayers are cautioned to remain vigilant, as the declaration of fraudulent invoices or the concealment of sales constitutes a cognizable offense under sales tax legislation. The FBR urged all registered entities to exercise utmost diligence while filing their returns to mitigate potential financial and criminal repercussions as outlined in Section 33 of the Sales Tax Act, 1990.