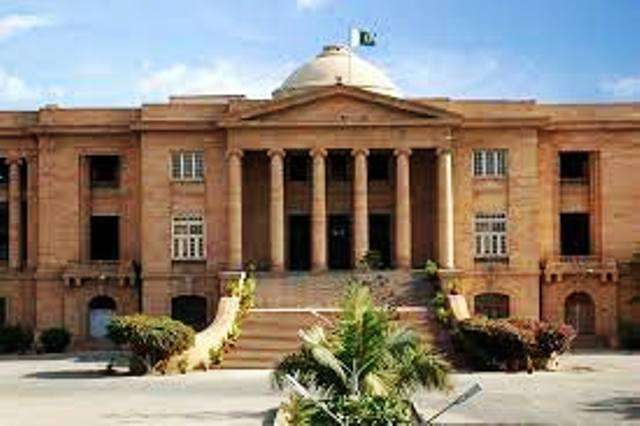

Karachi, September 23, 2025 – The Sindh High Court has dismissed a constitutional petition filed by M/s. Gama Lux Oleochemicals Limited challenging the Federal Board of Revenue’s (FBR) move to make electronic invoicing mandatory for registered taxpayers.

The case (C.P. No. D-4583 of 2025) was heard by Justice Adnan Iqbal Chaudhry and Justice Muhammad Jaffer Raza. The petitioner argued that SRO 709(1)/2025, issued on April 22, 2025, under section 50 of the Sales Tax Act, 1990, unlawfully compelled companies to integrate their hardware and software with FBR’s computerized system through licensed integrators. The company contended that section 23(3) of the Act provided businesses with the “option” to issue electronic invoices, relying on the use of the word “may” in the earlier version of the law.

However, the court noted that the Finance Act, 2024 had amended section 23(3), replacing “may” with “shall,” thus making electronic invoicing compulsory for registered persons. The judges also highlighted that the same Act inserted subsections (4) and (5) into section 40C of the Sales Tax Act, empowering the FBR to require integration of electronic invoicing systems for real-time sales reporting.

The bench observed that these legislative changes left no ambiguity: businesses notified by the FBR must comply with electronic invoicing, and the SRO in question was not ultra vires of the parent statute. The judges concluded that the petitioner’s challenge stemmed from a misreading of the law.

Consequently, the Sindh High Court dismissed the petition at the preliminary stage (in limine), upholding the FBR’s authority to enforce mandatory e-invoicing through licensed integrators.