KARACHI: Bank Alfalah has posted massive PKR 14.28 billion profit after tax for period of nine months (January – September) 2022, showing a growth of 33 per cent in the corresponding months last year.

(more…)Tag: Bank Alfalah

-

SBP issues IBAN list for donations to PM flood relief fund

State Bank of Pakistan (SBP) has issued a list of IBAN (International Bank Account Number) of Prime Minister Flood Relief Fund 2022 maintained by commercial banks.

READ MORE: SBP opens account for Balochistan Flood Relief, Rehabilitation Fund

Following is the list of banks and IBAN:

01. Allied Bank Limited (ABL), Title of Account # Prime Minister’s Flood Relief Fund Account, 2022, IBAN PK58ABPA001009849790015

02. Albaraka Bank, Title of Account # Prime Minister’s Flood Relief Fund Account, 2022, IBAN PK11AIIN0000150583517016

03. Askari Bank Limited, Title of Account # Prime Minister’s Flood Relief Fund 2022, IBAN PK82ASCM0000020100579916

04. Bank Alfalah Limited, Title of Account # Prime Minister’s Flood Relief Fund Account-2022, IBAN PK60ALFH0005001007990397

05. Bank Al Habib Limited, Title of Account # Prime Minister’s Flood Relief Fund 2022, IBAN PK32BAHL1001186690500301

06. Bank Islami Pakistan Limited, Title of Account # PRIME MINISTER’S FLOOD RELIEF FUND ACCOUNT, 2022, IBAN PK02BKIP0100339720620001

07. Bank of China, Title of Account # Prime Minister’s Flood Relief Fund 2022, IBAN PK37BKCH0100002600005375

08. Bank of Khyber, Title of Account # Prime Minister’s Flood Relief Fund 2022, IBAN PK66KHYB0001002008277365

09. Bank of Punjab, Title of Account # Prime Minister’s Flood Relief Fund 2022, IBAN PK52BPUN6010000181500176

10. Citi Bank, Title of Account PRIME MINISTER’S FLOOD RELIEF FUND, IBAN PK28CITI1000000103660009

11. Dubai Islamic Bank Limited, Title of Account # PRIME MINISTER FLOOD RELIEF FUND 2022, IBAN PK22DUIB0000000807647001

12. Faysal Bank Limited, Title of Account # Prime Minister’s Flood Relief Fund 2022, IBAN PK97FAYS3554Z17000001562

13. FINCA Microfinance Bank, Title of Account # PRIME MINISTERS FLOODRELIEF FUND, 2022, IBAN PK25FINC0223183643011000

READ MORE: SBP issues instructions to banks for flood relief donation awareness

14. Habib Metro Bank, Title of Account # PRIME MINISTERS FLOODRELIEF FUND, 2022, IBAN PK58MPBL0101027140665909

15. Habib Bank Limited, Title of Account # PM’s Flood Relief Fund Account, 2022, IBAN PK43HABB000042792244003

16 Habib Bank Limited Microfinance Bank, Title of Account # PRIME MINISTERS FLOODRELIEF FUND, 2022, IBAN PK62FMFB0021012862868015

17. ICBC, Title of Account # Prime Minister’s Flood Relief Fund 2022, IBAN PK76ICBK0010000000239638

18. JS Bank, Title of Account # PRIME MINISTER’S FLOOD ACCOUNT 2022, IBAN PK56JSBL9001000002029796

19. Khushhali Microfinance Bank, Title of Account # Prime Minister’s Flood Relief Fund 2022, IBAN PK85khbl0000012075443288

20 MCB, Title of Account # Prime Minister’s Flood Relief Fund Account, 2022, IBAN PK13MUCB0729483241037873

21. MCB Islamic Bank, Title of Account # Prime Minister’s Flood Relief Fund Account, 2022, IBAN PK58MCIB0351004196150001

22. Meezan Bank Limited, Title of Account Prime Minister’s Flood Relief Fund Account, IBAN PK39MEZN0001540107020124

23. National Bank of Pakistan, Title of Account # Prime Minister’s Flood Relief Fund 2022, IBAN PK92NBPA0002004181048973

24. NRSP Microfinance Bank, Title of Account # Prime Minister’s Flood Relief Fund Account, 2022, IBAN PK60NRSP0000020010002760

25. Samba Bank, Title of Account # PRIME MINISTER’S FLOOD RELIEF FUND, 2022, IBAN PK83SAMB0000002000117199

26. Silk Bank, Title of Account # Prime Minister’s Flood Relief Fund Account, 2022, IBAN PK68SAUD0000012010847043

27. Sindh Bank, Title of Account # PRIME MINISTER’S FLOOD RELIEF FUND ACCOUNT,2022, IBAN PK21SIND0003016411713500

28. SME Bank, Title of Account # PRIME MINISTER’s RELIEF FUND, 2022, IBAN PK16SMES1001000664000001

29. Soneri Bank, Title of Account # Prime Minister’s Flood Relief Fund Account, 2022, IBAN PK81SONE0000220010110875

30. Standard Chartered Bank, Title of Account Prime Minister’s Flood Relief Fund 2022, IBAN PK75SCBL0000001701259101

31. Summit Bank, Title of Account # PRIME MINISTERS FLOOD RELIEF FUND ACCOUNT -2022, IBAN PK57SUMB0201027140181164

32. U Microfinance Bank, Title of Account # Prime Minister’s Flood Relief Fund Account, 2022, IBAN PK26UMBL0107000093500096

33. United Bank Limited, Title of Account # Prime Minister’s Flood Relief Fund 2022, IBAN PK86UNIL0109000286613095

READ MORE: Tax exemption granted to donations for PM flood relief fund

-

Bank Alfalah posts 25% increase in half year profit

KARACHI: Bank Alfalah has declared 25 increase in net profit for the half year ended June 30, 2022.

According to unconsolidated financial results submitted to Pakistan Stock Exchange (PSX) on Friday, the bank declared profit after tax at Rs8.70 billion for the half year ended June 30, 2022 as compared with Rs6.93 billion in the same half of the last year.

READ MORE: Pakistan Tobacco’s profit falls on high taxes

The bank also announced earnings per share at Rs4.9 for the half year (January – June) 2022 as compared with Rs3.90 EPS in the same half of the last year.

The board of directors of Bank Alfalah met on July 28, 2022 and recommended an interim cash dividend for the half year ended June 30, 2022 at the rate of Rs2.50 per share i.e. 25 per cent.

Analysts at Insight Research said that the result remained below from expectations of rs2.8 per share, primarily due to higher both provisions charge and effective tax rate during the quarter.

READ MORE: Habib Bank posts 33% decline in half year profit

Net Interest Income remained in line with estimates to clocked in at Rs17.8 billion (up by 53 per cent/25 per cent YoY/QoQ), which is attributable to repricing of assets as bank’s investment book is fully geared up for current monetary policy settings.

READ MORE: FFBL declares Rs1.7 billion in 2QCY22

Non-markup income improved significantly in 2QCY22 to reached Rs6.5 billion (up 57 per cent/49 per cent YoY/QoQ) mainly due to massive foreign exchange income, which is clocked in at Rs3.4 billion amid better market share in remittances/trade and volatility in FX market. Whereas, fee income remained in-line with the estimates.

On the provision front, bank posted a net charge of Rs3.6 billion vs. expectation of Rs0.8 billion, as bank raised its general provisioning due concern on the economic slowdown.

Effective tax rate (ETR) remained above from estimates of 54 per cent to clock in at 59.2 per cent.

READ MORE: Hyundai announces second quarter financial results

-

Bank Alfalah posts 45% growth in profit after tax

KARACHI: The Board of Directors of Bank Alfalah Limited (BAFL), in its meeting held on April 26, 2022, approved BAFL’s financial results for the quarter ended March 31, 2022. The Bank’s impressive performance for 2022 is an endorsement of its customer centricity and product innovation driven by the growth strategy.

The growth trajectory continued in the first quarter of 2022. The Bank declared record profit after tax of 5.019 billion, showing a double digit growth of 45 per cent YoY, that translated into an EPS of Rs2.82 (SPLY: Rs. 1.95).

READ MORE: Bank Alfalah, Paymob collaborate for digital payments

This is one of the highest growth in profit after tax for Q1 across the industry, and is the testament that Bank Alfalah is maintaining its competitive position in the industry.

During the period under review, the Bank’s revenue increased by 31.9 per cent backed by strong net interest income and non-interest income growth. The Bank’s net interest margins improved year on year as a result of well thought out, focused and prudent ALM strategy, along with strong deposits growth.

The growth continued the upward trajectory with a growth momentum in home remittance business and trade flows, increase in market share, higher debit and credit card spend.

READ MORE: Mastercard, Bank Alfalah enter strategic partnership

Non-markup expenses were 21.6 per cent higher compared to the same period last year. This surge was driven by the full year impact of new branches opened last year along with expenses attributable to new initiatives.

The Bank continues to invest in technology, people and businesses, to improve market share and to become a leading transactions Bank. Despite the investment in multiple initiatives, Bank Alfalah witnessed an improvement in the cost to income ratio to 55.1 per cent.

The Bank’s quarter end deposit footing stood at Rs. 1.178 trillion at the end of Q1’22, with YoY growth of 29.0 per cent compared to Q1’21. The Bank continues to outpace the industry in deposit growth as well as exceptional current account growth. The current and savings accounts achieved an impressive YoY growth of 31.0 per cent and 35.6 per cent respectively. Bank Alfalah’s CASA mix noted an increment to 80.6 per cent versus 78.2 per cent SPLY that reinforces the clients’ trust on the Bank.

READ MORE: Bank Alfalah tops in house financing under MPMG

The Bank grew loans by record 17.3 per cent YoY, while maintaining stellar credit discipline and a strong balance sheet with significant capital and liquidity positions. Part of this growth is backed by government-backed schemes for economic development, in which the Bank’s delivery of Mera Pakistan Mera Ghar and Prime Minister’s Kamyab Jawan Scheme is ranked amongst the top performing banks.

The Bank, not only achieved the targets but also added value to these initiatives of SBP with effective marketing. As at the period end, the Bank’s gross advances to deposits ratio achieved 60.4 per cent, which is one of the highest in the industry. The Bank’s non-performing loans ratio stood at 3.4 per cent, while the non-performing loans remain fully covered.

READ MORE: Financing for Mera Pakistan Mera Ghar gains momentum

Despite the robust growth in advances, the Bank’s remains adequately capitalized, and well above the regulatory requirement with 14.77 per cent as at December 31, 2021.

This momentum will continue, despite the prevailing uncertainty, since the Bank is committed to its strategy of growth, customer centric approach and innovation.

-

Bank Alfalah, Paymob collaborate for digital payments

KARACHI: Bank Alfalah Limited and Paymob, MENA’s market-leading digital payments provider have collaborated to activate and support merchant acquisition and integration services across Pakistan.

The partnership will empower over 100,000 merchants across Pakistan and launch new innovative services in e-commerce acceptance for online merchants.

This partnership records Paymob’s first collaboration outside its Egyptian home market and comes as part of its expansion strategy in the MENAP region.

Bank Alfalah’s partnership with Paymob will drive financial inclusion and lead the way for swift payment acceptance, and will follow Bank Alfalah’s objective to support merchant acquisition and integration services across the country.

This collaboration will enable an instant onboarding feature for the first time in Pakistan using Paymob’s advanced solutions such as payment gateway integration, POS terminals and Soft POS.

The instant onboarding feature is empowered by the digital onboarding regulations recently published by the State Bank of Pakistan and comes as one of many positive steps the State Bank has led to enable MSME Merchants in order to further digitize the ecosystem.

The market opportunity in Pakistan is significant given the range of retail outlets and SME businesses across the country’s cities. With over four million SMEs using just over 80,000 POS terminals and less than 3000 e-commerce payment gateways, the market is perfectly suited to meet Paymob’s criteria and strategy to expand globally – and bridge the digital financial gap.

Speaking at the signing ceremony in Karachi, Atif Bajwa, President and CEO of Bank Alfalah said: “Bank Alfalah is proud to partner with Paymob in one of Pakistan’s largest Fintech partnerships. Our collaboration will aim to serve thousands of merchants across Pakistan and the industry first “Tap-on-Phone” service will allow us to reach even the most remotely located merchants in Pakistan.”

Alain El-Hajj COO of Paymob, said: “This is a remarkable moment for Paymob. We are honored to partner with Bank AlFalah under its progressive leadership to provide reliable and seamless digital payment services for SMEs across Pakistan. With this partnership we aim to contribute the shared vision of economic growth and digitization of SMEs.”

Pakistan’s market has several positive drivers. GDP growth is forecast at 5-6 per cent per annum, with the total value of e-commerce consumer goods having grown by 83 per cent in 2021 to reach US$3.9 billion.

The Pakistan Telecommunication Authority reports that 101 million people use the internet in Pakistan, with 46% having access to broadband services and 85 per cent (183 million) to mobile connections.

According to the PIDE, Pakistan has the potential for significant Fintech growth, due to its increasing youth population, disruptive internet and smartphone penetration, consumer preferences for mobile phones and social media, a booming e-commerce market facilitating digital payments, and the financial system’s overall capacity for innovation.

-

Mastercard, Bank Alfalah enter strategic partnership

KARACHI: Mastercard and Bank Alfalah have entered into a strategic partnership to empower businesses in Pakistan through the launch of two of Mastercard’s market-leading solutions powered by Mastercard Payment Gateway Services – Tap on Phone and Simplify Commerce – leveraging the power of technology to catalyze success and boost financial inclusion for businesses across the market, with a special focus on small enterprises.

The partnership allows businesses of all sizes to sign up for Mastercard Tap on Phone – an innovative, intuitive, and cost-effective application that allows businesses to embrace electronic acceptance through their smart mobile or tablet device.

Once downloaded, businesses can immediately offer it to their customers, providing consumers with a flexible, seamless, intuitive, and secure checkout experience.

Tap on Phone turns Android smartphones into secure payment acceptance devices for contactless cards, mobile wallets and smartwatches – with no additional equipment or setup-related costs, making it ideal for SMEs.

The partnership with Bank Alfalah will also see the first-ever launch of Mastercard Simplify Commerce in Pakistan.

The technology provides businesses with a suite of powerful payments and business management features that help simplify backend processes, allowing merchants to focus on core business functions as they enter and thrive in the digital marketplace.

According to the Pakistan Bureau of Statistics, in 2019, SMEs constitute nearly 90 per cent of entirely private businesses and employ almost 78 per cent of the non-agricultural labor force in Pakistan reflecting the huge potential for digitalization of these businesses to boost the nation’s economy.

Atyab Tahir, Pakistan Country Manager, Mastercard, said: “By partnering with Bank Alfalah, Mastercard is making it possible for businesses to realize their full potential with two of its most innovative digital payment solutions for the first time in Pakistan – Mastercard Tap on Phone, and Simplify Commerce.

“The provision of smartphone-based acceptance solutions is a much-needed development in the pursuit of financial inclusion, particularly in Pakistan whose population of 220 million people is significantly underserved by digital point-of-sale solutions and platforms.”

Mastercard simplify is specifically designed to be easy to set up, making it possible for merchants with only a minimal amount of digital experience to access a convenient and secure acceptance solution and receive payments within a matter of minutes.

Mehreen Ahmed, Group Head – Retail Banking, Bank Alfalah, said: “The integration of the Mastercard Tap on Phone and Simplify Commerce platform is a gamechanger for Bank Alfalah SME customers and millions of consumers who will now gain access to a seamless, secure and intuitive checkout experience through their contactless cards and devices.

“By providing merchants in Pakistan with the ability to affordably turn their Android phones into secure payment acceptance devices, Bank Alfalah is making a significant contribution to SME growth and inclusion within Pakistan’s flourishing digital economy.”

The announcement builds on Mastercard’s longstanding relationship with Bank Alfalah and its ongoing support to SMEs in Pakistan and across the MENA region. Globally, Mastercard has pledged to connect one billion people and 50 million micro, medium and small businesses to the digital economy by 2025 – with a direct focus on 25 million women entrepreneurs.

-

Bank Alfalah declares 33.4% surge in annual profit

KARACHI: Bank Alfalah Limited on Wednesday declared 33.4 per cent surge in net profit for the year 2021.

According to financial results submitted to Pakistan Stock Exchange (PSX) on Wednesday, the bank announced Rs14.46 billion as consolidated profit after tax earnings for the year ended December 31, 2021 as compared with Rs10.84 billion in the preceding year.

READ MORE: Bank Alfalah tops in house financing under MPMG

Bank Alfalah declared earnings per share at Rs8.12 for the year under review as compared with EPS of Rs6.10 during the preceding year.

The Board of Directors of the bank met on February 02, 2022 at Dubai, UAE and recommended final cash dividend for the year ended December 31, 2021 at Rs2 per share i.e. 20 per cent. This is in addition to interim cash dividend already paid at Rs2 per share i.e. 20 per cent.

READ MORE: Bank Alfalah enables QR option for retail payment

The board has not approved any bonus share, right share or any other entitlement / corporate action.

The board of directors authorized the bank to acquire 521,739 additional ordinary shares of Rs10 each (representing 1.3 per cent of the share capital) of its subsidiary, Alfalah CLSA Securities (Pvt) Limited from minority shareholders of the company. As a result, the total shareholding of the bank in the company will stand at 24,999,912 ordinary shares. Such purchase shall be subject to obtaining of all necessary corporate and regulatory approvals and completion of related formalities.

READ MORE: Bank Alfalah declares Rs10.48 billion after tax profit

According to the results, the net mark-up / interest income of the bank rose to Rs46.04 billion for the year ended December 31, 2021 as compared with Rs44.69 billion in the preceding year.

Total non-mark-up/interest income of the bank grew to Rs17.23 billion in the year 2021 as compared with Rs13.54 billion in the preceding year.

READ MORE: Bank Alfalah announces 21% growth in half year profit

Operating expenses of the bank increased to Rs36.54 billion during the year under review as compared with Rs31.62 billion in the preceding year.

-

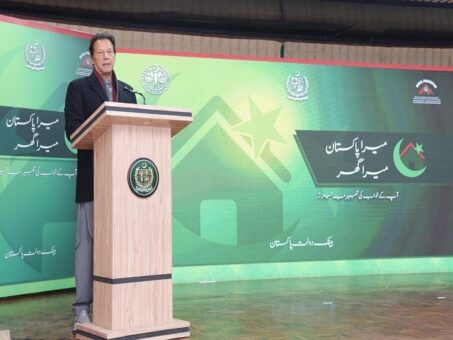

Bank Alfalah tops in house financing under MPMG

KARACHI: Bank Alfalah has secured the top position in house financing under the government’s flagship Mera Pakistan Mera Ghar (MPMG).

According to a statement issued by the State Bank of Pakistan (SBP), Bank Alfalah secured the top position followed by Meezan Bank Limited and Standard Chartered Bank Limited.

A ceremony was held on Friday at Prime Minister House, Islamabad to mark Rs 100 billion in home finance approvals of the Governments flagship Mera Pakistan Mera Ghar (MPMG) program under the theme “ Khawab ke tabeer ab tez ter”.

READ MORE: Financing for Mera Pakistan Mera Ghar gains momentum

The Prime Minister lauded the leading role of the State Bank of Pakistan and the efforts of the banking industry in the implementation of MPMG. He also witnessed ceremonial keys being handed over to six beneficiaries of MPMG who were from different regions and represented a variety of segments of Pakistan.

Over 20 other beneficiaries of MPMG also participated in the ceremony. The Prime Minister expressed his pleasure to see that low and middle-income citizens who were completely ignored earlier are now being served by the banks in obtaining home finance. While distributing awards among top-performing banks with respect to approvals and disbursements, he urged banks to accelerate their efforts to help realize the dream of every Pakistani to own their own homes.

The ceremony was attended by Ali Amin Gandhapur-Federal Minister for Kashmir Affairs & Gilgit Baltistan, Dr. Shahbaz Gill-Special Assistant to Prime Minister on Political Communication, Senator Shaukuat Tareen-Adviser to Prime Minister on Finance & Revenue, Governor State Bank of Pakistan, Chairman NAPHDA, Dr. Amjad Ali-Minister for Housing Khyber Pakhtunkhwa and Presidents/CEOs of banks.

READ MORE: SBP launches webpage for promoting house financing

Dr. Reza Baqir, Governor State Bank of Pakistan, shared the progress of MPMG since inception, highlighting that all stakeholders are taking steps in the right direction to translate the Prime Minister’s vision of increasing homeownership into reality. Till December 20, 2021, banks have received applications of Rs. 263 billion while approvals of Rs. 109 billion have already been made. Over the last nine months, the approved amount increased by Rs. 98 billion. Disbursement has also increased from almost zero in March 2021 to Rs. 32 billion by December 20, 2021. While shedding light on the theme of the event, he mentioned that during the last month, banks on average approved Rs. 4 billion and disbursed Rs. 1.6 billion on weekly basis. He underscored the need to maintain and accelerate this momentum. There are six banks that disbursed over Rs. 2 billion each and seven banks have disbursed over Rs. 1 billion each in the span of 9 months under MPMG.

The Governor said that growth in MPMG is attributed to various measures taken by the Government, SBP, and NAPHDA to provide a conducive environment for the banking industry to enter the untapped market of housing and construction finance. He mentioned the simplification of complex procedures, a significant reduction in documentation requirement, development of a model to assess informal income, effective redressal mechanism as examples of this support. Communication initiatives like Mera Pakistan Mera Ghar Meri Kahani –a series of testimonials of MPMG beneficiaries have also been instrumental in encouraging others to apply.

READ MORE: PM launches house financing scheme for NRPs

Earlier, in a meeting of the National Coordination Committee on Housing, Construction, and Development (NCCHCD), Governor SBP apprised the Prime Minister on developments in housing and construction finance. He recalled that in July 2020, in line with the Government’s vision of boosting economic activity, SBP mandated banks to increase their housing and construction finance to at least 5 percent of their domestic private sector advances by December 31, 2021. Five banks have already achieved their December 2021 targets. The best performing banks in this regard were Albaraka Bank followed by Meezan Bank and Dubai Islamic Bank. He highlighted that as of December 17, 2021, banks have lent Rs. 321 billion which is Rs. 173 billion more than their financing as of June 30, 2020, reflecting a growth of 117 percent since June 2020. He praised Bank Al Habib, National Bank, and Bank Alfalah for a significant increase in their housing and construction finance portfolio since June 2020 till date.

In conclusion, Governor Baqir expressed SBPs confidence that the banking industry will continue to pace up its performance rapidly to meet the objectives of Mera Pakistan Mera Ghar and to reach targets mandated for Housing and Construction Finance.

READ MORE: Meezan Bank becomes pioneer in Sharia financing for low cost housing

The MPMG event also witnessed speeches from Senator Shaukat Tareen, Adviser to Prime Minister on Finance & Revenue, and Lt Gen Anwar Ali Hyder, Chairman NAPHDA. The Finance Adviser reiterated the Government commitment to MPMG and assured banks to provide all needed support. Chairman NAPHA requested banks to demonstrate commitment in providing housing finance to individuals in NAPHDAs LDA City and Peri Urban projects.

-

Bank Alfalah enables QR option for retail payment

KARACHI: Bank Alfalah has enabled QR option for retail payment at Naheed Supermarket, a statement said on Wednesday.

Naheed Supermarket, a leading name in the retail shopping sector in Pakistan, has entered into an agreement with Bank Al Falah to enable its Alfa QR at its retail outlet.

The agreement enables the QR payment option for the Alfa QR customers, providing them ease of payment at the Naheed Supermarket, and can also enjoy upto 20 per cent or Rs 1000 cash back by making payment through Alfa QR as the launch promotion.

READ MORE: Bank Alfalah declares Rs10.48 billion after tax profit

The Alfa QR, a product backed by Bank Alfalah, enables the valued users to make payments with just 3 taps within the app.

With AlfaPay the customers can simply scan AlfaQR codes to make instant payments now at Naheed Super market as a Masterpass merchant.

Payments can be made using the Bank Alfalah Account, Credit Card, Wallet or with Orbits.

Sharing his thoughts, Munsub Abrar, CEO Naheed Supermarket said, “We at Naheed Supermarket facilitate our customers in terms of shopping with ease of payments and implementation of Alfa QR facility is our latest addition to it.

READ MORE: Bank Alfalah announces 21% growth in half year profit

“The enablement of digital payment system is aligned with the national vision of Digital Pakistan.”

The agreement was signed by Munsub Abrar, CEO Naheed Supermarket and Adnan Nasir, Head digital Payments, Bank Al-Falah at Naheed’s head office in Karachi, in presence of Abraruddin, Founder and Chairman, Muhammad Fahad COO, Hassan Raza, Head of Creative, from Naheed Supermarket; and Rabia Atlas Unit Head Proximity Payments, Arwa Saleem, Manager Proximity Payments, and Yahya Inam, Business Manager Proximity payments, from Bank Alfalah.

-

Dr. Alvi rejects banker’s plea in woman harassment case

ISLAMABAD: The President of Pakistan, Dr. Arif Alvi, has rejected a petition filed by a banker for reinstatement into service, who was sacked for harassing a woman.

The petitioner filed the appeal before the president against the decision of the Federal Ombudsman for Protection against Harassment of Women at Workplace which had modified the punishment of “dismissal from service” into “removal from service”.

READ MORE: President Alvi rejects MCB Bank’s appeal in fraud case

The President upheld the orders of the ombudsman noting that the petitioner was awarded the penalty of dismissal from service after inquiry wherein allegations of harassment stood established against him and the petitioner had failed to point out any illegality with the order of the learned ombudsman.

According to the background of the case, Naeem Iqbal was appointed as Bank Cashier Grade-1 at Bank Alfalah Ltd, on February 01, 2006, and he was later promoted to Operation Officer, Counter Services Manager and Branch Operation Manager in 2010, 2014 and 2016 respectively.

READ MORE: President Alvi orders two banks to pay victims of fraud

Ms Habiba Rauf had filed a complaint before the management of the bank alleging acts of harassment against the accused.

After inquiry, Iqbal was found guilty and, consequently, dismissed from the service by Bank Alfalah Ltd.

After making a representation before the competent authority, he filed an appeal before the Woman Ombudsman who ordered that the appeal of the accused deserves outright dismissal, yet, on considering his long service and the fact that he has a large family, consisting of small kids and aged parents, leniency in punishment looks more appropriate and nearer to justice and fair play.

READ MORE: President Alvi orders State Life to pay death insurance

The ombudsman, therefore, modified the punishment of “dismissal from service” into “removal from service” and disposed of his appeal.

Subsequently, Naeem Iqbal filed a representation with the President for reinstatement into service. While disposing of his appeal, the President noted that the petitioner was seeking setting aside of the order of the bank, dated March 18, 2019, and reinstatement into service purely on humanitarian grounds.

The learned Ombudsman had already converted the penalty of dismissal to removal from service on such grounds.

The President observed that since the petitioner had failed to point out any illegality with the order and no justification existed to interfere with the order of the Ombudsman, therefore, the instant representation is dismissed.

READ MORE: Dr. Alvi opens property exhibition for UAE based NRPs