Arif Habib Limited has released its detailed preview of Pakistan’s Federal Budget for FY2025-26, indicating a mix of strict tax measures alongside carefully targeted relief.

(more…)Tag: budget proposals

-

Banks request budget fix for bad debts tax treatment

Banks in Pakistan have called upon the government to restore the original tax treatment on bad debts as part of their proposals for the upcoming budget 2025–26.

(more…) -

Pharmaceutical industry submits tax proposals for Budget 2025–26

The pharmaceutical industry of Pakistan has officially submitted its tax proposals for the upcoming budget 2025–26, urging the government to address long-standing tax-related challenges that have adversely impacted the sector’s sustainability and affordability of medicine.

(more…) -

FY26 budget: ACCA Pakistan unveils bold taxation blueprint

Karachi, May 23, 2025 – In a move that could dramatically reshape Pakistan’s economic trajectory, the Association of Chartered Certified Accountants (ACCA) Pakistan has launched a groundbreaking Budget Proposal for fiscal year 2025–26.

(more…) -

Pakistan Budget 2025-26 targets chocolates, cookies with taxes

Islamabad, May 23, 2025 – A bitter twist awaits the sweet-toothed across Pakistan as the government prepares to slap a higher Federal Excise Duty (FED) on beloved treats like chocolates and cookies in the upcoming Budget 2025-26.

(more…) -

Budget 2025-26: FBR rejects final tax regime revival for exporters

Islamabad, May 23, 2025 – In a stunning blow to the country’s vital export sector, the Federal Board of Revenue (FBR) has flatly denied any plans to reinstate the Final Tax Regime (FTR) for exporters in the upcoming Budget 2025-26.

(more…) -

Explosive Expectations from Pakistan Budget 2025-26

As Pakistan gears up to unveil its Federal Budget 2025-26 on June 2, 2025, analysts are bracing for what could be a transformative fiscal document driven by International Monetary Fund (IMF) conditions, record-breaking debt obligations, and a widening tax net.

(more…) -

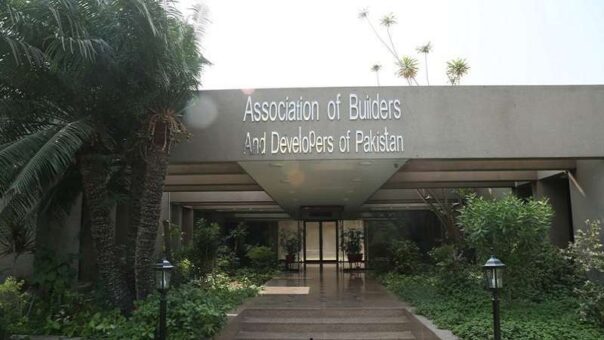

ABAD proposes abolishing Section 7E – deemed property income

Karachi, May 22, 2025 – In a powerful and urgent appeal, the Association of Builders and Developers of Pakistan (ABAD) has demanded the immediate abolition of the controversial deemed income tax under Section 7E of the Income Tax Ordinance, 2001.

(more…) -

Pakistan Textile Council proposes bold reforms in Budget 2025–26

Islamabad, May 22, 2025 – In a major policy move ahead of the federal budget 2025–26, the Pakistan Textile Council (PTC) has submitted a sweeping set of proposals aimed at reviving Pakistan’s export economy, improving ease of doing business, and reducing reliance on IMF programmes.

(more…) -

FBR eyes harsher penalties for retailers in budget 2025-26

Islamabad, May 22, 2025 – In a major move to curb tax evasion, the Federal Board of Revenue (FBR) is set to propose significantly heavier penalties on non-compliant retailers in the upcoming federal budget for 2025-26.

(more…)