KARACHI: State Bank of Pakistan (SBP) on Monday said opposition from traders against CNIC condition on sales transactions was because of misunderstanding.

In its annual report on State of Pakistan Economy, the SBP said that as part of the Finance Bill 2019, the federal government proposed an amendment in the Sales Tax Act of 1990.

Initially, the registered persons were required to issue a serially numbered tax invoice at the time of the sale of goods. The invoices had to include the name, address and registration number of the supplier and recipient of the goods; the date of issue of the invoice; the description and quantity of goods; value of the sales tax applied; and the price inclusive and exclusive of the GST.

According to the amendment, which was to become effective from 1st August, 2019 (but was later delayed), the requirements were elaborated further and the registered persons were instructed to record NIC number or NTN of the recipients unregistered with FBR for sales tax in addition to the details being recorded of the registered recipients.

A relaxation from this clause was granted for sales up to Rs 50,000, provided that the recipient is an ordinary customer (i.e. a person who is buying goods for his or her own consumption and not for the purpose of reselling).

The amendment caused significant unrest in the market, with a majority of the businesses taking a stance against it. Protests were arranged by the associations across the country and the government was asked to abolish the CNIC restriction.

However, much of the opposition against the reforms arose because of the misunderstanding about the announced measures.

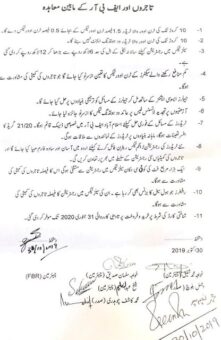

In this regard, the following points are important:

— The CNIC/NTN condition only pertains to sales of businesses that are registered with FBR. Those firms which are working informally do not need to ask for CNIC details from their purchasers, as they do not file tax returns. However, if those firms procure raw material from a registered firm, then they would have to provide the requisite CNIC details to the supplier.

— The buyer does not have to be a registered person. Registered firms can continue to transact with unregistered buyers; the only addition is that they would have to document the CNIC of the buyer in question.

— Sellers only have to record the NTN/CNIC number on the invoice; physical copies of the identity cards are not required. According to news reports, some businesses were fearing that they would have to keep photocopies of the recipients’ CNIC for record purposes, stating that such a measure would unjustly increase their operating and storage costs. However, no such provision has been proposed in the Finance Act.

— No action will be taken against the business if the CNIC/NTN details are found to be incorrect upon subsequent inspection. The following provision is to be made part of the Sales Tax Act upon its revision: “Provided also that if it is subsequently proved that CNIC provided by the purchaser was not correct, liability of tax or penalty shall not arise against the seller, in case of sale made in good faith.” It was later clarified that no action would be undertaken without the approval of the Chief Commissioner of the respective jurisdiction. Lastly, even if action against the seller is warranted, it would be taken only after necessary action has been taken against the person who provided the non-genuine CNIC. A further clarification released by FBR explained that the NIC/NTN of the buyer with respect to taxable supplies to an unregistered person shall be deemed to have been reported in good faith provided that:

(i) The tax invoice complies with the requirements ofsection 23(b) of the Act;

(ii) Payment made by or on behalf of the unregistered purchaser of the amount of the tax invoice, inclusive of sales tax and applicable further tax, is deposited into the supplier’s declared business bank account;

(iii) The NIC provided by the purchaser is found authenticated by NADRA; and

(iv) The NIC/NTN provided is not of the employee of the seller or of his associates as defined under the Income Tax Ordinance, 2001.

— The documentation clause would not result in the halt of purchasing by end-consumers. This is because ordinary buyers are exempted from such a condition, provided that the value of their purchases is up to Rs 50,000.

— The amendment would not result in any price hike, given that no additional tax measures have been adopted under the Finance Bill 2019.

— Sales tax filers feel that registered businesses have been unfairly tasked with the burden of identifying the nonfilers.

According to FBR, if the documentation efforts are not expanded to identify those individuals that are not paying any taxes, then the tax burden on existing registered enterprises would continue to remain high.

— The condition would not be enforced on small businesses in the cottage industry. According to the revised definition followed by FBR, a cottage industry player is one that: does not have an industrial gas or electricity connection; is located in a residential area; does not have a total labor force of more than ten workers; and has an annual turnover from all supplies not exceeding two million rupees.

It is important to note that such structural reforms are unpopular in nature (and were thus delayed earlier) as these might increase businesses’ transaction costs, create liquidity issues, and affect overall economic activity in the short term.

In particular, the introduction of the CNIC condition for sales tax purposes has faced serious resistance (including threats of lockdowns and protests) from traders across the country.

The FBR has since then issued clarification circulars and engaged with the businesses on various forums to help clarify the matters and take feedback. Therefore, it is important to build capacity within the FBR and to further digitize its functions to streamline procedures.

Moreover, the authority needs to continue the dialogue with relevant stakeholders for ensuring smooth implementation of policies, and alleviate regulatory and policy mistrust.