Karachi, April 13, 2024 – In a bid to accurately determine duty and taxes at the import stage, the Federal Board of Revenue (FBR) has introduced new customs valuations for several prominent brands of potato chips, including Lay’s and Pringles.

(more…)Tag: customs valuation

-

FBR Issues New Customs Values of Tyres and Tubes after Massive Revenue Fall

Karachi, November 4, 2023 – Federal Board of Revenue (FBR) has issued new customs values of tyres and tubes for determination of duty and taxes after massive fall of revenue under this head.

(more…) -

Pakistan customs settles dispute for clearance of 86 inch touch LCD

A classification committee of Pakistan Customs has settled dispute for clearance of all-in-One Interactive Computer System, Core i7 with 86 inch touch LCD.

(more…) -

Valuation committees for Afghan, Iran goods to be set up

ISLAMABAD: The Federal Board of Revenue (FBR) will constitute local valuation committee for customs valuations of goods imported or exported from Afghanistan and Iran.

Through SRO 1352 (I)/2021 dated October 14, 2021, the FBR issued draft amendments for local valuation committee rules under Section 25A of the Customs Act, 1969.

The proposed amendments would be applicable for the determination of value of goods of Afghan and Iran origin in order to regulate the Pak-Afghan bilateral trade by discouraging the incidences of under invoicing and smuggling.

The FBR said that the proposed amendments would be applicable on the Afghan and Iran origin goods, imported from Afghanistan and Iran through land routes. In case, if an item is being imported through sea route in significant quantities from Iran, then, the value of such items shall be determined in consultation with Directorate of Valuation, Karachi.

According to the draft amendments, the respective collector of customs (appraisement), on his own motion, in his area of jurisdiction may determine the customs values of any goods or category of goods imported in or exported out of Pakistan from or to Afghanistan and Iran through land customs stations through the following valuation committee constituted for the said purpose, members whereof shall be nominated by collector concerned, namely:

(a) one additional collector of the collectorate (chairman of the committee);

(b) two deputy or assistant collectors of the collectorate (Members of the committee);

(c) superintendents of principal appraisers or appraisers or inspectors as required;

(d) representative of respective chamber of commerce and industry;

(e) representative of Customs’ clearing agents association;

(f) All Pakistan Dry Fruits Importer and Exporter Association;

(g) all Pakistan Fresh Fruits Importers and Exporters Association; and

(h) any other co-opted member as deemed appropriate by the collector.

The values so determined by the collector on recommendations of the committee shall be valid for six months.

-

DG Customs Valuation assigned task to stop trade based money laundering

ISLAMABAD: Directorate General of Customs Valuation has been assigned to stop trade based money laundering through effective monitoring of goods clearance specially those goods having lower duty rates or exempt from duty and taxes.

The Federal Board of Revenue (FBR) on Friday issued SRO 503(I)/2021 to redefine functions of the Directorate General of Customs Valuation.

Through the SRO it is instructed the directorate that besides focusing on under invoicing of imports, also identify cases of over-invoicing of imports of low-duty or exempt items, and mis-invoicing of exports (to prevent flight of capital or trade-based money laundering) and to convey such information to concerned formations.

The FBR also instructed the valuation department to make special arrangements to aware trade and industry about the latest customs valuation of import and export of goods.

The directorate has been advised to develop and maintain a center for issuing advance rulings on valuation in accordance with international best practices.

The FBR asked the directorate to regularly obtain reference price data from accredited publications, official price list, websites, through market enquiries as well as findings of Post Clearance Audit and other authentic sources and to make such data available to all customs stations for smooth clearance of goods.

Further, the directorate has been advised to carry out proactive monitoring of valuation of goods imported into and exported from the country vis a vis international price trends, conduct and undertake sector wise studies of items prone to mis-invoicing and to advise the field formations regarding any abnormalities in valuation during clearance.

To maintain effective liaison with Pakistan Mission abroad for the purpose of valuation enquiries, with relevant valuation committees of World Trade Organization and World Customs Organization, and with foreign customs administration.

The FBR further advised the directorate to develop suitable training modules, in consultation with Directorate General of Training and Research, focused and providing necessary skills from basic level to advanced level to officers and officials working in all relevant functions including Model Customs Collectorates, Post Clearance Audit and Valuation Directorates.

-

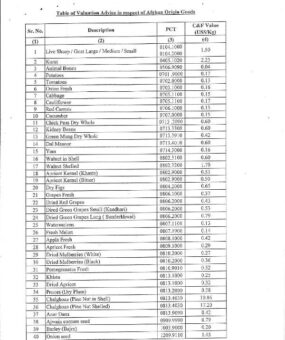

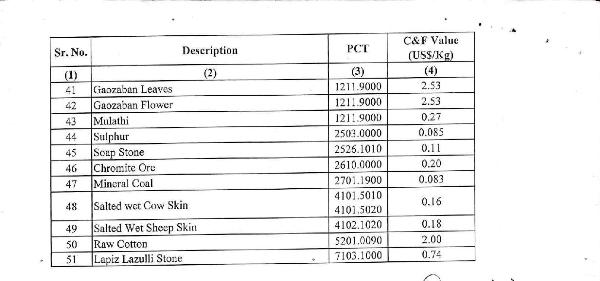

Customs valuation issued for Afghan origin goods

KARACHI: The Directorate General of Customs Valuation has issued valuation advice for Afghan origin goods on recommendations received from Peshawar and Quetta collectorates.

Previously a valuation advice was issued on December 12, 2020 in the light of values worked out and recommendations by MCC (Appraisement and Facilitation), Peshawar and Quetta, for Afghan origin goods imported via land route and cleared by said collectorates.

“However, both the collectorates approached the directorate and proposed new values for certain items, agreed and worked out by them and requested for modification of valuation advice accordingly.”

The directorate said that the new valuation advice has been issued on December 31, 2020 for a period of three months and the values are only for the purpose of assessment of duty and taxes for Afghan origin goods.

Following is the valuation advice:

-

FBR suggested simplification of valuation for imported vehicles

KARACHI: Federal Board of Revenue (FBR) has been advised to simplify valuation and levy of duty and taxes on imported vehicles.

Officials in FBR said that in budget proposals received for 2020/2021, the business community proposed simplification of valuation and fixing duty and taxes.

According to the proposals the valuation of vehicles may also be simplified and fixing duty / taxes as is already done for 1000 CC , 1300 CC and 1600 CC vehicles.

The duty for vehicles above 2000 CC may also be fixed or manufacturer’s retail price for each year may be made a basis and give lump sum adjustment on account of various factors.

This will simplify the assessment procedure.

Further, the business community also recommended simplification of assessment and duty/taxes regime for imported goods.

Currently entrepreneurs who want to set up new industries and importers wanted to know about the incidence of tax on various items have to contact either some customs expert or department.

The department never gives proper reply in a given time period or sometimes does not respond at all.

It is therefore proposed that the module of WeBOC relating to filing of GD and calculation of duty may be separately placed on the website of FBR so that any person can fill-in the description of item and HS code to get incidence of duty and taxes for imports.

At present, the custom duty is calculated on the original value whereas sales tax is calculated on the duty paid value (value +customs duty), FED is calculated on (value +customs duty+ ST) and income tax / withholding tax is calculated again on original value.

This makes the system very complicated. In case of sales tax the rate is already high i.e., 17 percent but it’s calculation on duty paid value further increases the rate beyond 17 percent. (If value is Rs 100 and custom duty is 15 percent the sales tax comes to Rs 21.25 instead of Rs 17).

In this way a common man will be able to calculate duty and taxes on any item.

-

Time limit for customs valuation issuance should be fixed

KARACHI: Federal Board of Revenue (FBR) has been recommended to fix time limit for issuance of customs valuation.

Federation of Pakistan Chambers of Commerce and Industry (FPCCI) in its proposals for budget 2020/2021, said that the validity of Valuation Ruling under Section, 25-A of the Customs Act, 1969 is life time utill or unless revised or rescinded by the competent authority and Genuine Importer suffer as the Assessing Offices reject the transaction Values and Increase the Values of Assessments.

Time limit may be fixed for issuance of Valuation Ruling under subsection 1 of section 25A of Custom Act, 1969, may not be more than 30 days and validity period under subsection 4 of section 25A of the Act should not be more than 90 or 120 days as we have fast internet system in the world over.

(i) The following proviso may be inserted after subsection 1 of section 25A of the ACT,1969.

“Provided that the time limit to notify the customs values under subsection 1 of section 25A should not me more than 30 days from date of first initiative of the subject exercise”.

(ii) The words after the “applicable” in subsection 4 of section 25A should be substituted as; “till ninety days from the date of issuance of determined customs values.”

-

FBR decides to publish customs valuation rulings

ISLAMABAD: Federal Board of Revenue (FBR) has decided to publish all prevailing valuation rulings to its official website in order to make customs clearance transparent and ease of doing business.

The FBR in a statement on Thursday said that the chairman Syed Shabbar Zaidi, had issued special instructions to publish all Customs Valuation Rulings on the Website of FBR so that Rulings are easily accessible to the general public.

The Instructions have been issued to further promote transparency and ease of doing business. The Chairman has requested the business community to assist FBR in identifying cases of under-valuation so that remedial action should be taken.

-

Any person can takeover imported goods by offering higher customs value

KARACHI: In order to prevent under-invoicing and mis-declaration the customs authorities have powers to accept offer from any person to allow clearance at higher value than the declared by an importer for the same consignment.

The Customs Act, 1969 has authorized the customs officials to allow such offer under Section 25C of the Act to takeover the imported goods.

Section 25: Power to takeover the imported goods

Sub-Section (1): If any person makes an offer in writing to buy the imported goods sought to be cleared at value declared by an importer in the goods declaration, and the Collector of Customs is satisfied that the declared value is not the actual transactional value, he may after approval of the Board order the following without prejudice to any other action against the importer or his authorized agent, namely:-

(i) entertain offer by any other person to buy these goods at substantially higher value than the declared customs value in the goods declaration and payment of customs duties and other leviable taxes thereon, provided such offer is accompanied by a pay order equal to twenty-five per cent of the amount of each such offer and duties and other taxes calculated in accordance with the offer;

(ii) give an option in writing to the importer of such goods for clearance of imported goods at the customs value equal to such highest offer for purchase of goods and payment of customs duties and other taxes chargeable thereon; and

(iii) in case the importer fails to clear the imported goods within seven days of the receipt of notice under clause (ii) above, the appropriate officer may takeover the goods on payment of customs value declared in the goods declaration and an amount equal to five per cent of such declared value;

Sub-Section (2): The imported goods taken over under sub-section (1) shall be delivered to the offerer on submission of two pay orders, one equal to the customs value declared in the goods declaration plus five per cent in the name of importer and the other pay order equal to the remaining amount of value of imported goods and the amount of customs duties and other taxes leviable on the imported goods in the name of Collector of Customs;

Sub-Section (3): In case the local buyer fails to take the delivery of the goods on payment of value and taxes as prescribed in sub-section (2) above, the pay order equal to twenty-five per cent of the amount shall be fore-feited in favour of the Federal Government and imported goods shall be released to the importer as per customs value determined under sections 25 or 25A as the case may be.