Islamabad, January 14, 2025 – The Senate Standing Committee on Finance and Revenue has raised concerns over the Federal Board of Revenue (FBR)’s recent acquisition of 1,010 new Honda cars for its officials. The committee has formally directed the FBR chairman to provide detailed information regarding this procurement, citing the need for transparency and fiscal responsibility.

(more…)Tag: FBR

FBR, Pakistan’s national tax collecting agency, plays a crucial role in the country’s economy. Pakistan Revenue is committed to providing readers with the latest updates and developments regarding FBR activities.

-

FTO Directs FBR to Clarify Tax Deduction on Internet Usage

Karachi, January 14, 2025 – The Federal Tax Ombudsman (FTO) has instructed the Federal Board of Revenue (FBR) to clarify issues surrounding the withholding tax deduction on internet usage.

(more…) -

Financial Sector Emerges as Largest Beneficiary of Tax Relief: FBR

Karachi, January 14, 2025 – The Federal Board of Revenue (FBR) has revealed that the financial sector emerged as the largest beneficiary of income tax relief during the tax year 2024. The findings were disclosed in a detailed report highlighting the exemptions and concessions provided across various sectors.

(more…) -

FBR Activates International Centre of Tax Excellence

ISLAMABAD: The Federal Board of Revenue (FBR) has officially activated the International Centre of Tax Excellence (ICTE) to enhance international tax cooperation, revenue forecasting, tax analysis, and the overall design and delivery of tax administration. This initiative aims to maximize revenue collection and modernize Pakistan’s tax system.

(more…) -

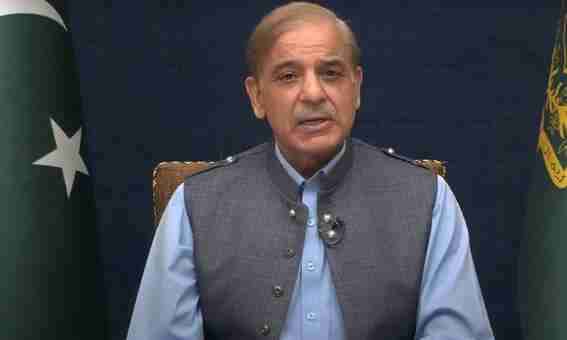

PM Shehbaz Wants Artificial Intelligence for Customs Clearance

Islamabad, January 13, 2025 – Prime Minister Muhammad Shehbaz Sharif on Monday expressed his desire that artificial intelligence should take control the clearance at Pakistan Customs.

(more…) -

Taxpayer Money Drives Heated Debate on FBR Honda Car Fleet

Karachi, January 13, 2025 – A heated debate has erupted among taxpayers over the Federal Board of Revenue’s (FBR) plan to purchase 1,010 Honda City 1.2 L CVT cars as part of its initiative to strengthen enforcement measures.

(more…) -

FBR Purchases 1,010 Honda City 1.2 L to Boost Tax Enforcement

Islamabad, January 12, 2025 – The Federal Board of Revenue (FBR) has announced the purchase of 1,010 Honda City 1.2 L CVT vehicles to bolster its enforcement efforts against tax evasion. This significant acquisition is part of the FBR’s strategy to enhance its operational capabilities and expand its tax net.

(more…) -

PM Shehbaz Sets Rs15M Reward for Faceless Customs Rollout

Islamabad, January 12, 2025 – Prime Minister Muhammad Shehbaz Sharif has announced a reward of Rs 15 million for the team responsible for implementing the innovative Faceless Customs Assessment System, marking a major leap forward in modernizing Pakistan’s customs operations.

(more…) -

Government to Make Shopping Difficult for Non-Filers: FBR Chief

Rashid Mahmood Langrial, Chairman of the Federal Board of Revenue (FBR), has announced plans to introduce new legislation aimed at making shopping more challenging for individuals who fail to file their tax returns.

(more…) -

Sales Tax Act Empowers IR Officers to Arrest and Prosecute

Karachi, January 11, 2025 – The Sales Tax Act, 1990, empowers officers of Inland Revenue (IR) to arrest and prosecute individuals for non-compliance with tax laws, strengthening enforcement mechanisms for tax evasion and fraud.

(more…)