Karachi, November 22, 2024 – The Federal Board of Revenue (FBR) on Thursday deployed tax officials at sugar mills located in the Sindh and Punjab provinces to detect tax evasion.

(more…)Tag: FBR

FBR, Pakistan’s national tax collecting agency, plays a crucial role in the country’s economy. Pakistan Revenue is committed to providing readers with the latest updates and developments regarding FBR activities.

-

RTO Islamabad Seals Five Restaurants for Issuing Fake Invoice

The Regional Tax Office (RTO) Islamabad took stern action on Thursday by sealing five prominent restaurants in the city for issuing fake invoices and receipts.

(more…) -

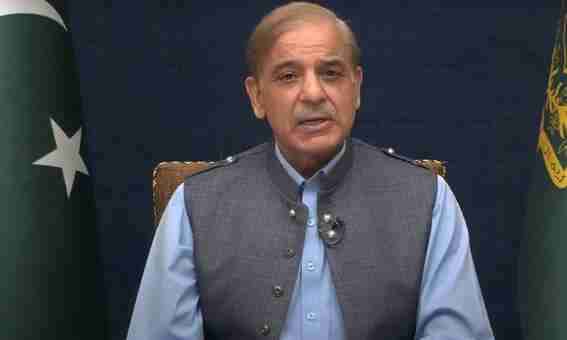

PM Shehbaz Rewards FBR Officer for Uncovering Tax Fraud

Prime Minister Shehbaz Sharif on Thursday presented a commendatory shield and a prize of Rs 5 million to FBR officer Ijaz Hussain for his role in uncovering a massive sales tax fraud worth trillions of rupees.

(more…) -

FBR Issues SOP for Penalizing Non-ATL Persons

Karachi, November 21, 2024 – The Federal Board of Revenue (FBR) on Thursday issued a Standard Operating Procedure (SOP) for penalizing persons not appearing on the Active Taxpayers List (ATL). The FBR issued the SOP on the directives of the Federal Tax Ombudsman (FTO) to streamline the process of penalizing non-ATL persons by publishing their names in the Income Tax General Order (ITGO).

(more…) -

FBR Targets High-Net-Worth Non-Filers for Tax Enforcement

The Federal Board of Revenue (FBR), acting on Prime Minister Shehbaz Sharif’s directive, has unveiled a stringent enforcement plan to target affluent individuals evading taxes. The initiative focuses on unregistered persons, non-filers, and individuals declaring nil income, especially those concealing income or significant assets.

(more…) -

FBR Announces Normal Working Days for November Saturdays

Islamabad, November 20, 2024 – The Federal Board of Revenue (FBR) announced on Wednesday that the last two Saturdays of November 2024 would be observed as normal working days.

(more…) -

PM Shehbaz Orders Crackdown on Sugar Sector Tax Evasion

Islamabad, November 19, 2024 – Prime Minister Muhammad Shehbaz Sharif has directed a coordinated effort by the Federal Board of Revenue (FBR), Federal Investigation Agency (FIA), and Intelligence Bureau to address tax evasion, undocumented sugar sales, and price manipulation in the sugar sector.

(more…) -

FBR Chairman Briefs World Bank on Transformation Plan

Islamabad, November 19, 2024 – Rashid Mahmood, Chairman of the Federal Board of Revenue (FBR), provided an in-depth briefing to the World Bank team on Tuesday regarding the FBR’s comprehensive transformation plan aimed at enhancing revenue collection and tax compliance in Pakistan.

(more…) -

FBR Set to Prosecute Banks for Incomplete Declarations

Karachi, November 19, 2024 – The Federal Board of Revenue (FBR) is preparing to take legal action against banks and other companies for submitting incomplete or inaccurate declarations, a move that underscores the government’s commitment to strengthening compliance within the financial sector.

(more…) -

FBR Updates Active Taxpayers List for 2024 to 5.52 Million

The Federal Board of Revenue (FBR) has revised its Active Taxpayers List (ATL) for the tax year 2024, reflecting a significant increase in active taxpayers. As of November 18, 2024, the list includes 5.52 million individuals, a rise from the 5.37 million taxpayers recorded in the initial ATL published on November 1, 2024.

(more…)