Karachi, October 19, 2024 – The Federal Board of Revenue (FBR) has provided a detailed explanation regarding the due dates for tax payment under the provisions of the Income Tax Ordinance (ITO), 2001. This clarification is aimed at ensuring taxpayers understand their obligations and comply with deadlines to avoid penalties or surcharges.

(more…)Tag: FBR

FBR, Pakistan’s national tax collecting agency, plays a crucial role in the country’s economy. Pakistan Revenue is committed to providing readers with the latest updates and developments regarding FBR activities.

-

FBR Orders Swift Action Against Tax Officials Involved in Flying Invoices

Karachi, October 19, 2024 – The Federal Board of Revenue (FBR) has issued a resolute directive calling for immediate action against tax officials implicated in the facilitation of counterfeit and flying invoices within sales tax returns.

(more…) -

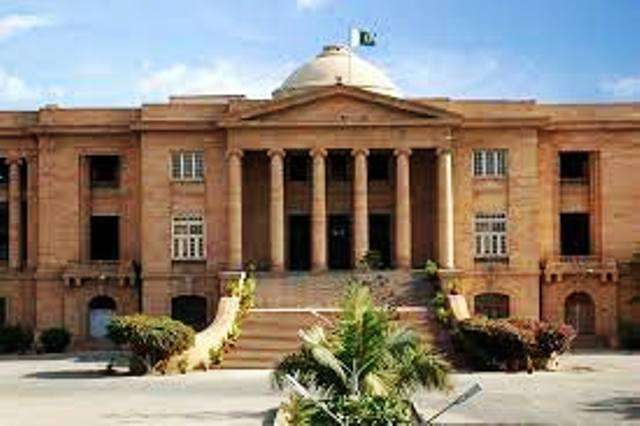

SHC Orders No Affidavit for September Sales Tax Returns

The Sindh High Court (SHC) has issued a pivotal directive to the Federal Board of Revenue (FBR), mandating that companies submit their sales tax returns for September 2024 without the requirement of affidavits from their chief financial officers. This order, articulated by the SHC on Friday, compels the FBR to facilitate the filing process of these returns devoid of the contested affidavits until the next scheduled hearing.

(more…) -

FBR to Launch New Active Taxpayers List on November 1, 2024

Karachi, October 18, 2024 – The Federal Board of Revenue (FBR) is poised to unveil the new Active Taxpayers List (ATL) for the tax year 2024 on November 1, 2024, marking a pivotal moment in Pakistan’s tax management system.

(more…) -

FBR’s Sales Tax Crackdown Triggers Alarm Among Foreign Buyers

Karachi, October 18, 2024 – Major textile exporters have raised concerns about Pakistan’s international reputation following the Federal Board of Revenue’s (FBR’s) aggressive crackdown on sales tax fraud. The Pakistan Textile Council (PTC), representing leading textile and apparel exporters, has issued a stark warning that foreign buyers are losing confidence in the country’s credibility due to the FBR’s recent actions.

(more…) -

E-Intermediaries Face License Cancellation in Tax Fraud Cases

Karachi, October 18, 2024 – The Federal Board of Revenue (FBR) has initiated stringent legal action against e-intermediaries involved in widespread sales tax fraud. This decisive move follows the identification of numerous fraud cases linked to the manipulation of sales tax records, particularly through fake and flying invoices, as well as the suppression of sales.

(more…) -

FBR Relaxes Affidavit Requirement for September Sales Tax Returns

Karachi, October 17, 2024 – The Federal Board of Revenue (FBR) has eased the requirement for submitting an affidavit alongside the sales tax return for September 2024, which is due to be filed in October. This relaxation follows appeals from trade bodies and aims to build trust among all stakeholders, the FBR announced on Thursday.

(more…) -

FBR Unveils New Strategy to Break Sales Tax Fraud Networks

Karachi, October 16, 2024 – In a decisive move to dismantle the entrenched practice of sales tax fraud, the Federal Board of Revenue (FBR) has unveiled a robust strategy aimed at curbing the use of fake and flying invoices.

(more…) -

People Turn Flying Invoices Into a Business: FBR Chairman

Karachi, October 16, 2024 – Federal Board of Revenue (FBR) Chairman, Rashid Mahmood Langrial, has expressed grave concern over the widespread sales tax fraud in Pakistan, particularly highlighting how “flying invoices” have morphed into a full-fledged business.

(more…) -

FBR Unveils Plan for Detection of Fake and Flying Invoices

Karachi, October 16, 2024 – The Federal Board of Revenue (FBR) has taken a significant step towards combatting tax evasion and enhancing fiscal integrity by directing tax offices to assign senior officers with the crucial responsibility of identifying fake and flying invoices.

(more…)