Karachi, August 16, 2024 – In a move aimed at alleviating the pressures faced by businesses amid widespread internet issues, the Federal Board of Revenue (FBR) has announced an extension for the filing of sales tax returns for July 2024.

(more…)Tag: FBR

FBR, Pakistan’s national tax collecting agency, plays a crucial role in the country’s economy. Pakistan Revenue is committed to providing readers with the latest updates and developments regarding FBR activities.

-

FBR Streamlines Income Tax Payments with New Guide

Karachi, August 16, 2024 – The Federal Board of Revenue (FBR) has rolled out comprehensive guidelines to assist taxpayers in fulfilling their income tax obligations, emphasizing the importance of timely payments as a national duty.

(more…) -

FBR Launches Streamlined Sales Tax Registration

Islamabad, August 14, 2024 – In a move aimed at simplifying tax compliance, the Federal Board of Revenue (FBR) has introduced a streamlined procedure for sales tax registration. This new process is designed to facilitate taxpayers, making it easier and more efficient to register for sales tax using the Iris Portal.

(more…) -

Tax Collection Rise 70% as Electricity Bills Burden Consumers

Karachi, August 14, 2024 – The Federal Board of Revenue (FBR) has reported a remarkable 70% surge in advance tax collection from electricity bills during the fiscal year 2023-24. This increase is largely attributed to the escalating electricity tariffs, which have been a source of concern for both industrial and residential consumers across Pakistan.

(more…) -

FBR Unveils Sales Tax Essentials: A Guide for Taxpayers

Islamabad, August 12, 2024 – The Federal Board of Revenue (FBR) has recently released a comprehensive guide explaining the basics of sales tax to help taxpayers navigate the complexities of registration and filing. This initiative aims to ensure that taxpayers have a clear understanding of sales tax laws, thereby facilitating compliance and reducing errors in tax returns.

(more…) -

MTL Sounds Alarm: Unclear GST Risks Production Shutdown

Karachi, August 12, 2024 – Millat Tractors Limited (MTL) raised a critical red flag on Monday, warning that the ongoing ambiguity in General Sales Tax (GST) regime could compel the company to halt its production activities.

(more…) -

FBR Extends Rs 41 Billion Tax Bonanza to Power Sector

Karachi, August 11, 2024 – In a move that is likely to raise eyebrows, the Federal Board of Revenue (FBR) has extended tax concessions worth a staggering Rs 41 billion to the power sector for the tax year 2024.

(more…) -

FBR Debunks Rumors of Taxing Arshad Nadeem’s Prize Money

Islamabad, August 11, 2024: The Federal Board of Revenue (FBR) has decisively quashed rumors swirling on social media about the alleged taxation of the prize money awarded to Arshad Nadeem, Pakistan’s golden athlete and the gold medalist at the Paris Olympics 2024.

(more…) -

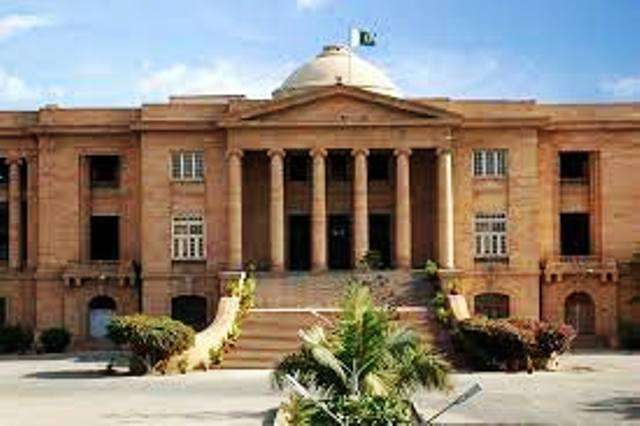

SHC Upholds FBR’s Transfer Orders: IRS Officers’ Plea Rejected

Karachi, August 10, 2024 – The Sindh High Court (SHC) has delivered a significant ruling by dismissing the petition of 12 senior officials from the Inland Revenue Service (IRS), who had challenged their recent transfers to the Federal Board of Revenue’s (FBR) administrative pool.

(more…) -

Entrustment Scheme: Pakistan Exempts Sales Tax on Gold Imports

Karachi, August 10, 2024 – Pakistan has granted a sales tax exemption on the import of gold under the entrustment scheme. The Federal Board of Revenue (FBR) announced the tax exemption, which has been introduced through the Finance Act, 2024. The exemption is part of broader changes made to the Sixth Schedule of the Sales Tax Act, 1990.

(more…)