Karachi, July 7, 2024 – The commencement of the annual income tax return filing for tax year 2024 marks a pivotal moment for taxpayers in Pakistan as the Federal Board of Revenue (FBR) has officially launched the finalized return forms.

(more…)Tag: FBR

FBR, Pakistan’s national tax collecting agency, plays a crucial role in the country’s economy. Pakistan Revenue is committed to providing readers with the latest updates and developments regarding FBR activities.

-

FBR Nets 4.5 Million Potential Tax Evaders in Digital Dragnet

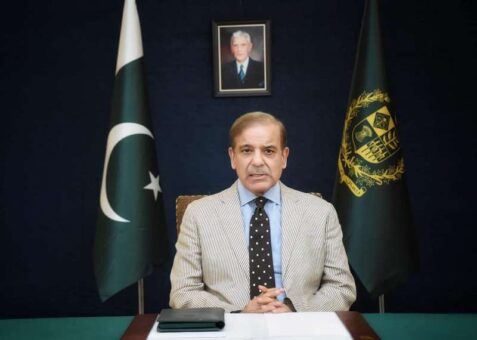

Islamabad, July 6, 2024 – Pakistan’s Federal Board of Revenue (FBR) has made a significant breakthrough in its efforts to combat tax evasion. In a briefing presented to Prime Minister Shehbaz Sharif, the FBR identified a staggering 4.5 million individuals with taxable income who are currently not registered within the national tax system.

(more…) -

PM Shehbaz Asks FBR to Create Dashboard to Monitor Digitization

Islamabad, July 5, 2024 – Prime Minister Shehbaz Sharif, emphasizing the government’s priority of digitizing the taxation system to prevent tax evasion worth billions of rupees, directed the concerned authorities on Friday to promptly establish a dashboard to monitor the ongoing digitization and the implementation of reforms.

(more…) -

FBR Makes Batch of 27 BS-20 Officers as OSD

Karachi, July 4, 2024 – In a sweeping move aimed at cleansing its ranks of alleged incompetence and corruption, the Federal Board of Revenue (FBR) has relegated a cohort of 27 officers to Officer on Special Duty (OSD) status.

(more…) -

Finance Act, 2024: Rs100M Penalty for Failure in ITGO Compliance

Karachi, July 3, 2024 – The Finance Act, 2024, has introduced significant penalties for utility providers failing to comply with the Income Tax General Order (ITGO). The government has recommended a penalty of up to Rs 100 million for non-compliance.

(more…) -

Aurangzeb Commends FBR for Surpassing FY24 Tax Target

Islamabad, July 1, 2024 – Finance Minister Muhammad Aurangzeb praised the Federal Board of Revenue (FBR) on Monday for exceeding the tax collection target for the fiscal year 2023-24.

(more…) -

Active Taxpayers List Swells to 4.84 Million: FBR

Islamabad, July 1, 2024 – The Federal Board of Revenue (FBR) announced on Monday a significant increase in the number of active taxpayers, which has risen to 4.84 million based on returns filed for the tax year 2023 by June 30, 2024.

(more…) -

IRSOA Congratulates FBR for Impressive FY24 Tax Collection

KARACHI: The Inland Revenue Service Officers Association (IRSOA) has lauded the Federal Board of Revenue (FBR) for achieving remarkable tax collection results in the fiscal year 2023-24.

(more…) -

FBR Surpasses Tax Collection Target by Rs 54 Billion for FY24

Islamabad, June 30, 2024 – The Federal Board of Revenue (FBR) announced on Sunday that it has surpassed its tax collection target for the fiscal year 2023-24 by Rs 54 billion, achieving a total collection of Rs 9.306 trillion.

(more…) -

Finance Act, 2024 – Tax on Builders and Developers Explained

Karachi, June 30, 2024 – The Federal Board of Revenue (FBR) has introduced a new tax regime for builders and developers through the Finance Act, 2024, aiming to streamline taxation in the real estate sector.

(more…)