Islamabad, October 16, 2025 – The Federal Board of Revenue (FBR) has come under sharp criticism for its failure to issue the manual income tax return form for the Tax Year 2025, exposing what many describe as a new “hallmark of negligence” within the tax authority.

(more…)Tag: FBR

FBR, Pakistan’s national tax collecting agency, plays a crucial role in the country’s economy. Pakistan Revenue is committed to providing readers with the latest updates and developments regarding FBR activities.

-

Pakistan suspends Afghan transit trade amid border unrest

Karachi, October 16, 2025 – Pakistan has suspended Afghan transit trade operations with immediate effect amid escalating unrest along the Pak-Afghan border, according to an official notification issued by the Directorate of Transit Trade, a division of the Federal Board of Revenue (FBR).

(more…) -

Two customs intelligence officers face major penalty over bribery allegations

Islamabad, October 16, 2025 – The Federal Board of Revenue (FBR) has imposed major penalties on two officers of the Directorate of Intelligence and Investigation (Customs), Karachi, following disciplinary proceedings involving allegations of inefficiency, misconduct, and corruption.

(more…) -

FBR dismisses preventive officer over seized car theft case

Karachi, October 15, 2025 — The Federal Board of Revenue (FBR) has dismissed a preventive officer from service after an internal inquiry found him guilty of negligence and misconduct in a seized car theft case.

(more…) -

FBR announces second extension for 2025 tax returns

Islamabad, October 15, 2025 – The Federal Board of Revenue (FBR) has announced another extension in the deadline for submission of the annual income tax return for the tax year 2025, allowing taxpayers additional time for filing until October 31, 2025.

(more…) -

LTO Islamabad seizes Bahria Town Land for Rs24.47bn

Islamabad, October 14, 2025 – The Large Taxpayers Office (LTO) Islamabad has confiscated a prime piece of land owned by Bahria Town in Murree over outstanding tax liabilities amounting to Rs24.47 billion.

(more…) -

IRSOA denounces attack on FBR officials, demands strict action

Islamabad, October 13, 2025 – The Inland Revenue Service Officers Association (IRSOA) has vehemently condemned the recent cowardly attack on officials of the Federal Board of Revenue (FBR) who were performing their lawful duties near Kohat Toll Plaza under Section 40D of the Sales Tax Act, 1990.

(more…) -

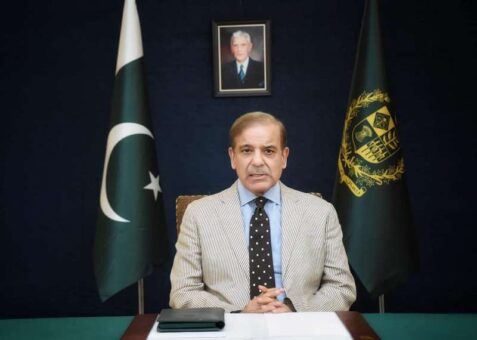

PM Shehbaz fires senior FBR officer in corruption case

Islamabad, October 13, 2025 – In a decisive move to uphold integrity and transparency within government institutions, Prime Minister Muhammad Shehbaz Sharif has approved a major penalty against Rana Waqar Ali, a BS-20 officer of the Inland Revenue Service (IRS), following his proven involvement in corruption and misconduct.

(more…) -

Internet tax collection in Pakistan soars 138% in FY25

Karachi, October 13, 2025 – The Federal Board of Revenue (FBR) has reported a remarkable 138% surge in tax collection from internet services during the fiscal year 2024–25, reflecting Pakistan’s accelerating shift toward a digital economy.

(more…) -

PM Shehbaz imposes penalty on BS-20 IRS officer for misconduct

Islamabad, October 13, 2025 – Prime Minister Muhammad Shehbaz Sharif has imposed a minor penalty on Amjad Farooq, a BS-20 officer of the Inland Revenue Service (IRS), currently serving as Chief (Admin Pool) at the Federal Board of Revenue (FBR) Headquarters, Islamabad.

(more…)