Islamabad, January 28, 2026 – The Federal Board of Revenue (FBR) has collected withholding tax over Rs3 trillion during the first half (July–December) of fiscal year 2025-26 (1HFY26), reflecting a notable improvement in revenue mobilization despite mixed performance across various withholding tax heads.

(more…)Tag: FBR

FBR, Pakistan’s national tax collecting agency, plays a crucial role in the country’s economy. Pakistan Revenue is committed to providing readers with the latest updates and developments regarding FBR activities.

-

Banks to pay super tax from tax year 2023 onwards, court rules

Islamabad, January 28, 2026 — Banks will be required to pay super tax from tax year 2023 onwards after the Federal Constitutional Court upheld the applicability of super tax under Section 4C of the Income Tax Ordinance, 2001, according to a press release issued by the Federal Board of Revenue (FBR).

(more…) -

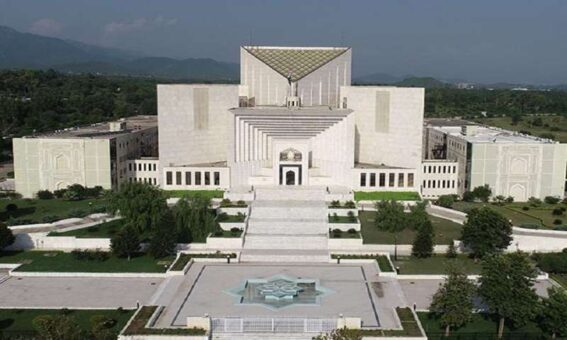

Supreme Court declares FBR notices issued after expiry unlawful

Islamabad, January 28, 2026 — The Supreme Court of Pakistan has ruled that tax orders issued by the Federal Board of Revenue (FBR) after the expiry of the legally prescribed time limit are unlawful, reaffirming that such actions cannot be sustained under the Sales Tax Act, 1990.

(more…) -

Taxpayers lose super tax legal battle as FBR eyes Rs300 billion recovery

Islamabad, January 27, 2026 — In a major setback for taxpayers and corporate entities, the Federal Constitutional Court (FCC) on Tuesday upheld the legality of the super tax, paving the way for the Federal Board of Revenue (FBR) to recover nearly Rs300 billion in outstanding dues.

(more…) -

FBR introduces AI-based chick counting system to monitor poultry sector

Islamabad, January 27, 2026 – In a move to tighten oversight of the poultry industry, the Federal Board of Revenue (FBR) has announced plans to implement an advanced Artificial Intelligence (AI) system to monitor every chick produced across Pakistan’s hatcheries.

(more…) -

FBR abolishes role of local agents in valuation of imported vehicles

Islamabad, January 26, 2026 — In a significant policy move aimed at facilitating vehicle importers, the Federal Board of Revenue (FBR) has officially ended the role of authorized local agents in the valuation of imported vehicles, especially luxury cars originating from Europe.

(more…) -

Withholding tax collection from retailers jumps 37% in 1HFY26: FBR

Islamabad, January 27, 2026 — The Federal Board of Revenue (FBR) has reported a sharp 37 percent increase in withholding income tax collection from retailers during the first half of the ongoing fiscal year 2025-26 (July–December), compared to the same period last year.

(more…) -

FBR restricts customs officials from using social media without approval

Islamabad, January 26, 2026 — The Federal Board of Revenue (FBR) on Monday issued strict instructions barring Customs officers and officials from using social media platforms without obtaining prior approval from the competent authority.

(more…) -

Export of services boosts FBR tax collection by 22% in 1HFY26

Islamabad, January 26, 2026 — Pakistan’s export of services has delivered a strong boost to national revenues, helping the Federal Board of Revenue (FBR) record a 22 percent increase in tax collection during the first half of fiscal year 2025–26 (July–December) compared to the same period last year.

(more…) -

FBR targets AC owners, pushes millions into Pakistan’s tax net

Islamabad, January 25, 2026 – Chairman of the Federal Board of Revenue (FBR), Rashid Langrial, has said that people who have installed air conditioners should be brought into the tax net, stressing that widening the tax base is essential for stabilizing Pakistan’s economy.

(more…)