In a bid to streamline taxation procedures and ensure clarity for taxpayers, the Federal Board of Revenue (FBR) has released details regarding the tax rates on immovable property for the tax year 2022. The information is part of the Income Tax Ordinance, 2001, updated up to June 30, 2021, incorporating amendments introduced through the Finance Act, 2021.

(more…)Tag: Federal Board of Revenue

The Federal Board of Revenue is Pakistan’s apex tax agency, overseeing tax collection and policies. Pakistan Revenue is committed to providing timely updates on the Federal Board of Revenue to its readers.

-

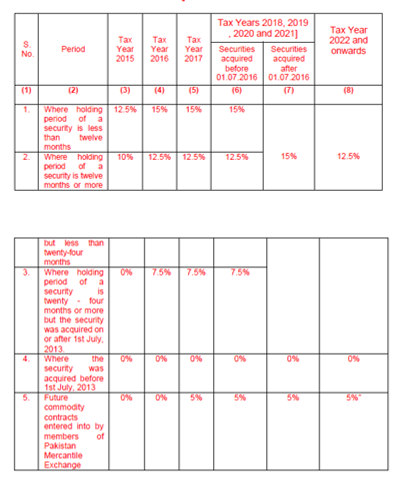

CGT rates on disposal of securities during Tax Year 2022

The tax rates on disposal of securities for tax year 2022 under the First Schedule of the Income Tax Ordinance, 2001.

The Federal Board of Revenue (FBR) issued the Income Tax Ordinance, 2001 updated up to June 30, 2021. The Ordinance incorporated amendments brought through Finance Act, 2021.

Following are the rates on disposal of securities:

The rate of tax to be paid under section 37A shall be as follows:—

TABLE I

Provided that the rate of tax on cash settled derivatives traded on the stock exchange shall be 5% for the tax years 2018 to 2020.

Provided that the rate for companies shall be as specified in Division II of Part I of First Schedule, in respective of debt securities;

Provided further that a mutual fund or a collective investment scheme or a REIT scheme shall deduct Capital Gains Tax at the rates as specified below, on redemption of securities as prescribed, namely:—

Category Rate Individual and association of persons 10% for stock funds 10% for other funds Company 10% for stock funds 25% for other funds Explanation.- For removal of doubt, it is clarified that, the provisions of this proviso shall be applicable only in case of a mutual fund or collective investment scheme or a REIT scheme.

-

Tax rates on shipping, air transport income

The Federal Board of Revenue (FBR) has specified the tax rates on shipping and air transport income earned by non-resident persons under Section 7 of the Income Tax Ordinance, 2001.

(more…) -

Tax rates on royalty, fee for technical services

The Federal Board of Revenue (FBR) has announced updated tax rates for payments made to certain non-residents, specifically on account of royalty or fees for technical services, as defined under Section 6 of the Income Tax Ordinance, 2001.

(more…) -

Rate of tax on return on investment in sukuks

The rate of tax on return on investment in sukuks received from a special purpose vehicle has been defined under Section 5AA of Income Tax Ordinance, 2001.

(more…) -

Non-filing penalty of each day default implements

ISLAMABAD: A penalty of Rs1,000 each day of default has been implemented from Saturday after the expiry of return filing date on October 15, 2021.

(more…) -

Only 2.6M returns amid putting taxpayers’ money on ads

The Federal Board of Revenue (FBR) in Pakistan has faced a shortfall in tax return submissions for the tax year 2021, despite significant spending on advertising and media campaigns aimed at encouraging taxpayers.

(more…) -

Rate for profit on debt for Tax Year 2022

The Federal Board of Revenue (FBR) has disclosed the tax rates applicable to profit on debt under section 7B of the Income Tax Ordinance, 2001, for the tax year 2022.

(more…) -

Rate of dividend tax for Tax Year 2022

The tax rates for dividend tax imposed under section 5 of the Income Tax Ordinance, 2001 for tax year 2022 under the First Schedule of the Income Tax Ordinance, 2001.

The Federal Board of Revenue (FBR) issued the Income Tax Ordinance, 2001 updated up to June 30, 2021. The Ordinance incorporated amendments brought through Finance Act, 2021.

Following are the rates of dividend tax:

The rate of tax imposed under section 5 on dividend received from a company shall be-

(a) 7.5% in the case of dividends paid by Independent Power Producers where such dividend is a pass through item under an Implementation Agreement or Power Purchase Agreement or Energy Purchase Agreement and is required to be re-imbursed by Central Power Purchasing (CPPA-G) or its predecessor or successor entity.

(b) 15% in mutual funds, Real Estate Investment Trusts and cases other than those mentioned in clauses (a) and (c).

(c) 25% in case of a person receiving dividend from a company where no tax payable by such company, due to exemption of income or carry forward of business losses under Part VIII of Chapter III or claim of tax credits under Part X of Chapter III.

(Disclaimer: The text of the above section is only for information. Team PkRevenue.com makes all efforts to provide the correct version of the text. However, the team PkRevenue.com is not responsible for any error or omission.)

-

Hopes for further return filing date extension

ISLAMABAD: Today October 15, 2021 is the last date for filing return or income for tax year 2021. However, a large number persons still require to file their returns. They hope the FBR may further extend the last date beyond October 15, 2021.

(more…)