The Federal Board of Revenue (FBR) has unveiled insights into the tax treatment of properties co-owned by two or more individuals through Section 66 of the Income Tax Ordinance, 2001.

(more…)Tag: Federal Board of Revenue

The Federal Board of Revenue is Pakistan’s apex tax agency, overseeing tax collection and policies. Pakistan Revenue is committed to providing timely updates on the Federal Board of Revenue to its readers.

-

Tax rates on immovable properties for 2021-2022

The Federal Board of Revenue (FBR) has issued updated rates of withholding tax on sale and purchase of immovable properties.

(more…) -

FBR disposes of 25,323 appeals involving Rs900bn tax

ISLAMABAD: The Legal Wing of the Federal Board of Revenue (FBR) has disposed of 25,323 appeals involving tax revenue of around Rs900 billion during fiscal year 2020/2021.

(more…) -

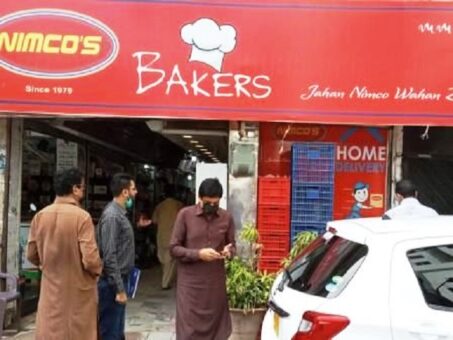

FBR posts officials at retail outlets for sales monitoring

KARACHI: The Federal Board of Revenue (FBR) has initiated action against big retailers by posting tax officials at business premises for monitoring of sales.

Corporate Tax Office (CTO) Karachi, an arm of the FBR, has posted its staff at eight outlets of a big retailer for checking sales, purchase and production of saleable goods.

The tax office posted its staff at eight outlets of Clifton Nimco Private limited under Section 40B of the Sales Tax Act, 1990.

Sources said that it was major step taken by the tax authorities to check tax evasion at retail level.

They said that the step was taken on the directives of Dr. Aftab Imam, chief commissioner inland revenue in order to assure the retail unit is making true declaration of its sales.

The tax office also enforced sales tax rules to install point of sale (POS) at the outlet, which is mandatory for big retailers.

Installing POS machine is mandatory for all retailers falling under category of Tier-1 retailers.

One of the major changes brought through the Finance Act, 2021 that all those outlets accepting debit and credit cards are required to integrate their sales with the FBR.

The sources said that the team of the tax officials would depute till gathering of require information to ascertain the sales and income of the outlet.

-

FBR increases minimum prices of steel products

The Federal Board of Revenue (FBR) announced on Wednesday that it has increased the minimum prices of steel products in an effort to align them with the rising costs observed in both domestic and international steel markets.

(more…) -

Tax rates on car registration for 2021-2022

The Federal Board of Revenue (FBR) has issued revised rates for advance tax on the registration or transfer of motor car.

(more…) -

Tax credit for capital investment in specified sectors

Section 65G of Income Tax Ordinance, 2001 has allowed tax credit for capital investment in specified industrial undertakings.

(more…) -

Law allows certain persons to avail tax credit

Section 65F of Income Tax Ordinance, 2001 has allowed tax credit for certain persons against their incomes.

(more…) -

Tax credit for establishing industrial undertaking

Tax credit for establishing industrial undertaking has been clarified by the Federal Board of Revenue (FBR) to facilitate the business community.

(more…) -

Tax incentive for companies on purchase of machinery

Tax incentive for companies on purchase of machinery and expansion has been clarified by the Federal Board of Revenue (FBR).

(more…)