Islamabad, May 23, 2025 – A bitter twist awaits the sweet-toothed across Pakistan as the government prepares to slap a higher Federal Excise Duty (FED) on beloved treats like chocolates and cookies in the upcoming Budget 2025-26.

(more…)Tag: Federal Board of Revenue

The Federal Board of Revenue is Pakistan’s apex tax agency, overseeing tax collection and policies. Pakistan Revenue is committed to providing timely updates on the Federal Board of Revenue to its readers.

-

Budget 2025-26: FBR rejects final tax regime revival for exporters

Islamabad, May 23, 2025 – In a stunning blow to the country’s vital export sector, the Federal Board of Revenue (FBR) has flatly denied any plans to reinstate the Final Tax Regime (FTR) for exporters in the upcoming Budget 2025-26.

(more…) -

FBR orders Saturday overtime to supercharge tax collection drive

Islamabad, May 22, 2025 — In a bold and urgent move to ramp up tax revenue, the Federal Board of Revenue (FBR) has sounded the alarm and issued fresh directives to its nationwide tax offices, calling for extended enforcement operations and late-night sittings on Saturday, May 31, 2025—a clear sign of intensifying efforts to meet its ambitious collection goals.

(more…) -

FBR admits high taxes forcing capital flight to Dubai

In a revelation that has sent shockwaves through the country’s economic corridors, the Federal Board of Revenue (FBR) has officially admitted that high tax rates and rigid fiscal policies are triggering an alarming capital flight to Dubai.

(more…) -

FBR eyes harsher penalties for retailers in budget 2025-26

Islamabad, May 22, 2025 – In a major move to curb tax evasion, the Federal Board of Revenue (FBR) is set to propose significantly heavier penalties on non-compliant retailers in the upcoming federal budget for 2025-26.

(more…) -

FBR seeks data on officials receiving both salary and pension

Islamabad, May 21, 2025 – The Federal Board of Revenue (FBR) has initiated a detailed investigation to identify federal officials who are simultaneously drawing a salary and pension.

(more…) -

FBR cracks down on 72 Pakistanis’ foreign income, assets secrets

Karachi, May 21, 2025 – In a bold and dramatic move, the Federal Board of Revenue (FBR) has zeroed in on 72 ultra-wealthy and influential individuals, launching a high-stakes investigation into their foreign income and offshore assets.

(more…) -

FBR boots corrupt officer over weapons, smuggling, luxury assets

ISLAMABAD, May 21, 2025 – In a shocking move that has rattled the corridors of Pakistan’s civil service, the Federal Board of Revenue (FBR) has officially dismissed Inspector Customs Syed Momin Hussain Shah from service, following a sensational corruption scandal involving illegal weapons, smuggling, and undeclared luxury assets worth Rs150 million.

(more…) -

Tax credits likely to be restored in FY26 budget to boost investment

ISLAMABAD, May 21, 2025 – The federal government is working on several proposals to encourage investment and strengthen the corporate sector in the upcoming budget for fiscal year 2025-26. Among the key recommendations under serious consideration is the restoration of tax credits, which were previously available for investments in equity mutual funds and initial public offerings (IPOs).

(more…) -

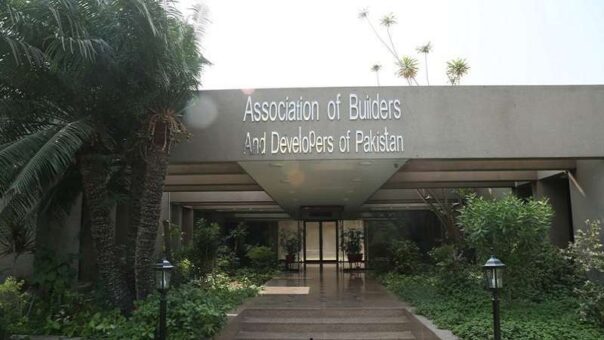

MTO Karachi, ABAD discuss tax issues in construction sector

Karachi – In a significant move to address long-standing tax concerns within Pakistan’s construction sector, the Medium Taxpayers Office (MTO) Karachi and the Association of Builders and Developers of Pakistan (ABAD) held a comprehensive dialogue on Tuesday.

(more…)