KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) has warned the government that industry will opt black economy as formal banking channels are out of reach due to high interest rate.

(more…)Tag: Federation of Pakistan Chambers of Commerce and Industry

-

Dollar crisis: SBP striving to clear 11,000 import payment pending cases

KARACHI: Facing acute shortage of US dollar, the State Bank of Pakistan (SBP) is striving to clear 11,000 import payment pending cases, said SBP governor Jameel Ahmad on Wednesday.

(more…) -

Pakistan Customs to launch module to link international prices for updated valuations

KARACHI: Pakistan Customs is set to launch a module which will link with the international markets to reflect updated prices for making accurate customs valuations.

(more…) -

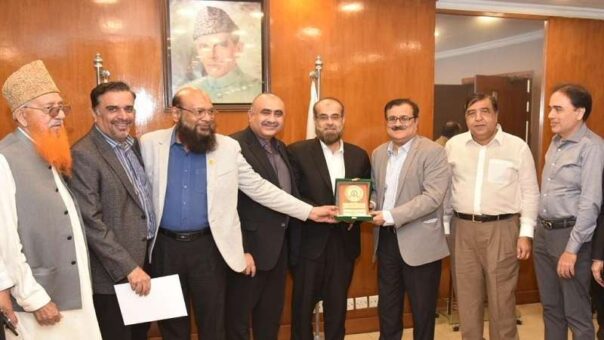

FPCCI, BoI to launch Invest Pakistan initiative

KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) and Board of Investment (BoI) have agreed to form a Joint Consultative Working Group to help constitute and effectively operationalize an independent body called Invest Pakistan under the leadership of Prime Minister through Prime Minister’s Office (PMO).

READ MORE: Over 400 vegetable containers stuck up at ports due to dollar shortage

According to a statement issued on Monday, FPCCI President Irfan Iqbal Sheikh apprised that Invest Pakistan will ensure the policy advocacy initiatives with the support and full-backing of private-sector to promote and facilitate FDI in Pakistan. We have decided to lend a helping hand to make this initiative a success story in the broader national interest, he added.

READ MORE: FPCCI demands release of soybean, canola cargoes

FPCCI Chief added that he has liked the initiative as its concept note entails giving up to 80 percent representation to private-sector on Invest Pakistan board and 51 percent equity or shareholding to private-sector. However, the exact modalities and ToRs will be worked out when the meetings of the working group take place, he added.

Suleman Chawla, SVP FPCCI, who co-chaired the meeting with Ms. Ambreen Iftikhar, Additional Secretary BoI, at the FPCCI Head Office, explained the Public-Private Partnership (PPP) frameworks have proven to be most successful the world over – be it promoting FDI or enticing private-sector investments. He added that PPP mechanism ensures first-hand knowledge and expertise on a sectorial-level from the business, industry and trade community.

READ MORE: KATI urges removal of regulatory duty on yarn

Ms. Ambreen Iftikhar outlined the objectives of Invest Pakistan intuitive as: (i) develop a new and innovative private partnership to facilitate, promote and convert FDI (ii) possibility of joint equity of Invest Pakistan between public and private sectors (iii) seat on the policy negotiation and decision-making forums to avoid disconnect between government institutions and the business community (iv) joint targeting of investment and customized resolution of binding constraints (v) Brand Pakistan through actual investment successes rather through verbose material.

READ MORE: Pakistan slaps 5pc regulatory duty on yarn import

It is pertinent to note that apart from its President and SVP, FPCCI has nominated three other of its prominent members to Joint Consultative Working Group; namely, Mian Nasser Hyatt Maggo, immediate past President FPCCI; Mr. Amjad Rafi, Chairman of Pakistan-Turkiye Joint Business Council of FPCCI and Mr. Jawaid Ilyas, Chairman of Pakistan-China Business Council of FPCCI.

-

SRB says cases worth Rs 80 billion stuck in litigation

KARACHI: Sindh Revenue Board (SRB) Friday said that cases worth Rs80 billion were stuck in litigation and it is willing to resolve amicably.

SRB chairman Dr. Wasif Ali Memon highlighted that Rs80 billion worth of cases are stuck in litigation and the provincial revenue board is all-willing to resolve as many cases amicably as possible.

READ MORE: Customs appraising officer awarded major penalty for inefficiency

“We want to be the facilitators and partners to the business community and no highhandedness is ever desired by SRB,” he added during his visit to Federation of Pakistan Chambers of Commerce and Industry (FPCCI).

On the demand of FPCCI, Dr. Wasif Ali Memon announced that an effective and inclusive Alternative Dispute Resolution Committee (ADRC) would be formulated by SRB in few weeks and we will include 5 – 6 nominees of FPCCI into the committee.

READ MORE: Further tax collection on pharmaceutical products unlawful: KTBA

Chairman SRB also proposed that FPCCI nominees should come from varied sectors to address issues of all the sectors. Additionally, he requested the business community to exhaust the ADRC and other SRB procedures before going into litigation as it only delays the dispute resolution.

On the occasion, Irfan Iqbal Sheikh, President FPCCI, has stressed upon the need to strengthen and broaden the scope of ADRC to save the precious time, resources and hassle of both the sides, i.e. business community and the SRB.

Co-chairing the high-profile meeting with SRB Chairman, Suleman Chawla, SVP FPCCI, offered to nominate technical and expert members of the business, industry and trade community from the platform of FPCCI to facilitate SRB’s efforts to strengthen ADRC.

READ MORE: Non-filers will not be included in ATL 2022

FPCCI nominees will come with the first-hand knowledge of real issues and with deep understanding of the taxation matters, he added.

Shabbir Mansha, VP FPCCI, demanded that as Karachi contributes the lion’s share of taxes in federal & provincial authorities, there should be an enhanced focus on the infrastructural development of Karachi – specifically in industrial& commercial areas and port infrastructure. This will only increase the revenue generation from Karachi, he added.

READ MORE: FBR directs BS-21 officers to submit declaration of assets

Shuakat Omerson, VP FPCCI, apprised the top management of SRB that many members of FPCCI are qualified in alternative dispute resolution mechanism; including the incumbent and former office bearers of FPCCI; and, they can offer great support to SRB’s ADRC initiatives.

Khurram Ejaz, Advisor to the President of FPCCI on FBR & revenue matters, said that FPCCI considers SRB as their partners and not as adversaries; because objectives of both the institutions are same – economic development of the province and resolution of all disputes & anomalies pertaining to provincial tax collection.

-

FPCCI demands release of soybean, canola cargoes

KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) on Monday demanded the government to release the consignments of soybean and canola cargoes at the earliest.

In different communications sent to the Prime Minister, the finance minister and the commerce minister, the apex trade body informed that soybean seed was a major raw material for the different industries in Pakistan.

READ MORE: KATI urges removal of regulatory duty on yarn

Initially it has been used for oil extracting industry for the production of oil purpose then its residual is used in the feed of animals because it is protein rich substance. In poultry industry it has been used as feed.

If the supply of this raw material is stopped or delayed then the industries which are directly attached with the poultry industry like hatching industry and feed mills may also suffer and as a result of this millions of people will lose their jobs.

READ MORE: Pakistan slaps 5pc regulatory duty on yarn import

“It is also used in the feed of cows, goats and buffalos in this connection the Halal industry of Pakistan will also be hurt by this decision,” the FPCCI added.

The soybean and canola cargoes are stuck up at port area Karachi due to restriction of PPRO organization which comes under the ministry of food security. The ministry has stopped the consignments on the arguments that the goods are GMO Seeds with the apprehension which may cause cancer to humans.

“Whereas the industry has a point of view that it only happens when it is used in sowing purpose and in Pakistan it is only used in oil extracting and feed industry,” the FPCCI informed.

READ MORE: Industries threaten mass protest against gas supply shutdown

The cargoes are under heavy demurrage and detention since their arrival and adding cost to the miseries of stakeholders. It is pointed out that soybean meal is an ingredient which contributes 15-20 per cent of used in the industry.

Soybean is termed as to contain the highest crude protein content to the extent of 44 per cent which contributes to reasonable yield in milk production.

It is to record that soybean is being imported in the country since last many years and widely traded commodity. However, its clearance is at halt for the reasons best known to the hierarchy. “The situation is causing cancellation of market commitment and contracts escalating the cost of doing business,” it added.

READ MORE: Member Customs assures swift clearance of export consignments

On the other hand its substitute i.e. canola meal is also being treated on the same line and consignments are pending clearance at the port.

The FPCCI of the view that if such practices are carried on and the consignments are stuck up at the port, the situation will result in shortage of poultry, meat and dairy items are the basic commodities which has a routine use in daily life,

FPCCI is analyzing the situation seriously, and strongly recommended that immediate relief to the stakeholders may be granted before the situation gets out of control.

-

No tax amnesty, no tax rate cut under IMF program: FBR chief

KARACHI: The chairman of Federal Board of Revenue (FBR) Asim Ahmad on Saturday said that under ongoing program of the International Monetary Fund (IMF) the government committed for not granting any tax amnesty scheme and no tax rate cut.

FBR chief was talking to business community at the Federation of Chamber of Commerce and Industry (FPCCI) during his visit to the Federation House.

READ MORE: FBR may withdraw condition of invoice, packing list in containers

He said that the government had agreed with the IMF for neither allow any tax amnesty nor allow tax rate cut under the loan program. “Therefore, all the stakeholders have to work together on the policy,” he added.

The chairman admitted that under imports under Chapter 84 and 85 of Customs Act, 1990 was problem not only for the business community but it was also for the tax authorities as well. “Hopefully this issue will be resolved very soon,” he assured the business community.

READ MORE: Customs Enforcement announces auction of vehicles on Nov 09, 2022

Asim Ahmed said that FBR never wanted to stop the clearance of parts and machinery. “Because industrial activity ensures revenue collection for the country,” he added.

The chairman said that tax officials were in touch with the business community to resolve the issues.

He said that tax reform commission had started its work soon after Ishaq Dar assumed as the finance minister. The chairman also informed that the tax audit would be conducted once in four year.

READ MORE: FBR auctions confiscated immovable properties on Nov 15, 2022

The chairman said that the retailer and wholesaler sectors were not filing income tax returns, which was main hindrance in identifying true income. He said by enforcing the relevant tax laws on retail sector there was revenue potential of Rs20 billion. In contrast the tax authorities were able to collect only Rs6 billion from this sector.

READ MORE: FBR issues circular to relax income tax return filing deadline

On the occasion, Suleman Chawla, senior Vice President of the FPCCI said that business community was uncomfortable on the issues of return filing and selection of audit. These issues should be resolved on priority.

-

FPCCI seeks statutory time for return filing after error removals

KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI), the apex trade body of the country, has urged the tax authorities to give statutory time for filing tax return after removing all errors in the return form.

“Proper legal time for compliance should be granted as per the statute after resolving all problems in the tax return forms,” said Suleman Chawla in a letter sent to Asim Ahmad, chairman, Federal Board of Revenue (FBR).

READ MORE: FBR advised to extend tax return filing date for three months

The apex trade body pointed out numerous errors and mistakes in the return forms on the Iris – the online filing portal of the FBR – both technical, related to IT, and legal.

Due to the technical errors the tax filers are reluctant to pay undue taxes, and their consultants remain unable to file the returns, the FPCCI said in the letter sent on September 24, 2022.

“It is regretful to note that none of the issues have been addressed as yet and, therefore, the pace of compliance of filing the tax returns is very slow,” Suleman Chawla said.

READ MORE: PTBA suggests measures to resolve refund adjustment ahead return filing deadline

The FPCCI highlighted the following issues in its letter to the FBR chairman:

Column for adjustment of brought forward capital losses under the head of capital gains tax is not available in income tax returns form due to which tax on capital gain cannot be calculated correctly.

The column of tax credit for specified industrial undertaking under section 65G of the Income Tax Ordinance, 2001 is inadvertently available in the tax credit annexure of income tax return for salaried individuals, which has no correlation with such tax credit.

READ MORE: Penalties for failure to file return tax year 2022 within due date

Column for adjustment of brought forward capital losses under the head of capital gains is not available in Income tax return form due to which tax on capital gain cannot be calculated correctly.

The Column of tax credit for specified industrial undertakings u/s 65G of the Income Tax Ordinance, 2001 is inadvertently available in the Tax Credits Annexure of income tax return for salaried individuals, which has no correlation with such tax credit.

Although the rate of tax on contract receipts under section 153 was reduced from 7.5% to 7% for Tax Year 2022, however, there is no column for such reduced rate in the return for the TY 2022 available on IRIS.

The draft of manual return forms for the Individuals and AOPs for the Tax Year 2022 was issued belatedly on August 26, 2022, whereas the final SRO. 1733(1)/2022 was issued on September 13, 2022 meaning thereby only 17 days of time has been allowed to file the manual returns, which is insufficient as provided under the law.

READ MORE: FBR fails to remove return filing glitches; KTBA seeks legal time

The IRIS portal is calculating incorrect tax liability on gain on sale of immovable properties in violation of section 37(1A) of the Income Tax Ordinance, 2001 which needs to be taken care off as soon as possible.

The IRIS portal is calculating incorrect tax on profit/yield on Bahbood Certificates/ Pensioner’s Benefit Account/ Shuhada Family Welfare Account in violation of clause (6) of Part-III, 2nd Schedule of the Income Tax Ordinance, 2001, which provides that tax shall not exceed 10 percent of such Profit/ Yield.

There lies no option list in drop downs country and currency under Code “7006” having description “Investment (Non-Business) (Account / Annuity / Bond / Certificate / Debenture / Deposit / Fund / Instrument / Policy / Share / Stock / Unit, etc.)” due to which a taxpayer remains unable to file the Foreign Income & Assets Statement under section 116A(1) of the Ordinance.

Opening wealth is being shown in “Reconciliation of Net Assets” Value of opening net assets is being shown under code ‘703002’ despite the fact that the taxpayer’s residency status is selected as “non-resident” for Tax Year 2022 after which, he should not be required to file the wealth statement including reconciliation of net assets.

The withholding rates on payment of Dividend @ 7.5%, 15% and 25%, (under section 150 of the Ordinance) are appearing in the Income Tax Return Form of “Income for a person deriving income only from salary and other sources and the Column Code 64330052 (Dividend u/s 150 @25%) is missing.

Proviso was inserted under section 22(2) of the Tax Ordinance by Finance Act, 2020 whereby depreciation on additions to fixed assets made after 01-Jul-2020 would be reduced by 50% However, when entries related to written down values are entered in in depreciation schedule as opening values, the IRIS is calculating depreciation at 50% on total values.

In addition to above, what lately has been done by FBR is that it has deleted the column of “Adjustment of Refunds”, which is certainly an afterthought while the Manual Tax Returns, which were issued vide SRO 1612(I)/2022 dated 26 August, 2022 do retain the “Column of Tax Return Refund”. There is no explanation or justification for this glaring disparity, which is to be taken care of the clarification of Taxpayers.

Online Refund Adjustment Column is still not available on Return loaded on IRIS irrespective of the fact that it is available in the SRO issued by Board.

Profit on debt/interest income on government securities is subject to FTR

-

State Bank agrees to clear invoices up to $50,000: FPCCI

KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) on Wednesday said that the State Bank of Pakistan (SBP) has agreed to allow clearance of consignments valuing up to $50,000.

FPCCI President Irfan Iqbal Sheikh in a statement apprised the entire business, industry and trade community of Pakistan that in a breakthrough achievement from the platform of FPCCI and under the leadership of its Senior Vice President and FPCCI’s focal person on SBP-related matters, Suleman Chawla, “SBP has agreed to clear / settle all the backlog and stuck up payments within two days, which fall under chapters 84 & 85 of the customs tariff; and, if their invoice values are up to fifty thousand dollars.”

READ MORE: KATI expresses concern over delaying revision in petroleum prices

Irfan Iqbal Sheikh maintained that FPCCI has been working relentlessly over the past couple of months on the issue of delayed clearance of dollar payments of importers; and, finally after multiple detailed rounds of consultative sessions between FPCCI and SBP, the central bank has agreed, in principle, to at least release all payments in the range of $50,000 or less.

Suleman Chawla informed that he has also released an official notification from FPCCI on the development to inform all members of the apex body & stakeholders of the lingering issue.

READ MORE: FBR suggested fixed tax regime for women entrepreneurs

He added that FPCCI has been receiving numerous calls each day for the past couple of months from across Pakistan and across various sectors affected by the restrictions – which were also impacting raw materials and equipment falling under chapters 84 & 85 – and,FPCCI is expecting that all payments falling under the aforementioned category will be cleared within this week.

READ MORE: Karachi Chamber urges allowing imports from India

Suleman Chawla reiterated that the commercial importers and manufacturers have suffered a lot due to the restrictions as these were announced abruptly and without any homework or consultation. Authorities should have been meticulously selective in implementation of the restrictions to only luxury items; which, in turn, would have saved the business community millions of dollars in demurrages, container charges and lost export orders, he added.

READ MORE: FPCCI rejects central bank’s claim of ‘no import restriction’

-

FPCCI rejects central bank’s claim of ‘no import restriction’

KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) on Wednesday strongly rejected the claim of the central bank regarding no restriction on imports.

FPCCI’s acting president, Suleman Chawla in a statement categorically refuted the claims and assertions made by the State Bank of Pakistan (SBP) that there are no restrictions in place on import of raw materials.

READ MORE: No restriction on imports, SBP clarifies

Import payments not being cleared swiftly by SBP are resulting in disruptions in industrial production; unbearable demurrages and container charges; loss-making delays in fulfillment of export orders; inflationary pressures in the domestic markets and compounding of discouraging investor sentiments, he added.

Acting FPCCI Chief explained that due to the unavailability of foreign exchange, continuous rupee depreciation, speculative trading and delays by SBP, manufacturers and commercial importers are in a jeopardy and exports have started to fall. The country will suffer due to the dwindling exports, increasing trade deficit and yawning current account deficit (CAD), he added.

READ MORE: Pakistan’s apex body wants fixed exchange rate regime

Suleman Chawla has maintained that SBP has failed in exercising its constitutional duties of effectively regulating the commercial banks through various policy tools at its disposal; and, commercial banks are making windfall profits through speculative trading of dollars.

FPCCI has time and again reminded SBP, in no uncertain terms, of their responsibilities to control commercial banks; but, it is always unfruitful & goes in vain, he added.

Acting FPCCI President emphasized that dollar is trading in the open market at a premium of PKR. 8 – 10 and it is a glaring testimony of the fact that the importers are not being able to source the dollars that they need to fulfill their import contracts and related commercial transactional procedures from the banking channels. It will only aggravate the situation and promote the informal open market, he added.

READ MORE: KCCI managing committee candidates elected unopposed

Chawla pointed out that there are still difficulties in opening LCs with commercial banks under chapter 84 & 85 of the custom tariff; despite the claimed circular issued by SBP to the commercial banks and that reflects badly on SBP’s ability to implement its regulatory role. However, he emphasized, SBP has all the means and policy tools to implement its decisions & circulars.

Engr. M. A. Jabbar, VP FPCCI, highlighted that despite taking responsibility of its failure, SBP has resorted to blaming the industrialists and their representatives; who are already under unprecedented strains due to the various other factors in addition to the dearth of dollars in the banking channel.

READ MORE: APTMA demands immediate release of textile machinery

Engr. Jabbar added that FPCCI sees SBP’s conduct as detrimental to industrial growth, an utter lack of responsibility, insensitivities to people’s sufferings due to depleting employment opportunities, debilitating inflation and counterintuitive coupled with lack of initiative to fulfill its mandated duties.