ISLAMABAD: Pakistan has announced a sharp increase in advance tax on purchase of immovable property to 250 per cent for persons not filing income tax returns.

The country presented budget 2022/2023 on June 10, 2022 and announced various taxation measures to boost revenue collection.

The Finance Bill, 2022 proposed the sharp increase in advance tax for persons not filing tax returns. The decision has been taken to further burden the persons not complying with the statutory requirements.

READ MORE: Pakistan massively increases taxation on motor vehicles

The bill proposed amendment in Section 236K of Income Tax Ordinance, 2001. According to the proposed amendment:

“Provided further that the tax required to be collected under section 236K shall be increased by two hundred and fifty percent of the rate specified in Division XVIII of Part IV of the First Schedule in case of persons not appearing in the active taxpayers.”

At present the buyer, in case of filer of income tax return, of immovable property is required to pay advance tax at 1 per cent of the value. However, in case of non-filer the rate shall be enhanced by 100 per cent or 2 per cent as envisaged under Tenth Schedule of the Income Tax Ordinance, 2001.

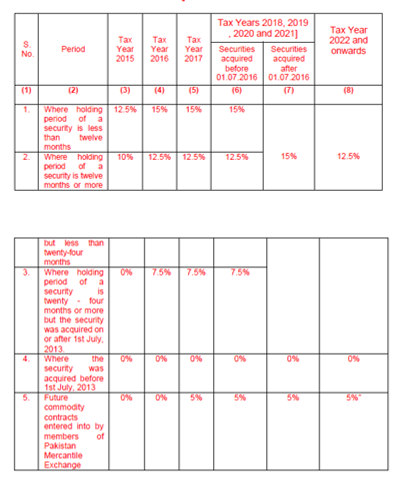

READ MORE: New rates of capital gain tax on disposal of securities

According to the Ordinance updated up to June 30, 2021, following is the text of Section 236K:

236K. Advance tax on purchase or transfer of immovable property.—(1) Any person responsible for registering, recording or attesting transfer of any immovable property shall at the time of registering, recording or attesting the transfer shall collect from the purchaser or transferee advance tax at the rate specified in Division XVIII of Part IV of the First Schedule.

Explanation,—For removal of doubt, it is clarified that the person responsible for registering, recording or attesting transfer includes person responsible for registering, recording or attesting transfer for local authority, housing authority, housing society, co-operative society, public and private real estate projects registered/governed under any law, joint ventures, private commercial concerns and registrar of properties.

(2) The advance tax collected under sub-section (1) shall be adjustable:

READ MORE: Pakistan slaps 45% corporate tax on banks

Provided that if the buyer or transferee is a non-resident individual holding a Pakistan Origin Card (POC) or National ID Card for Overseas Pakistanis (NICOP) or Computerized National ID Card (CNIC) who has acquired the said immovable property through a Foreign Currency Value Account (FCVA) or NRP Rupee Value Account (NRVA) maintained with authorized banks in Pakistan under the foreign exchange regulations issued by the State Bank of Pakistan, the tax collected under this section from such persons shall be final discharge of tax liability for such buyer or transferee.

(3) Any person responsible for collecting payments in installments for purchase or allotment of any immovable property where the transfer is to be effected after making payment of all installments, shall at the time of collecting installments collect from the allotee or transferee advance tax at the rate specified in Division XVIII of Part IV of the First Schedule:

READ MORE: Tax rates for business individuals, AOPs during TY2023

Provided that where tax has been collected along with installments, no further tax under this section shall be collected at the time of transfer of property in the name of buyer from whom tax has been collected in installments which is equal to the amount payable in this section.

(4) Nothing contained in this section shall apply to a scheme introduced by the Federal Government, or Provincial Government or an Authority established under a Federal or Provincial law for expatriate Pakistanis:

“Provided that the mode of payment by the expatriate Pakistanis in the said scheme or schemes shall be in the foreign exchange remitted from outside Pakistan through normal banking channels.”

READ MORE: Pakistan reintroduces advance tax on foreign payments